Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. State the importance of cash flows. [Marking Scheme: Any 3 importance- 3 marks] 2. On April 10, Sangi Corporation purchased 5,000 shares of

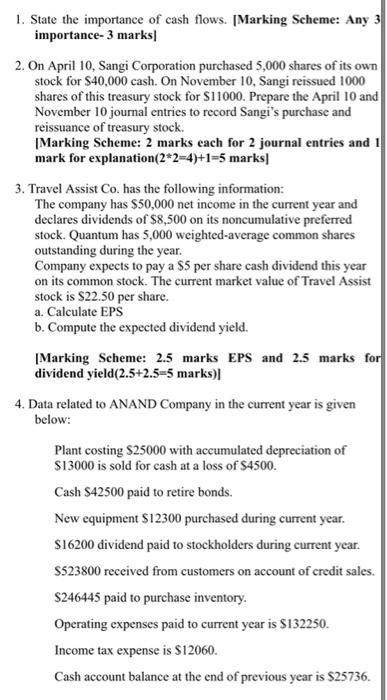

1. State the importance of cash flows. [Marking Scheme: Any 3 importance- 3 marks] 2. On April 10, Sangi Corporation purchased 5,000 shares of its own stock for $40,000 cash. On November 10, Sangi reissued 1000 shares of this treasury stock for $11000. Prepare the April 10 and November 10 journal entries to record Sangi's purchase and reissuance of treasury stock. [Marking Scheme: 2 marks each for 2 journal entries and 1 mark for explanation (2*2=4)+1=5 marks] 3. Travel Assist Co. has the following information: The company has $50,000 net income in the current year and declares dividends of $8,500 on its noncumulative preferred stock. Quantum has 5,000 weighted-average common shares outstanding during the year. Company expects to pay a $5 per share cash dividend this year on its common stock. The current market value of Travel Assist stock is $22.50 per share. a. Calculate EPS b. Compute the expected dividend yield. [Marking Scheme: 2.5 marks EPS and 2.5 marks for dividend yield(2.5+2.5=5 marks)] 4. Data related to ANAND Company in the current year is given below: Plant costing $25000 with accumulated depreciation of $13000 is sold for cash at a loss of $4500. Cash $42500 paid to retire bonds. New equipment $12300 purchased during current year. $16200 dividend paid to stockholders during current year. $523800 received from customers on account of credit sales. $246445 paid to purchase inventory. Operating expenses paid to current year is $132250. Income tax expense is $12060. Cash account balance at the end of previous year is $25736.

Step by Step Solution

★★★★★

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Quiz 1 1 The importance of cash flows include It provides information about the companys operating performance and financial position It is useful in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started