Answered step by step

Verified Expert Solution

Question

1 Approved Answer

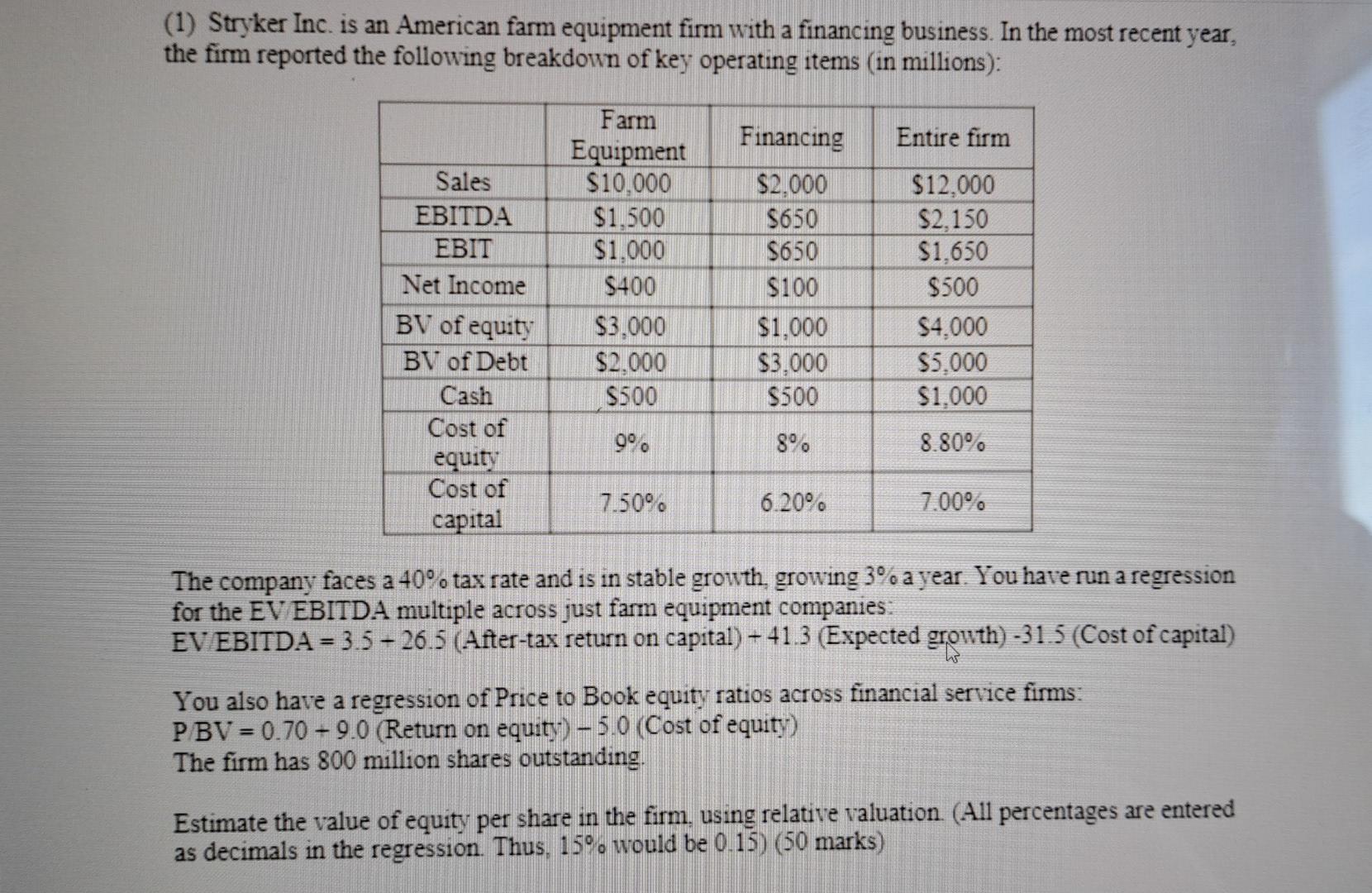

(1) Stryker Inc. is an American farm equipment firm with a financing business. In the most recent year, the firm reported the following breakdown of

(1) Stryker Inc. is an American farm equipment firm with a financing business. In the most recent year, the firm reported the following breakdown of key operating items (in millions): Entire firm Sales EBITDA EBIT Net Income BV of equity BV of Debt Cash Cost of equity Cost of capital Farm Equipment $10,000 $1,500 $1.000 $400 $3.000 $2.000 $500 Financing $2,000 $650 $650 $100 $1,000 $3.000 $500 $12.000 $2,150 $1,650 $500 $4.000 $5.000 $1,000 9 8 8.80% 7.500. 6.20% 7.00% The company faces a 40. tax rate and is in stable growth, growing 3 a year. You have run a regression for the EV EBITDA multiple across just farm equipment companies: EV EBITDA = 3.5 - 26.5 (After-tax return on capital) - 41.3 (Expected growth) -31.5 (Cost of capital) You also have a regression of Price to Book equity ratios across financial service firms: PBV = 0.70 -9.0 (Return on equity) 5.0 (Cost of equity) The firm has 800 million shares outstanding. Estimate the value of equity per share in the firm, using relative valuation. (All percentages are entered as decimals in the regression. Thus, 15% would be 0.15) (50 marks) (1) Stryker Inc. is an American farm equipment firm with a financing business. In the most recent year, the firm reported the following breakdown of key operating items (in millions): Entire firm Sales EBITDA EBIT Net Income BV of equity BV of Debt Cash Cost of equity Cost of capital Farm Equipment $10,000 $1,500 $1.000 $400 $3.000 $2.000 $500 Financing $2,000 $650 $650 $100 $1,000 $3.000 $500 $12.000 $2,150 $1,650 $500 $4.000 $5.000 $1,000 9 8 8.80% 7.500. 6.20% 7.00% The company faces a 40. tax rate and is in stable growth, growing 3 a year. You have run a regression for the EV EBITDA multiple across just farm equipment companies: EV EBITDA = 3.5 - 26.5 (After-tax return on capital) - 41.3 (Expected growth) -31.5 (Cost of capital) You also have a regression of Price to Book equity ratios across financial service firms: PBV = 0.70 -9.0 (Return on equity) 5.0 (Cost of equity) The firm has 800 million shares outstanding. Estimate the value of equity per share in the firm, using relative valuation. (All percentages are entered as decimals in the regression. Thus, 15% would be 0.15) (50 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started