Answered step by step

Verified Expert Solution

Question

1 Approved Answer

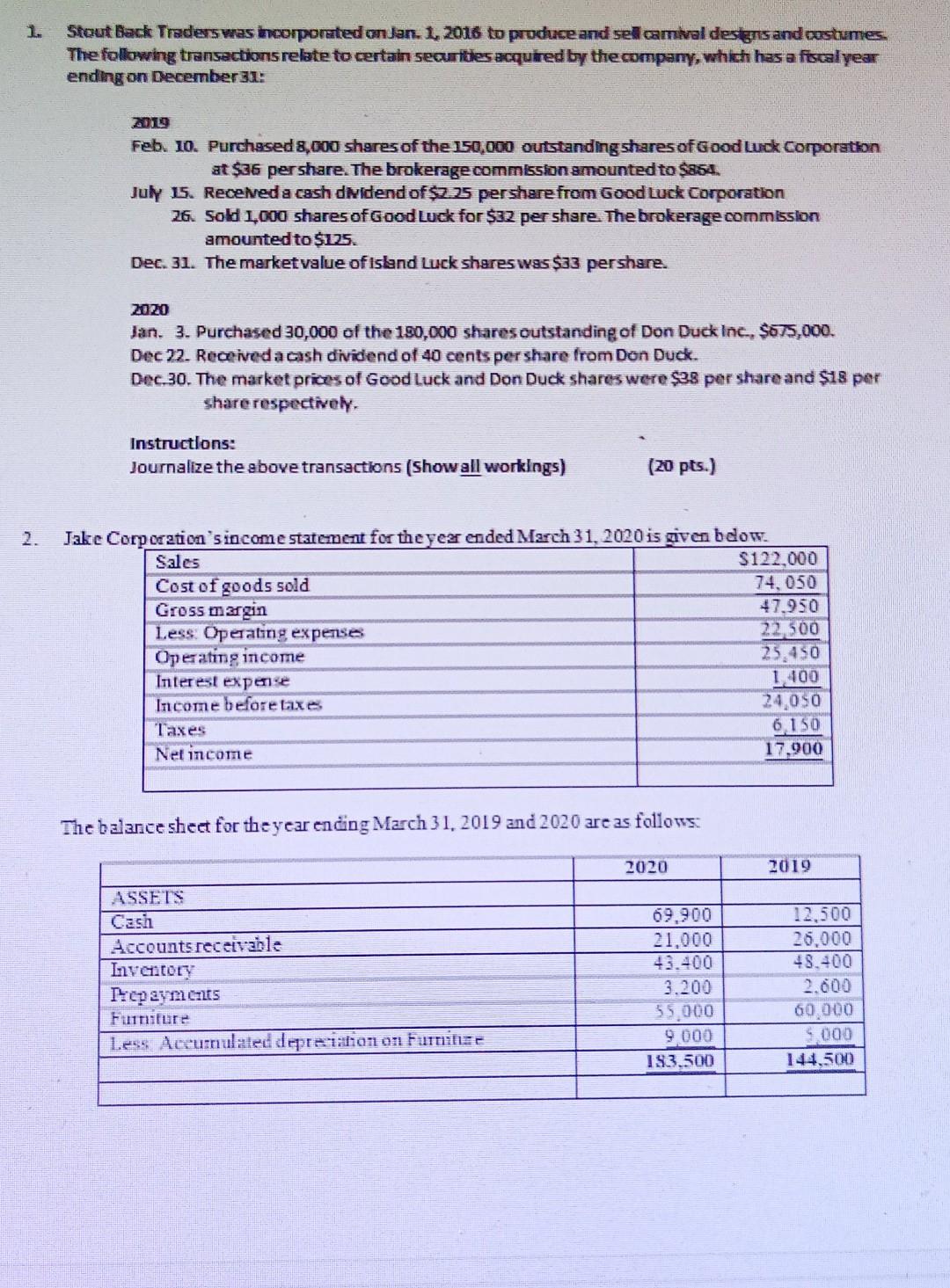

1. Stout Back Traders was incorporated on Jan. 1, 2016 to produce and sell camival designs and astumes The following transactions relate to certain securities

