Question

1. Silva Corporation's contribution format income statement for the most recent month appears below. Required: a. Compute the degree of operating leverage to two decimal

1.

Silva Corporation's contribution format income statement for the most recent month appears below.

Required: a. Compute the degree of operating leverage to two decimal places. b. Using the degree of operating leverage, estimate the percentage change in net operating income that should result from a 3% increase in sales volume.

Sales $506,000

Variable expenses $236,500

Contribution margin $269,500

Fixed expenses $241,700

Net operating income $27,800

2.

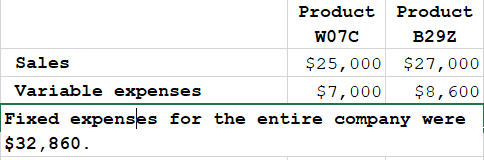

Kamaru Incorporated produces and sells two products. Data concerning those products for the most recent month appears below. Required: a. Prepare a Contribution Income Statement for the month showing the contribution margin in total and as a ratio for each product and the company as a whole. b. Determine the overall break-even point for the company in total sales dollars. c. If the sales mix shifts toward Product W07C with no change in total sales, what will happen to the break-even point for the company? Explain.

3.

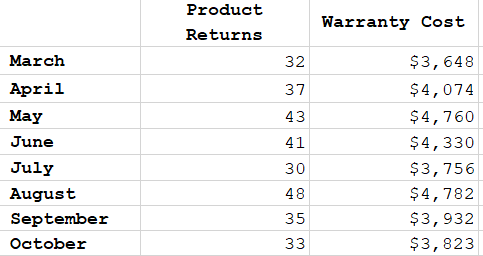

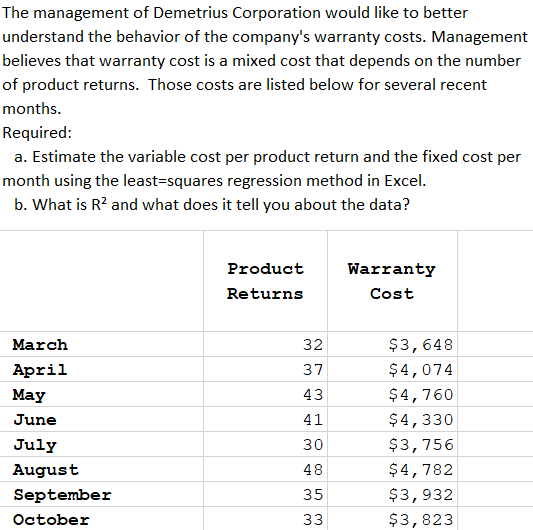

The management of Demetrius Corporation would like to better understand the behavior of the company's warranty costs. Management believes that warranty cost is a mixed cost that depends on the number of product returns. Those costs are listed below for several recent months.

Required: a. Estimate the variable cost per product return and the fixed cost per month using the high-low method. b. If product returns are estimated to be 31 in November, what will be the estimated total cost of warranties for November?

4.

Product Product W07C B292 Sales $25,000 $27,000 Variable expenses $7,000 $8,600 Fixed expenses for the entire company were $32,860. Product Returns Warranty Cost 32 37 43 March April May June July August September October 41 30 48 35 33 $3,648 $4,074 $4,760 $4,330 $3,756 $4,782 $3,932 $3,823 3 The management of Demetrius Corporation would like to better understand the behavior of the company's warranty costs. Management believes that warranty cost is a mixed cost that depends on the number of product returns. Those costs are listed below for several recent months. Required: a. Estimate the variable cost per product return and the fixed cost per month using the least-squares regression method in Excel. b. What is R2 and what does it tell you about the data? Product Returns Warranty Cost March April May June July August September October 32 37 43 41 30 48 35 $3,648 $4,074 $4,760 $4,330 $3,756 $4, 782 $3,932 $3,823 3 3 33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started