Answered step by step

Verified Expert Solution

Question

1 Approved Answer

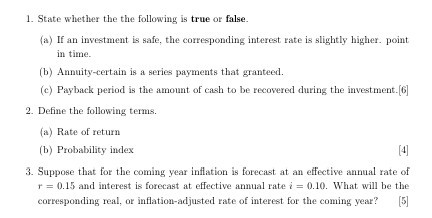

1. State whether the the following is true or false. (a) If an investment is safe, the corresponding interest rate is slightly higher point in

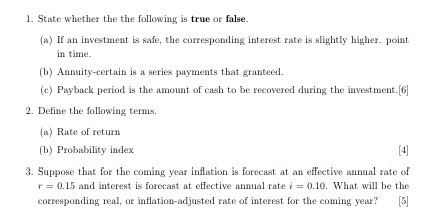

1. State whether the the following is true or false. (a) If an investment is safe, the corresponding interest rate is slightly higher point in time. (b) Annuity-certain is a series payments that granteed. (c) Payback period is the amount of cash to be recovered during the investment.[6] 2. Define the following terms. (a) Rate of return (b) Probability index (4 3. Suppose that for the coming year inflation is forecast at an effective annual rate of r = 0.15 and interest is forecast at effective annual rate i = 0.10. What will be the corresponding real, or inflation-adjusted rate of interest for the coming year? (5) 1. State whether the the following is true or false. (a) If an investment is safe, the corresponding interest rate is slightly higher point in time. (b) Annuity-certain is a series payments that granteed. (c) Payback period is the amount of cash to be recovered during the investment.[6] 2. Define the following terms. (a) Rate of return (b) Probability index (4 3. Suppose that for the coming year inflation is forecast at an effective annual rate of r = 0.15 and interest is forecast at effective annual rate i = 0.10. What will be the corresponding real, or inflation-adjusted rate of interest for the coming year? (5) (4 (a) 20 deposited at 3% followed by n deposits at 4% (b) n deposit at 3% followed by n deposit at 4% Question 3 A large pension fund has a value of N$ 350 millions at the beginning of the year. During the year the fund receives contributions of N$ 80 millions, pays out benefits of NS 20 millions and has interest income of N$ 40 millions. Estimate the yield rate on the fund for each of the following cases: (a) Contributions, benefits and interest are uniformly spread throughout the year. [4] (b) Benefit payments, interest income, and 20 millions of contributions are uniformly spread throughout the year, but there is a lump sum contribution of 60 millions in September 6 (c) Same as () expect that the lump sum contributions are 50 millions on May and 10 Millions on September. (5) TOTAL: 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started