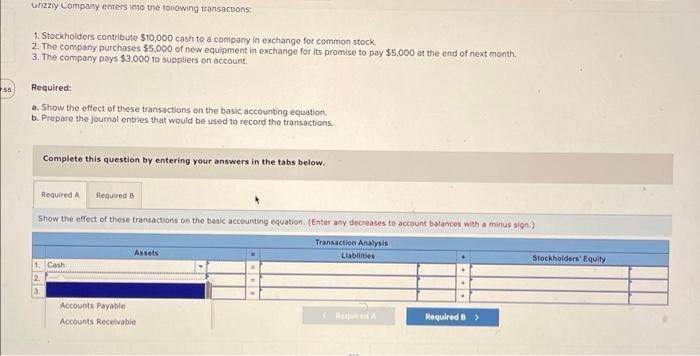

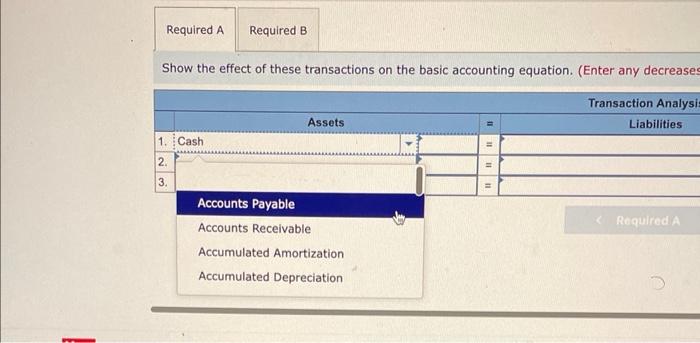

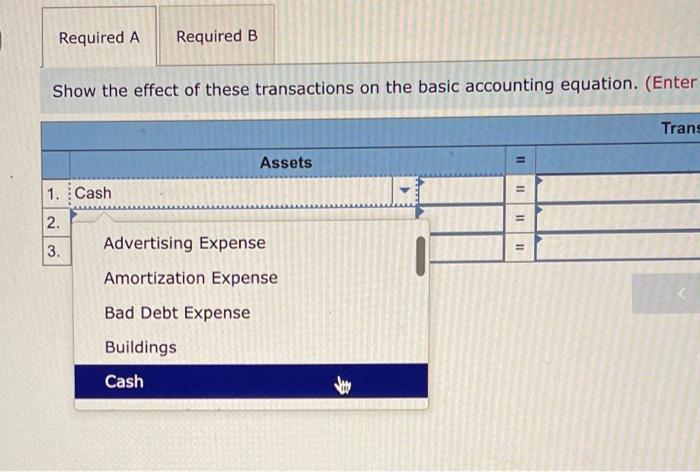

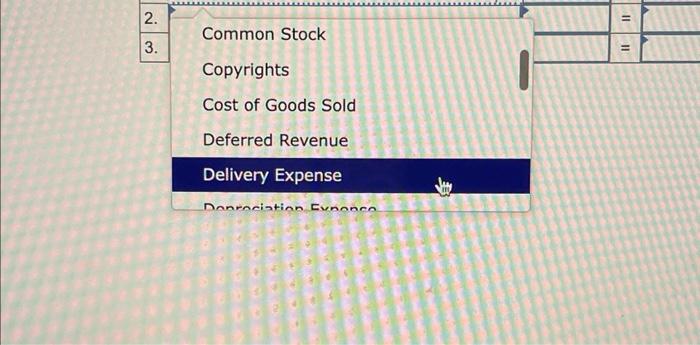

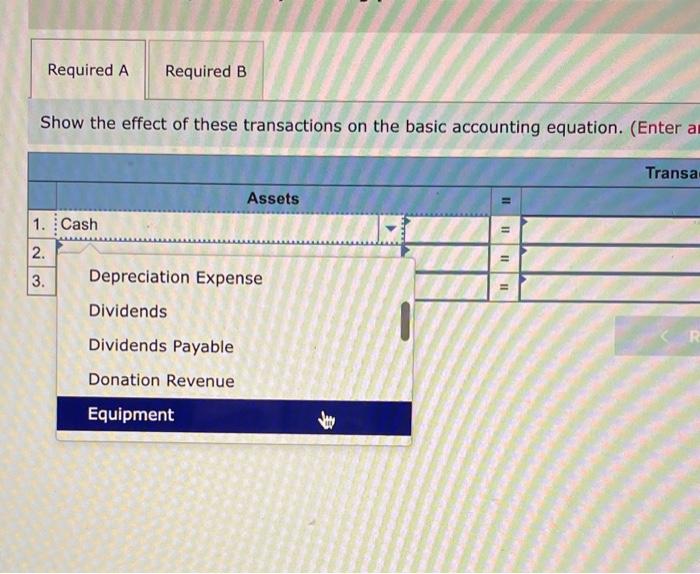

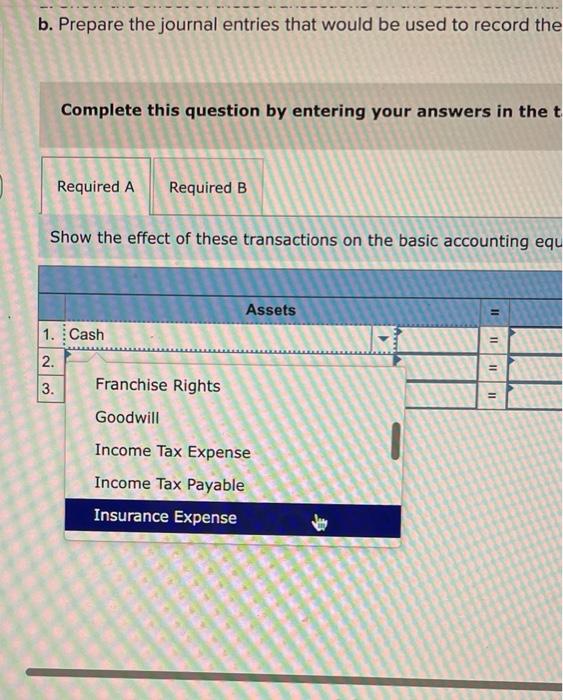

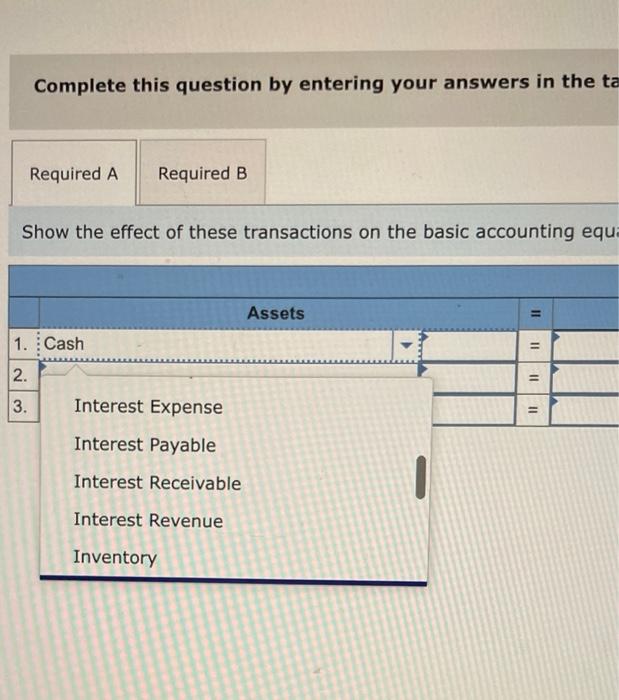

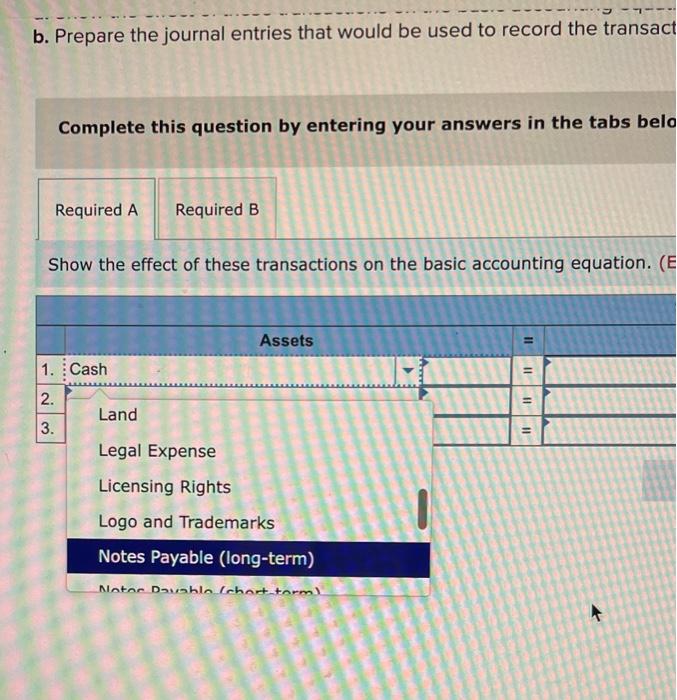

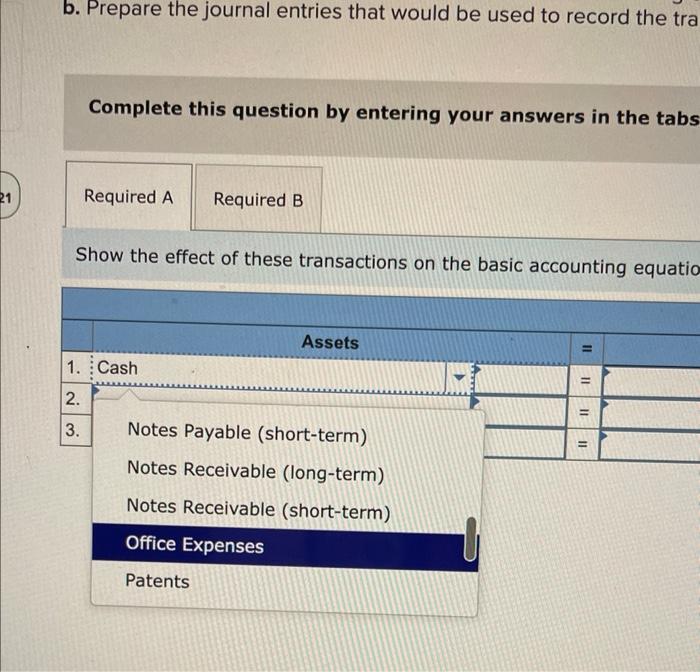

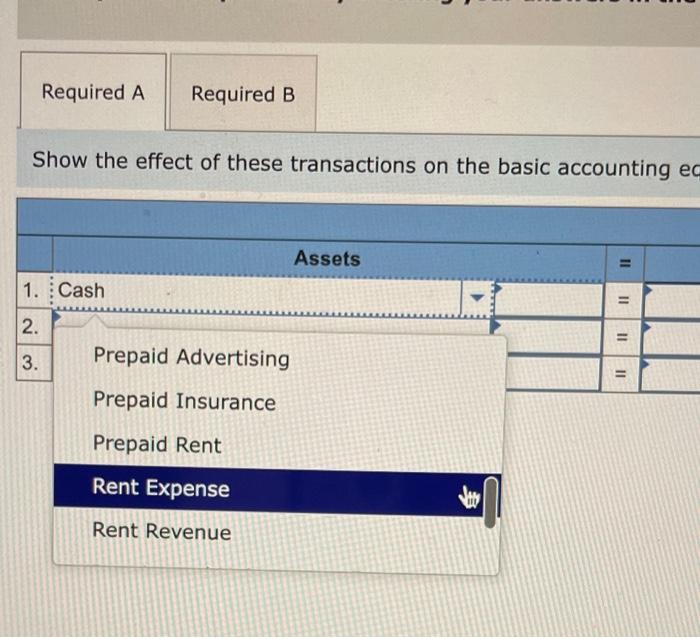

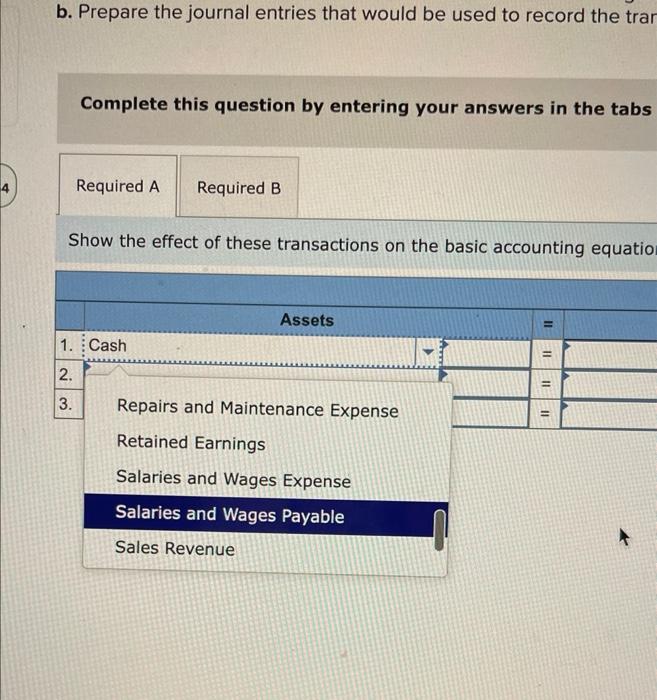

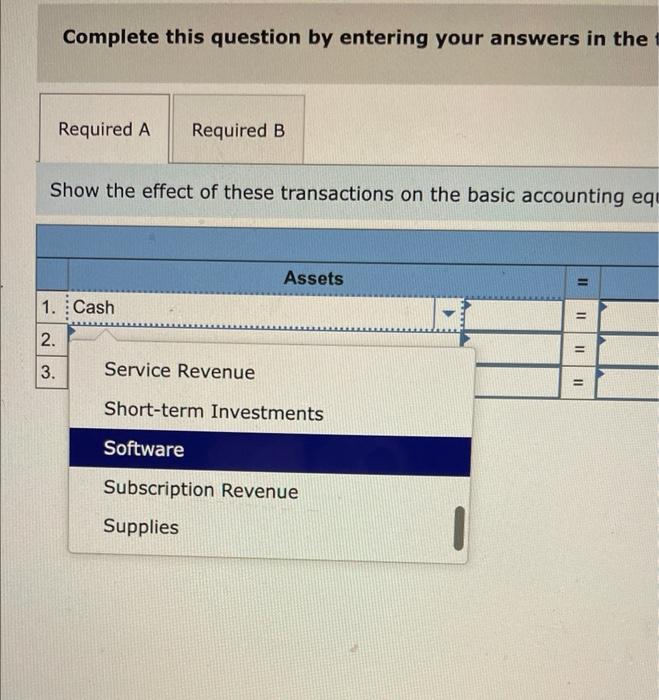

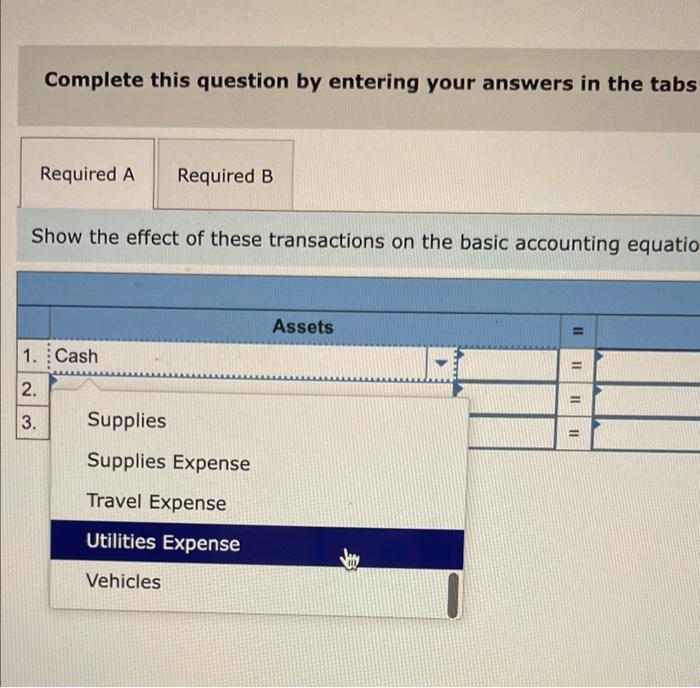

