Question

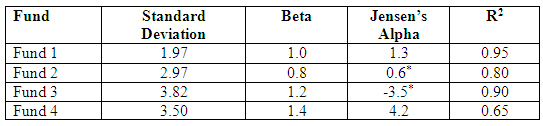

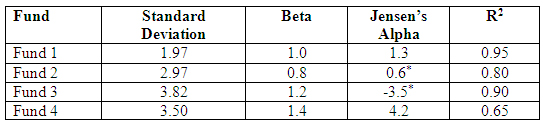

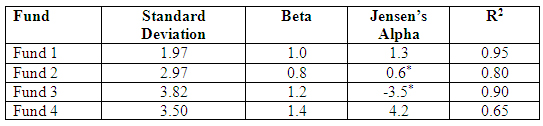

(1) * Significant at the 5 percent level Which funds returns are best explained by the market's returns? Group of answer choices Fund 1 Fund

(1)

* Significant at the 5 percent level Which funds returns are best explained by the market's returns?

* Significant at the 5 percent level Which funds returns are best explained by the market's returns?

Group of answer choices

Fund 1

Fund 2

Fund 3

Fund 4

(2)

* Significant at the 5 percent level Which of the funds has the most market risk?

* Significant at the 5 percent level Which of the funds has the most market risk?

Group of answer choices

Fund 1

Fund 2

Fund 3

Fund 4

(3)

* Significant at the 5 percent level Which fund has the most total risk?

* Significant at the 5 percent level Which fund has the most total risk?

Group of answer choices

Fund 1

Fund 2

Fund 3

Fund 4

(4)

* Significant at the 5 percent level Based on Jensens performance measure, which fund significantly outperformed?

* Significant at the 5 percent level Based on Jensens performance measure, which fund significantly outperformed?

Group of answer choices

Fund 1

Fund 2

Fund 3

Fund 4

(5)

* Significant at the 5 percent level Which fund is least well-diversified?

* Significant at the 5 percent level Which fund is least well-diversified?

Group of answer choices

Fund 1

Fund 2

Fund 3

Fund 4

Fund Beta R? Jensen's Alph: Standard Deviation 1.97 2.97 3.82 3.50 1.0 0.8 Fund 1 Fund 2 Fund 3 Fund 4 1.3 0.6 0.95 0.80 0.90 0.65 4.2 Fund Beta R? Jensen's Alph: Standard Deviation 1.97 2.97 3.82 3.50 1.0 0.8 Fund 1 Fund 2 Fund 3 Fund 4 1.3 0.6 0.95 0.80 0.90 0.65 4.2 Fund Beta R? Jensen's Alph: Standard Deviation 1.97 2.97 3.82 3.50 1.0 0.8 Fund 1 Fund 2 Fund 3 Fund 4 1.3 0.6 0.95 0.80 0.90 0.65 4.2 Fund Beta R? Jensen's Alph: Standard Deviation 1.97 2.97 3.82 3.50 1.0 0.8 Fund 1 Fund 2 Fund 3 Fund 4 1.3 0.6 0.95 0.80 0.90 0.65 4.2 Fund Beta R? Jensen's Alph: Standard Deviation 1.97 2.97 3.82 3.50 1.0 0.8 Fund 1 Fund 2 Fund 3 Fund 4 1.3 0.6 0.95 0.80 0.90 0.65 4.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started