Question

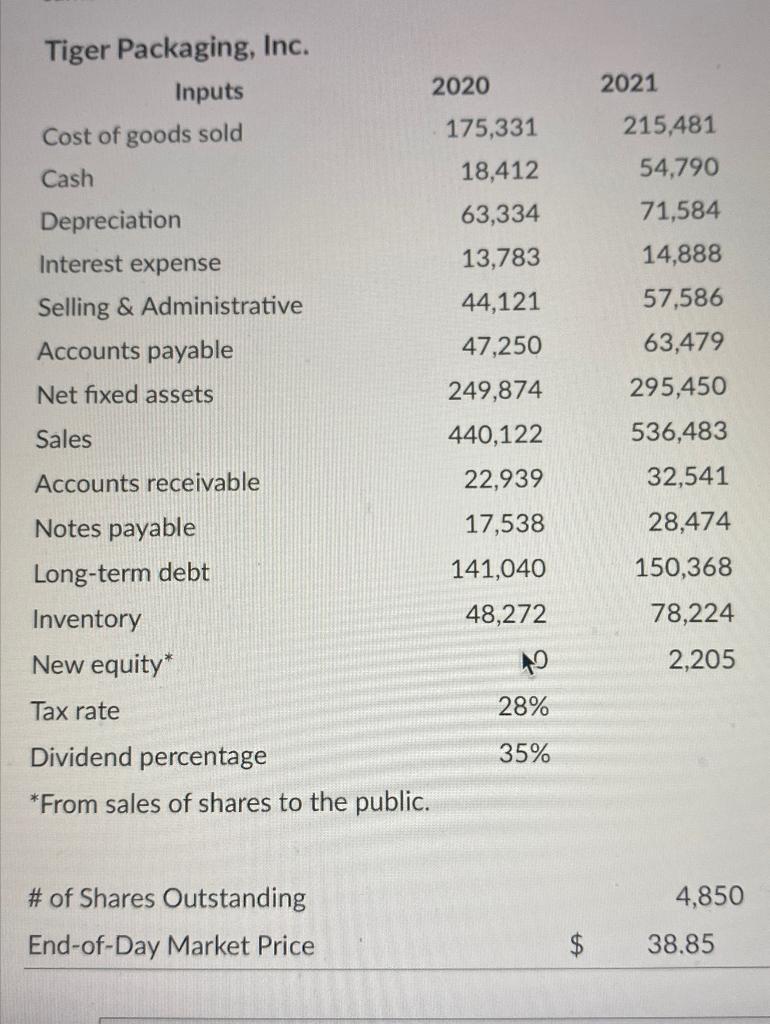

1. Spending on fixed assets (or plant, property, and equipment) is often referred to by convention as capital expenditure or Cap Ex. What is the

1. Spending on fixed assets (or plant, property, and equipment) is often referred to by convention as "capital expenditure" or Cap Ex. What is the dollar value of Tiger Packaging's Cap Ex in Year 2021?

2. Describe the change in the capital structure of Tiger Packaging from Year 2020 to Year 2021.

a. Tiger reduced the leverage on its balance sheet.

b. Tiger increased the leverage on its balance sheet.

c. Tiger repurchased more share from the public than is sold to the public.

d. Tiger repaid more debt than it sold to the public.

Given the change in the balance sheets for Tiger Packaging from Year 2020 to Year 2021, which of the following is NOT true?

a. Tiger sold off its inventory.

b. Tiger sold more notes than it paid to finance net working capital (NWC).

c. Tiger sold more equity to the public than it repurchased.

d. Tiger increased loan balances in order to finance asset purchases.

Which of the following is true concerning cash flows (CF) to creditor and shareholders?

a. CF to creditors exceeded CF to shareholders due to relatively large interest payments.

b. CF to shareholders fell short of CF to creditors due to relatively large equity buy-backs.

c. CF to shareholders exceeded CF to creditors due to relatively large dividend payments.

d. CF to creditors fell short of CF to shareholders despite net repayment of outstanding bond principal.

2020 2021 Tiger Packaging, Inc. Inputs Cost of goods sold Cash Depreciation Interest expense Selling & Administrative Accounts payable Net fixed assets 175,331 18,412 63,334 13,783 44,121 47,250 215,481 54,790 71,584 14,888 57,586 63,479 295,450 536,483 32,541 249,874 440,122 Sales Accounts receivable 22,939 28,474 150,368 Notes payable Long-term debt Inventory New equity* 17,538 141,040 48,272 19 78,224 2,205 Tax rate 28% 35% Dividend percentage *From sales of shares to the public. # of Shares Outstanding 4,850 38.85 End-of-Day Market Price $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started