Answered step by step

Verified Expert Solution

Question

1 Approved Answer

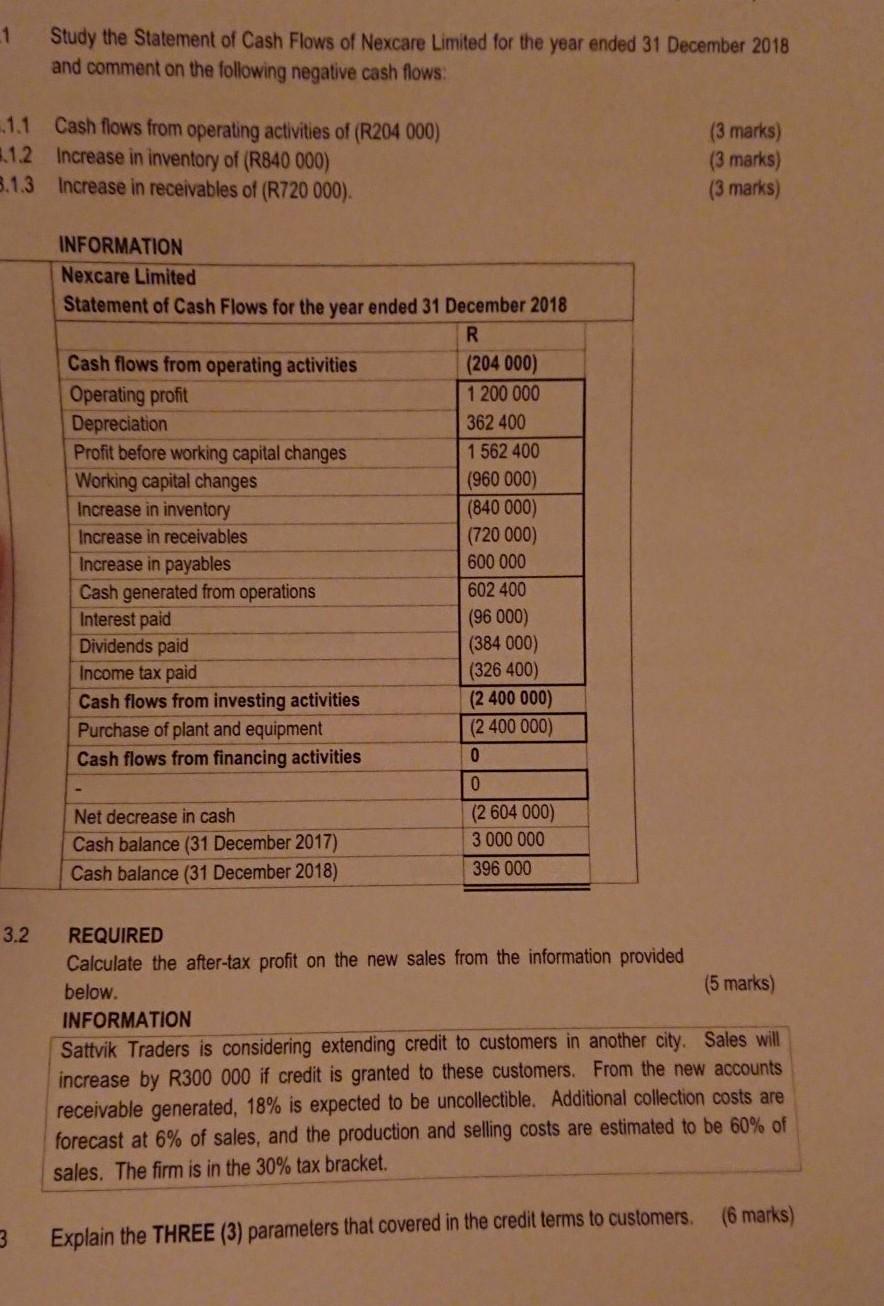

1 Study the Statement of Cash Flows of Nexcare Limited for the year ended 31 December 2018 and comment on the following negative cash flows:

1 Study the Statement of Cash Flows of Nexcare Limited for the year ended 31 December 2018 and comment on the following negative cash flows: 1.1 Cash flows from operating activities of (R204 000) 12 Increase in inventory of (R840 000) 3.1.3 Increase in receivables of (R720 000). (3 marks) (3 marks) (3 marks) INFORMATION Nexcare Limited Statement of Cash Flows for the year ended 31 December 2018 R Cash flows from operating activities (204 000) Operating profit 1 200 000 Depreciation 362 400 Profit before working capital changes 1 562 400 Working capital changes (960 000) Increase in inventory (840 000) Increase in receivables (720 000) Increase in payables 600 000 Cash generated from operations 602 400 Interest paid (96 000) Dividends paid (384 000) Income tax paid (326 400) Cash flows from investing activities (2 400 000) Purchase of plant and equipment (2 400 000) Cash flows from financing activities 0 0 Net decrease in cash (2 604 000) Cash balance (31 December 2017) 3 000 000 Cash balance (31 December 2018) 396 000 3.2 REQUIRED Calculate the after-tax profit on the new sales from the information provided below. (5 marks) INFORMATION Sattvik Traders is considering extending credit to customers in another city. Sales will increase by R300 000 if credit is granted to these customers. From the new accounts receivable generated, 18% is expected to be uncollectible. Additional collection costs are forecast at 6% of sales, and the production and selling costs are estimated to be 60% of sales. The firm is in the 30% tax bracket. (6 marks) 3 Explain the THREE (3) parameters that covered in the credit terms to customers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started