Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Sierra Company determined that due to the obsolescence, equipment with an original cost of P180,000 and accumulated depreciation at january 1, 2011 of

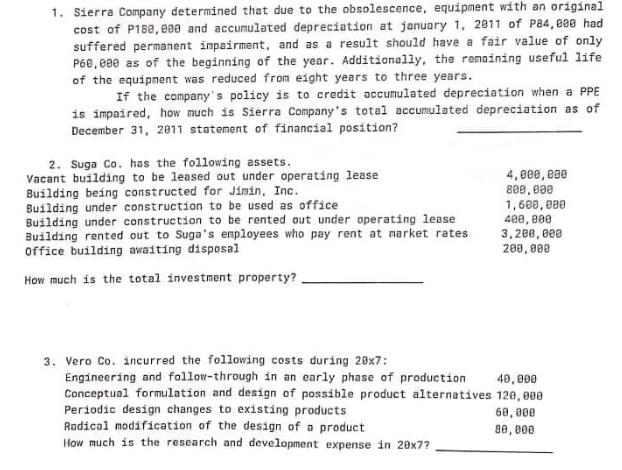

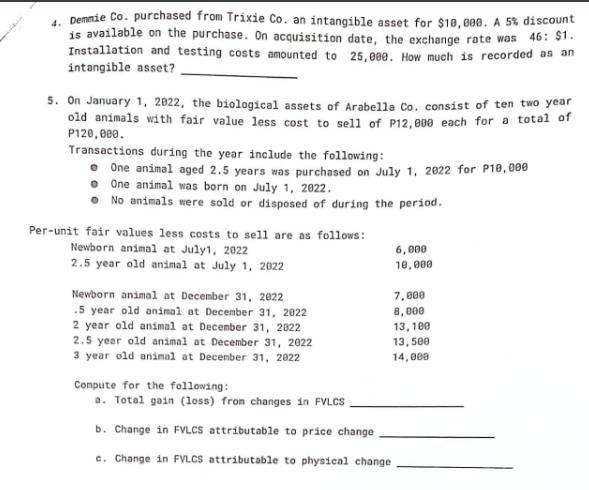

1. Sierra Company determined that due to the obsolescence, equipment with an original cost of P180,000 and accumulated depreciation at january 1, 2011 of P84,000 had suffered permanent impairment, and as a result should have a fair value of only P60,000 as of the beginning of the year. Additionally, the remaining useful life. of the equipment was reduced from eight years to three years. If the company's policy is to credit accumulated depreciation when a PPE is impaired, how much is Sierra Company's total accumulated depreciation as of December 31, 2011 statement of financial position? 2. Suga Co. has the following assets. Vacant building to be leased out under operating lease Building being constructed for Jimin, Inc. Building under construction to be used as office Building under construction to be rented out under operating lease Building rented out to Suga's employees who pay rent at market rates Office building awaiting disposal How much is the total investment property? 4,000,000 800,000 1,600,000 400,000 3,200,000 200,000 3. Vero Co. incurred the following costs during 28x7: 40,000 Engineering and follow-through in an early phase of production Conceptual formulation and design of possible product alternatives 120,000 Periodic design changes to existing products Radical modification of the design of a product How much is the research and development expense in 20x7? 69,000 80,000 4. Demnie Co. purchased from Trixie Co. an intangible asset for $18,000. A 5% discount is available on the purchase. On acquisition date, the exchange rate was Installation and testing costs amounted to 25,000. How much is recorded as an intangible asset? 46: $1. 5. On January 1, 2022, the biological assets of Arabella Co. consist of ten two year old animals with fair value less cost to sell of P12,000 each for a total of P120,000. Transactions during the year include the following: One animal aged 2.5 years was purchased on July 1, 2822 for P10,000 One animal was born on July 1, 2022. No animals were sold or disposed of during the period. Per-unit fair values less costs to sell are as follows: Newborn animal at July1, 2022 2.5 year old animal at July 1, 2022 Newborn animal at December 31, 2022 .5 year old animal at December 31, 2022 2 year old animal at December 31, 2022 2.5 year old animal at December 31, 2022 3 year old animal at December 31, 2022 6,000 10,000 7,000 8,000 13,100 13,500 14,000 Compute for the following: a. Total gain (loss) from changes in FVLCS b. Change in FVLCS attributable to price change c. Change in FVLCS attributable to physical change

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate Sierra Companys total accumulated depreciation as of December 31 2011 you need to account for the impairment of equipment First find the depreciation expense for the year Original Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started