Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.) some answers i have filled in but the blank ones i need help with thank you! 2.) 3.) 4.) The following is a December

1.)

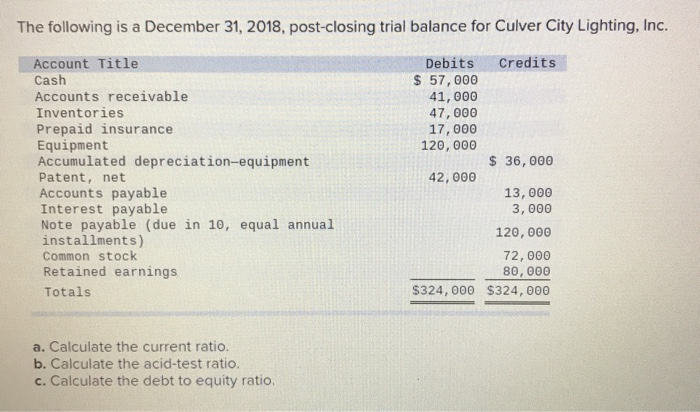

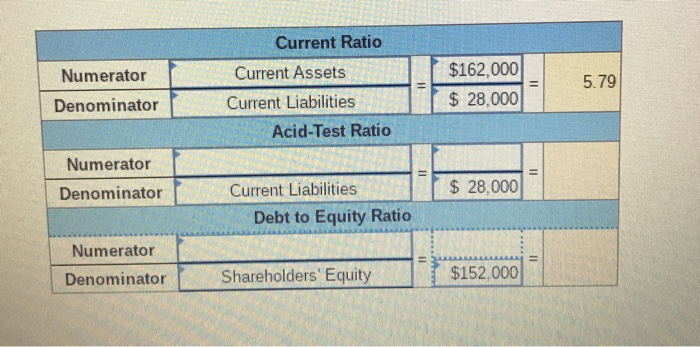

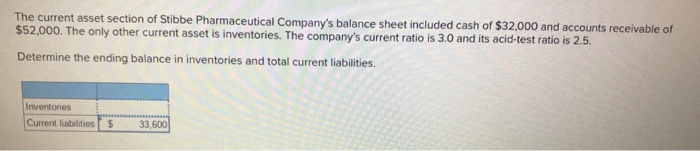

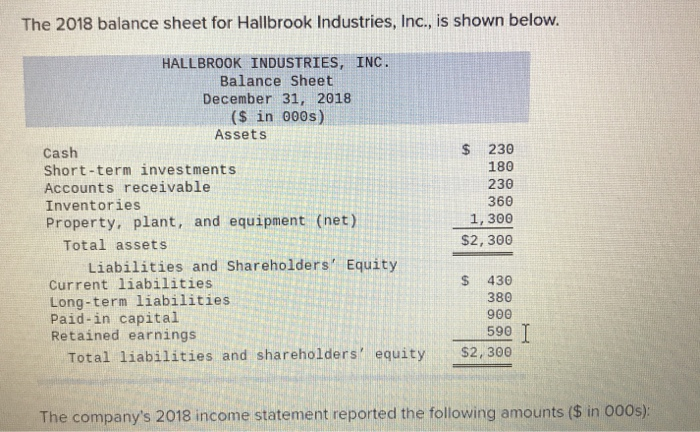

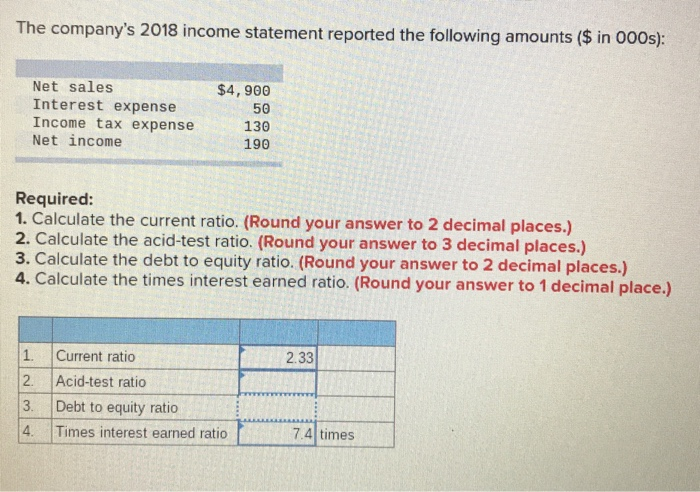

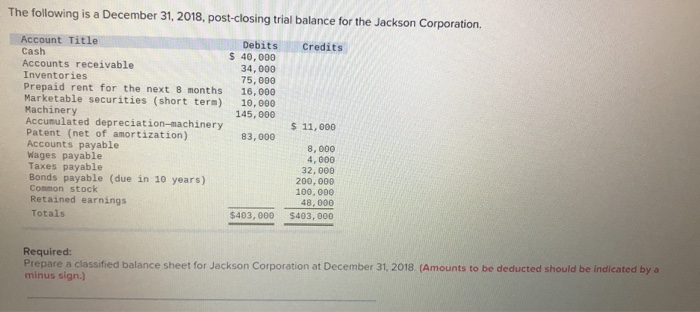

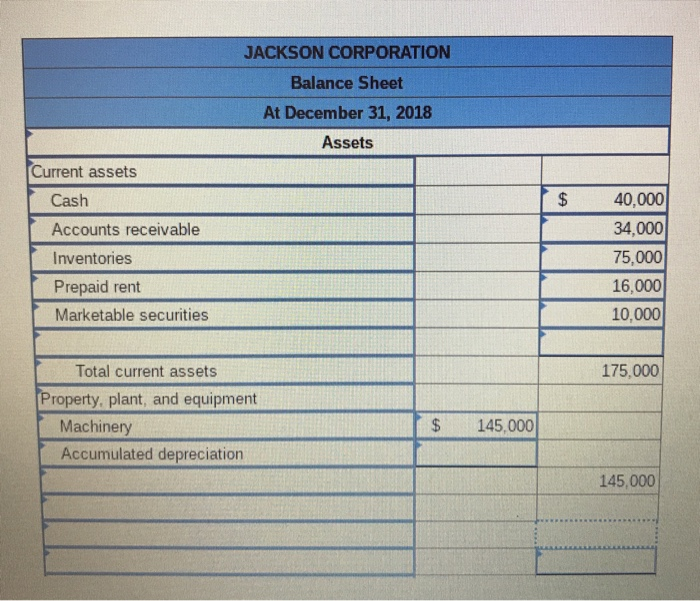

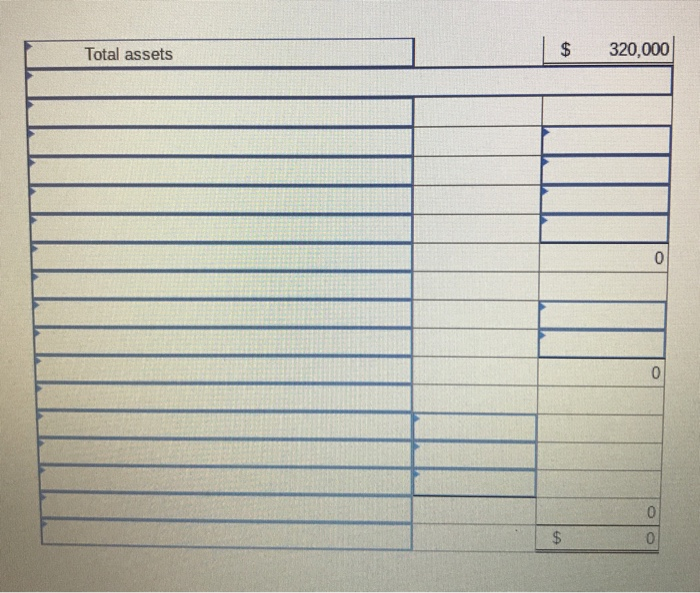

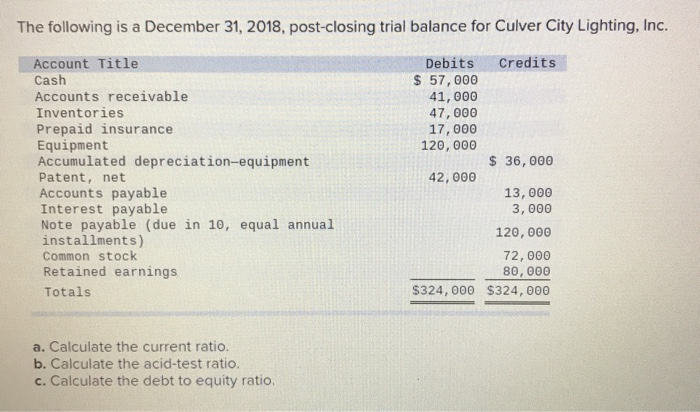

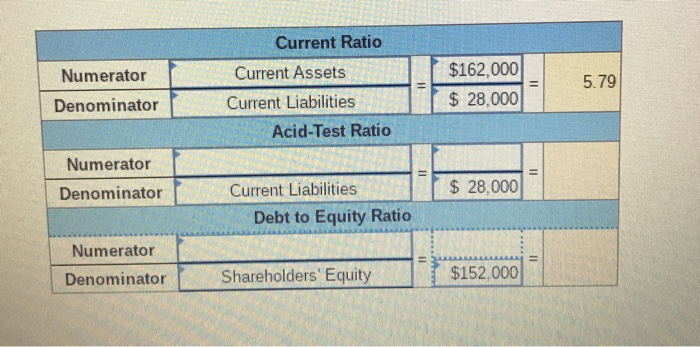

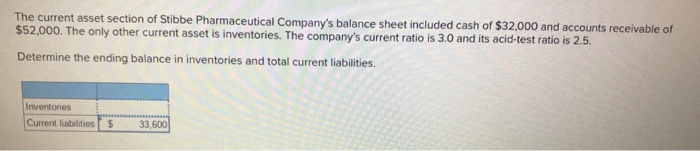

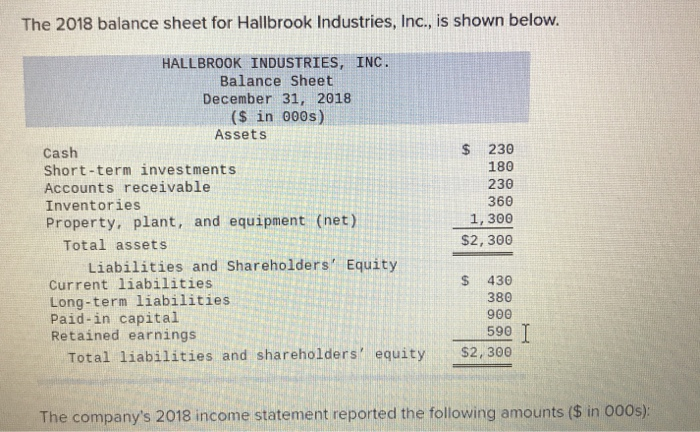

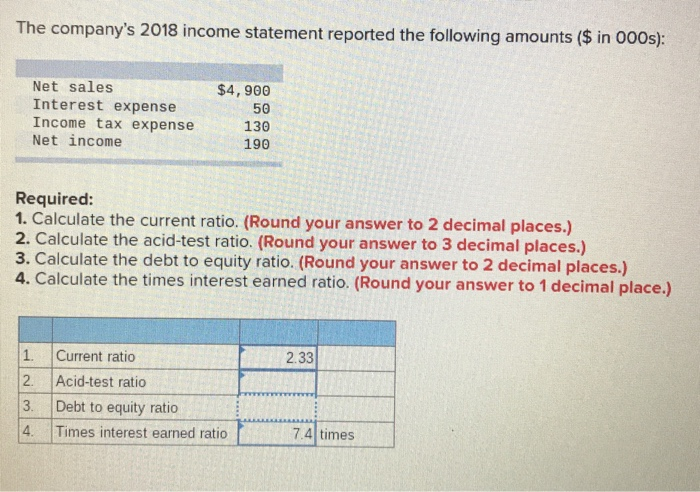

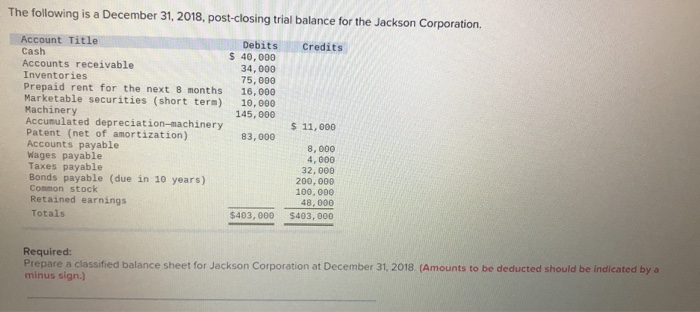

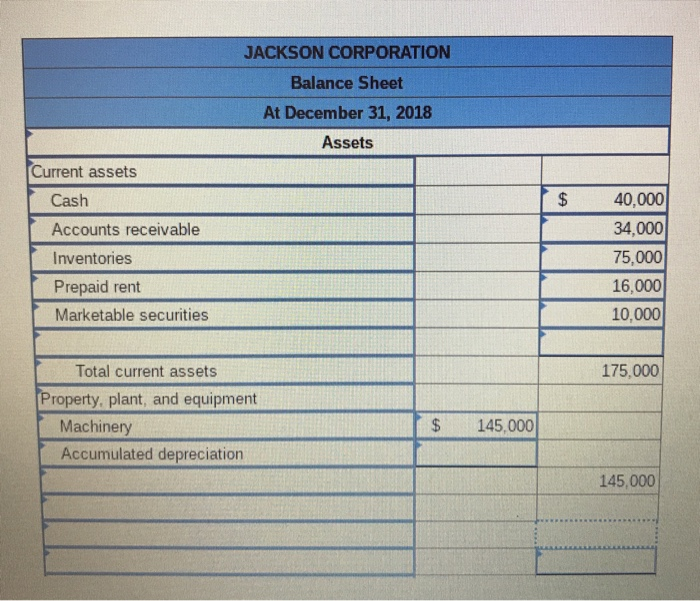

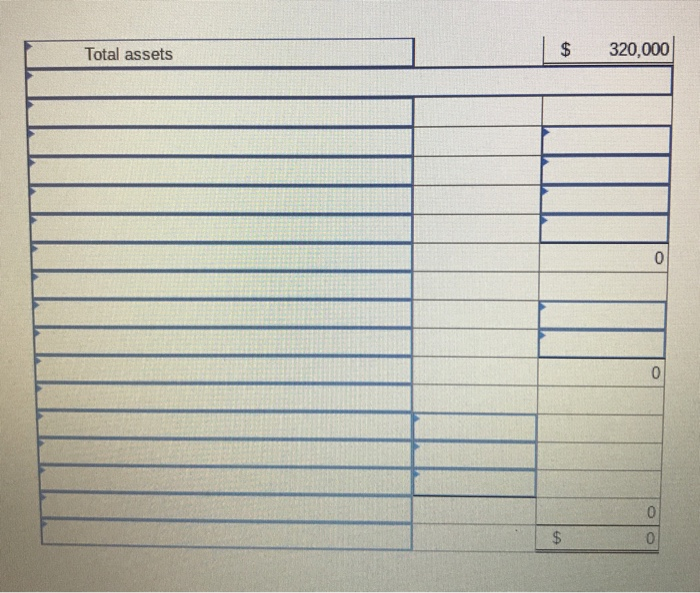

The following is a December 31, 2018, post-closing trial balance for Culver City Lighting, Inc. Account Title Cash Accounts receivable Inventories Prepaid insurance Equipment Accumulated depreciation-equipment Patent, net Accounts