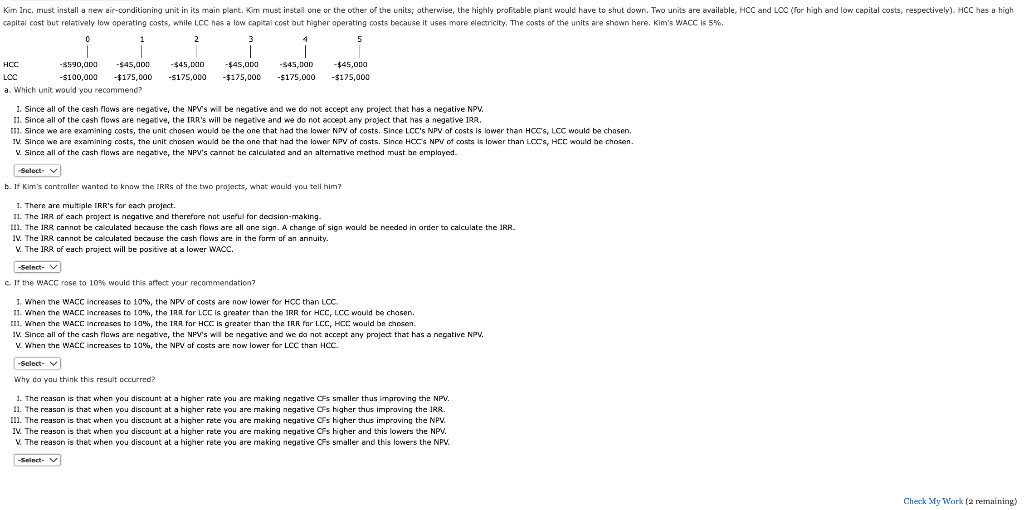

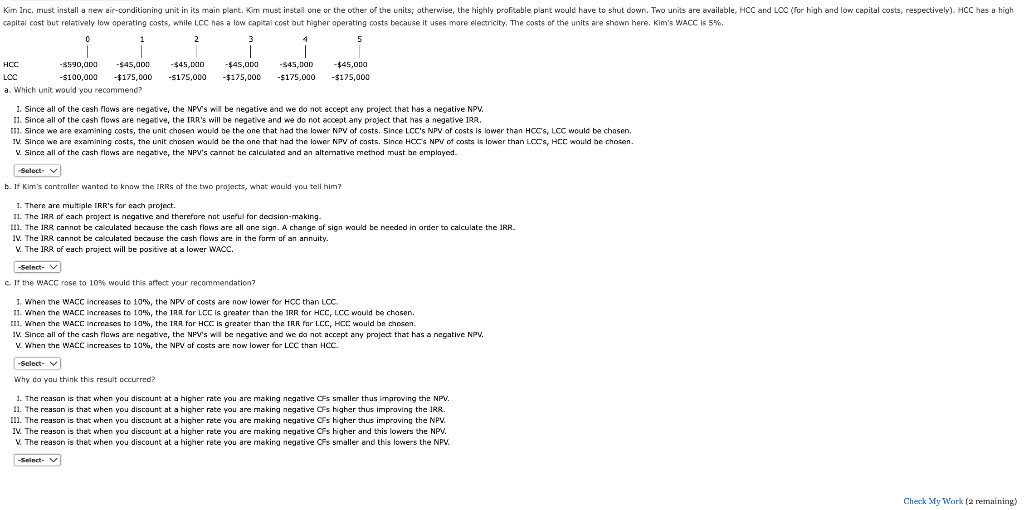

1. Since all of the cash flows are negative, the NPV's will be negative and we do not accept any project that has a negative NPV. II. Since all of the cash flows are negative, the IRR's will be negative and we do not accept any project that has a negative IRR. II. Since we are examining costs, the unit chosen would be the one that had the lower NPV of costs, 5 ince LCC's NPV of costs is lawer than HCC's, LCC would be chasen. IV. Since we are examining costs, the unit chosen would be the one that had the lower NPV af costs. 5 ince HCCS NPV of costs is lower than LCCS, HCC would be chosen. V. Since all of the cash flows are negative, the NFY's cannot he calculated and an altemative method must be emplayed. b. If Kin's controller wanted to know the IRRs of the two projects, what wauld you tell him? 1. There are multiple IRR's for ench project. 11. The 1RR of each praject is negative and therefore not uscful for decision-making. t11. The 1RR cannot be caloulated because the cash flaws are all ane sign. A change of sign would be needed in order to calculate the 1RR. IV. The IRR cannot be caloulated because the cash flaws are in the furm of an annuity. V. The IRR of each project will be positive at a lower WACC. c. It the WaCc rose to 10% would this affect your recommendation? 1. When the WACC increases to 10%, the NPY of costs are now lower for HCC than LOC. 11. When the WACC, increases to 10%, the IrR, for LCC is greater than the IRR for HCC, LCC would be chosen. IV. Since all of the cash flows are negative, the NFV's will be negative and we do not accept any project that has a negative NPV. V. When the WACC increases to 10%, the NFV af costs are now lower for LCC than HCC. Why do you think this result cccurred? 1. The reasan is that when you discount at a higher rate you are making negative Ges smaller thus improving the NPV. 11. The reasan is that when you discaunt at a higher rate you are making negative CFs higher thus improving the IRR. [11. The reason is that when you discuunt at a higher rate you are making negative CFs higher thus improving the NPV. IV. The reason is that when you discount at a higher rate you are making negative CFs higher and this lowers the NPV. W. The reason is thet when you discount at a higher rate you are making negative CFs smaller end this lowers the NPY