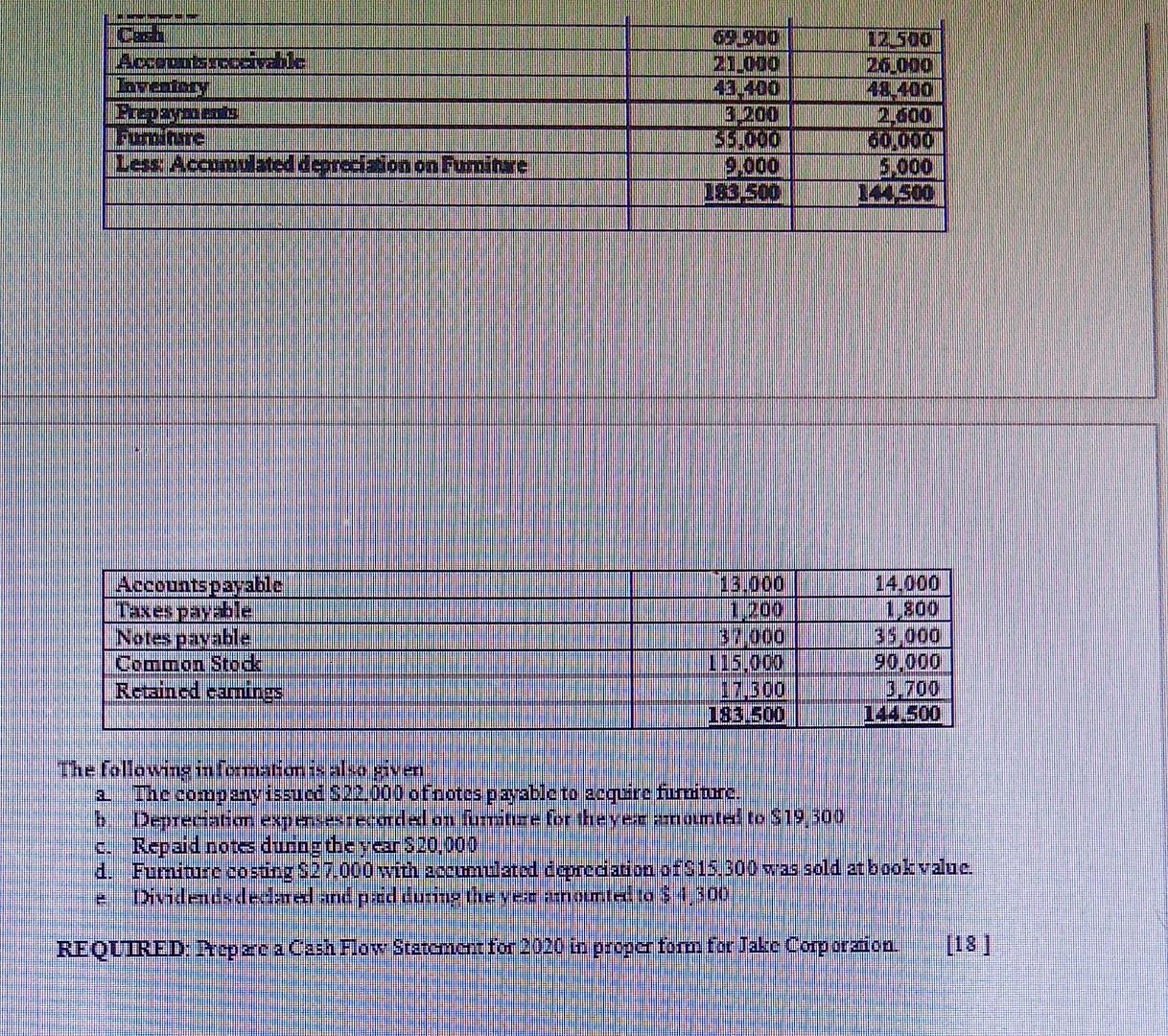

1. Stout Back Traders was incorporated on Jan. 1, 2016 to produce and sell camival designs and astumes The following transactions relate to certain securities acquired by the company, which has a fiscalyear ending on December 31: Feb. 10. Purchased 8,000 shares of the 150.000 outstanding shares of Good Luck Corporation at $36 per share. The brokerage commission smounted to $854. July 15. Receved a cash didendof$2.25 pershere from Good Luck Corporation 26. Solo 1,000 shares of Good Luck for $32 per share. The brokerage commission amounted to $125. Dec. 31. The market value of Island Luck shares was $33 pershare. 2020 Jan. 3. Purchased 30,000 of the 150,000 shares outstanding of Don Duck Inc., $675,000. Dec 22. Receiveda cash dividend of 40 cents pershare from Don Duck. Dec.30. The market prices of Good Luck and Don Duck shares were $38 per share and $18 per share respectively, Instructions: Journalize the above transactions (Show all workings) (20 pts.) 2. Jake Corporation's income statement for theyear ended March 31, 2020 is given below. Sales $122.000 Cost of goods sold 74,050 Gross margin 47.950 Less Operating expenses 22 500 Operating income 25.450 Interest expense 1.400 Income before taxes 24.050 Taxes 6 150 Net income 17,900 The balance sheet for the year ending March 31, 2019 and 2020 are as follows: 2020 2019 ASSETS Casin Accounts receivable Inventory Trepayments Furniture Less Accumulated depletion on Furnize 69.900 21,000 43.400 3.200 55.000 9000 153.500 12.500 26.000 48.400 2.000 60.000 $ 000 144.500 KAMI PM PLEARCORSICOLO layan ELD Tante Les Acamulated dennedalonon Fuminte 691900 21.000 43100 13200 35.000 9.000 TO 20.000 44100 2.500 GOOOO 5000 Accounts payable Taxes payable Notes pavable Common Stode Retained camings 113.000 1200) 37000 115.000 17-300 183500 14.000 1,800 35 000 90.000 3700 500 The following in lommation is also given 2 The company issued $22.000 ofnotes payable to acquire fumimre. Depregatim expensesrecedalon fumtae for theve unamthi to $19.300 c. Repaid notes dunog the year $20.000 d. Fumiture costing $27.000 with accumulated depredation of $15.300 was sold at book value. e Dividendsdedral and pedd dumne the year annoutal ta $1,000 REQUIRED: Pepze a Cash Flow Statement for 2020 in proper fom for Jake Corporzion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started