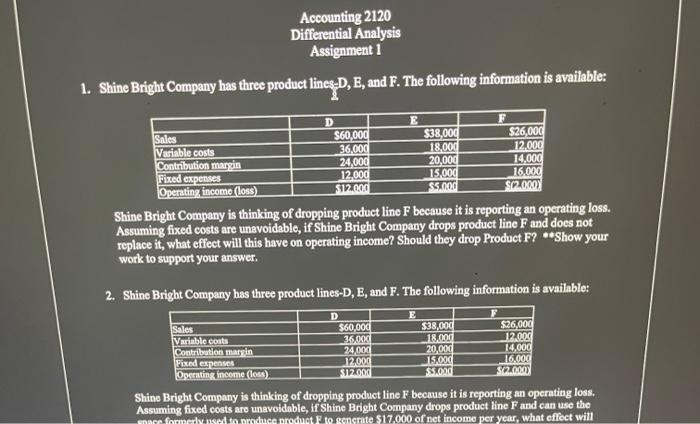

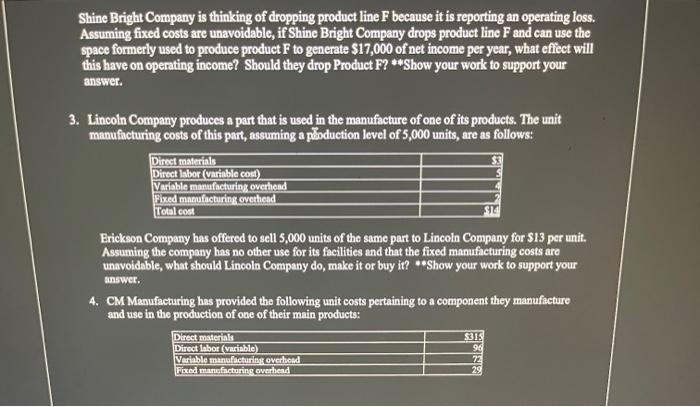

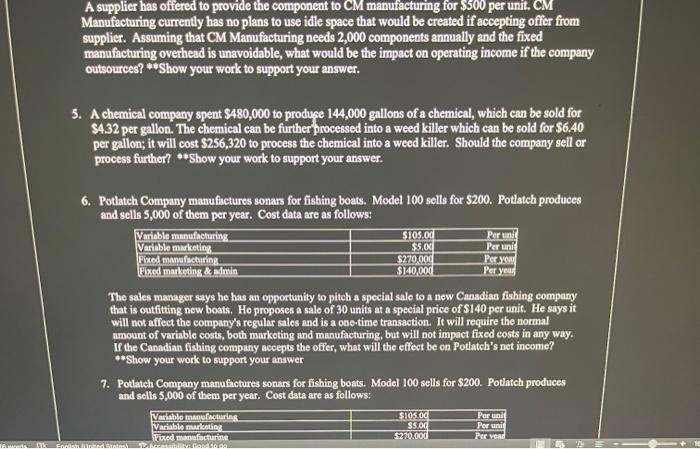

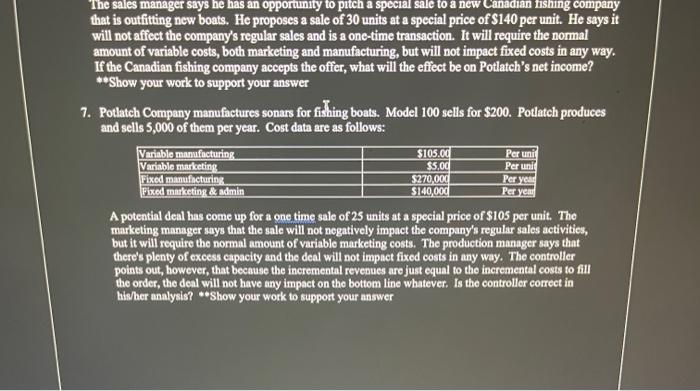

1. Shine Bright Company has three product lineg-D, E, and F. The following information is available: Shine Bright Company is thinking of dropping product line F because it is reporting an operating loss. Assuming fixed costs are unsvoidable, if Shine Bright Company drops product line F and does not replace it, what effect will this have on operating income? Should they drop Product F? * Show your work to support your answer. 2. Shine Bright Company has three product lines-D, E, and F. The following information is available: Shine Bright Company is thinking of dropping product line F because it is reporting an operating loss. Assuming fixed costs are unavoldable, if Shine Bright Company drops product line F and can use the A supplier has offered to provide the component to CM manufacturing for $500 per unit. CM Manufacturing currently has no plans to use idle space that would be created if accepting offer from supplier. Assuming that CM Manufacturing needs 2,000 components annually and the fixed manufacturing overhead is unavoidable, what would be the impact on operating income if the company outsources? *t Show your work to support your answer. 5. A chemical company spent $480,000 to produge 144,000 gallons of a chemical, which can be sold for $432 per gallon. The chemical can be further processed into a weed killer which can be sold for $6.40 per gallon; it will cost $256,320 to process the chemical into a weed killer. Should the company sell or process further? * Show your work to support your answer. 6. Potlatch Company manufictures sonars for fishing boats. Model 100 sells for \$200. Potlateh produces and sells 5,000 of them per year. Cost data are as follows: The sales manager says he has an opportunity to pitch a special sale to a new Canadian fishing company that is outfiting new boats. He proposes a salo of 30 units at a special price of 5140 per unit. He says it will not affect the company's regular sales and is a one-time transaction. It will require the normal amount of variable costs, both marketing and manufacturing, but will not impact fixed costs in any way. If the Canadian fishing company aceepts the offer, what will the effect be on Potlateh's net income? **Show your work to support your answer 7. Potlatch Company manufhetures sonars for fishing boats. Model 100 sells for $200. Pothtch produces and sells 5,000 of them per year. Cost data are as follows: Shine Bright Company is thinking of dropping product line F because it is reporting an operating loss. Assuming fixed costs are unavoidable, if Shine Bright Company drops product line F and can use the space formerly used to produce product F to generate $17,000 of net income per year, what effect will this have on operating income? Should they drop Product F? **Show your work to support your answer. 3. Lincoln Company produces a part that is used in the manufacture of one of its products. The unit manufacturing costs of this part, assuming a poduction level of 5,000 units, are as follows: Erickson Company has offered to sell 5,000 units of the same part to Lincoln Company for $13 per unit. Assuming the company has no other use for its facilities and that the fixed manufacturing costs are unavoidable, what should Lincoln Company do, make it or buy it? * Show your work to support your answer. that is outfitting new boats. He proposes a sale of 30 units at a special price of $140 per unit. He says it will not affect the company's regular sales and is a one-time transaction. It will require the normal amount of variable costs, both marketing and manufacturing, but will not impact fixed costs in any way. If the Canadian fishing company accepts the offer, what will the effect be on Potlatch's net income? * Show your work to support your answer 7. Potlatch Company manufactures sonars for fishing boats. Model 100 sells for $200. Potlatch produces and sells 5,000 of them per year. Cost data are as follows: A potential deal has come up for a one time sale of 25 units at a special price of $105 per unit. The marketing manager says that the sale will not negatively impact the company's regular sales activities, but it will require the normal amount of variable marketing costs. The production manager says that there's plenty of excess capacity and the deal will not impact fixed costs in any way. The controller points out, however, that because the ineremental revenues are just equal to the incremental costs to fill the order, the deal will not have any impact on the bottom line whatever. Is the controller correct in hitsher analysis? * Show your work to support your