payable Interest payable Note payable (due in 10, equal annual installments) Common stock Retained earnings Totals Debits Credits $ 57,000 41,000 47,000 17,000 120,000 $ 36,000 42,000 13,000 3,000 120,000 72,000 80,000 $324,000 $324,000 a. Calculate the current ratio. b. Calculate the acid-test ratio. c. Calculate the debt to equity ratio. Numerator Denominator Current Ratio Current Assets Current Liabilities Acid-Test Ratio $162,000 $ 28,000 5.79 Numerator Denominator $ 28,000 Current Liabilities Debt to Equity Ratio Numerator Denominator Shareholders' Equity $152.000 The current asset section of Stibbe Pharmaceutical Company's balance sheet included cash of $32,000 and accounts receivable of $52,000. The only other current asset is inventories. The company's current ratio is 3.0 and its acid-test ratio is 2.5. Determine the ending balance in inventories and total current liabilities. Inventories Current liabilities $ 33,600 The 2018 balance sheet for Hallbrook Industries, Inc., is shown below. 230 180 HALLBROOK INDUSTRIES, INC. Balance Sheet December 31, 2018 ($ in 000s) Assets Cash Short-term investments Accounts receivable Inventories Property, plant, and equipment (net) Total assets Liabilities and Shareholders' Equity Current liabilities Long-term liabilities Paid-in capital Retained earnings Total liabilities and shareholders' equity 230 360 1,300 $2,300 $ 430 380 900 590 $2,300 The company's 2018 income statement reported the following amounts ($ in OOos): The company's 2018 income statement reported the following amounts ($ in 000s): $4,900 Net sales Interest expense Income tax expense Net income 50 130 190 Required: 1. Calculate the current ratio. (Round your answer to 2 decimal places.) 2. Calculate the acid-test ratio. (Round your answer to 3 decimal places.) 3. Calculate the debt to equity ratio. (Round your answer to 2 decimal places.) 4. Calculate the times interest earned ratio. (Round your answer to 1 decimal place.) 1. 2.33 2. Current ratio Acid-test ratio Debt to equity ratio Times interest earned ratio 3. 4. 7.4 times The following is a December 31, 2018, post-closing trial balance for the Jackson Corporation. Credits Debits $ 40,000 34,000 75,000 16,000 10,000 145,000 Account Title Cash Accounts receivable Inventories Prepaid rent for the next 8 months Marketable securities (short term) Machinery Accumulated depreciation-machinery Patent (net of amortization) Accounts payable Wages payable Taxes payable Bonds payable (due in 10 years) Common stock Retained earnings Totals $ 11,000 83,000 8,000 4,000 32,000 200,000 100,000 48,000 $40,000 $403,000 Required: Prepare a classified balance sheet for Jackson Corporation at December 31, 2018. (Amounts to be deducted should be indicated by a minus sign.) JACKSON CORPORATION Balance Sheet At December 31, 2018 Assets Current assets Cash Accounts receivable Inventories Prepaid rent Marketable securities 40,000 34,000 75,000 16,000 10,000 175.000 Total current assets Property, plant, and equipment Machinery Accumulated depreciation | $ 145,000 145,000 Total assets 320,000

some answers i have filled in but the blank ones i need help with thank you!

2.)

3.)

4.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started