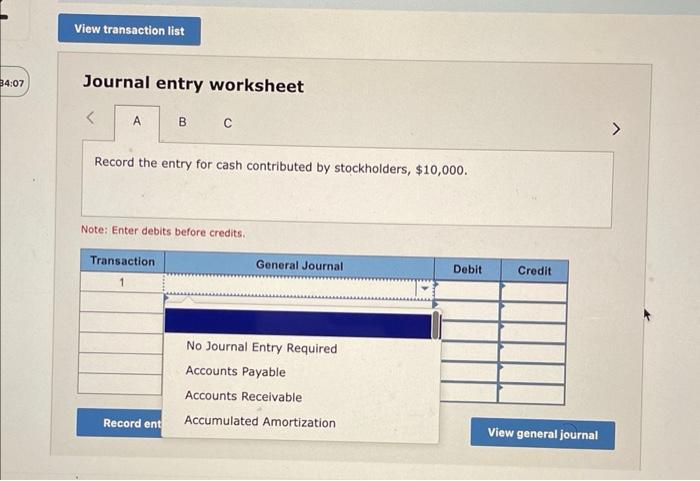

1. Stockholders contribute $10,000 cash to a company in exchange for common stock. 2. The company purchases $5,000 of new equipment in exchange for its promise to pay $5,000 at the end of next month. 3. The company poys $3,000 to suppliers on account. Required: a. Sirow the effect of these transactions on the basic accounting equation. b. Prepare the journal entries that would be used to record the transactions. Complete this question by entering your answers in the tabs below. Show the effect of these transactions on the basic accounting equation. (Enter any decrease Show the effect of these transactions on the basic accounting equation. (Enter Cost of Goods Sold Deferred Revenue Delivery Expense Show the effect of these transactions on the basic accounting equation. (Enter a b. Prepare the journal entries that would be used to record the Complete this question by entering your answers in the Show the effect of these transactions on the basic accounting equ Complete this question by entering your answers in the t Show the effect of these transactions on the basic accounting equ b. Prepare the journal entries that would be used to record the transac Complete this question by entering your answers in the tabs bel Show the effect of these transactions on the basic accounting equation. b. Prepare the journal entries that would be used to record the tra Complete this question by entering your answers in the tabs Show the effect of these transactions on the basic accounting equatio Show the effect of these transactions on the basic accounting b. Prepare the journal entries that would be used to record the trar Complete this question by entering your answers in the tabs Show the effect of these transactions on the basic accounting equatio Complete this question by entering your answers in the Show the effect of these transactions on the basic accounting eq Complete this question by entering your answers in the tabs Show the effect of these transactions on the basic accounting equatio Journal entry worksheet Record the entry for cash contributed by stockholders, $10,000. Note: Enter debits before credits