Question

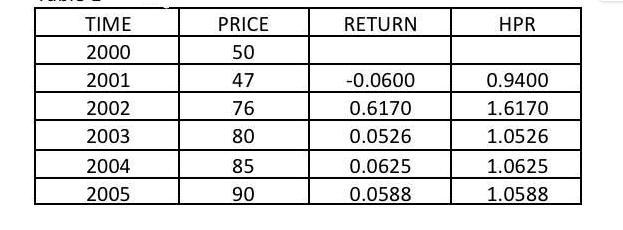

1. Solve for the arithmetic mean annual yield. 2. Solve for the geometric mean annual yield. 3. Did your wealth increase? TIME 2000 2001

1. Solve for the arithmetic mean annual yield. 2. Solve for the geometric mean annual yield. 3. Did your wealth increase? TIME 2000 2001 2002 2003 2004 2005 PRICE 50 47 76 80 85 90 RETURN -0.0600 0.6170 0.0526 0.0625 0.0588 HPR 0.9400 1.6170 1.0526 1.0625 1.0588

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the arithmetic mean annual yield and the geometric mean annual yield you can follow the...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investments Analysis and Management

Authors: Charles P. Jones

12th edition

978-1118475904, 1118475909, 1118363299, 978-1118363294

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App