Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Subsidiary sold inventory that has cost $12,000 to its parent for $15,000 on 20 April 2024. The parent sold 40% of inventory for

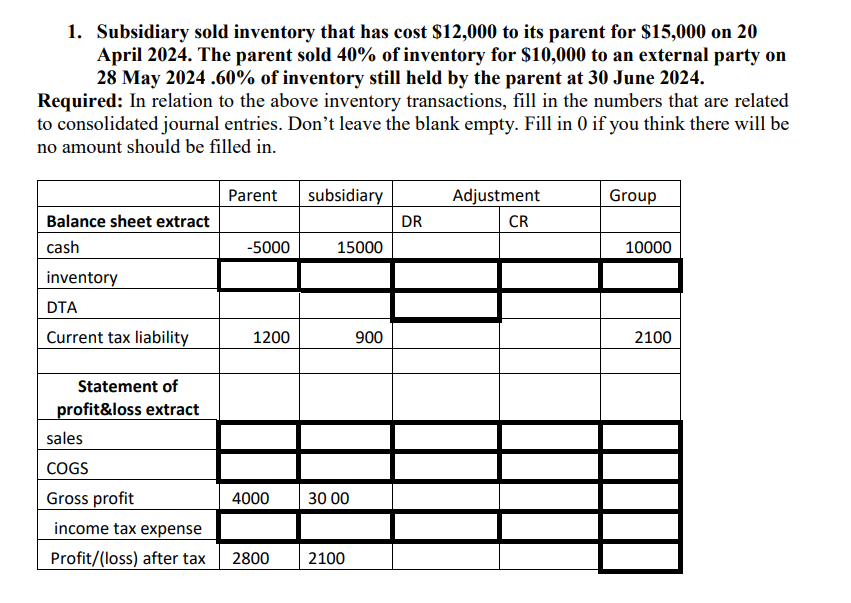

1. Subsidiary sold inventory that has cost $12,000 to its parent for $15,000 on 20 April 2024. The parent sold 40% of inventory for $10,000 to an external party on 28 May 2024.60% of inventory still held by the parent at 30 June 2024. Required: In relation to the above inventory transactions, fill in the numbers that are related to consolidated journal entries. Don't leave the blank empty. Fill in 0 if you think there will be no amount should be filled in. Parent subsidiary Adjustment Group Balance sheet extract DR CR cash -5000 15000 10000 inventory DTA Current tax liability 1200 900 2100 Statement of profit&loss extract sales COGS Gross profit 4000 30 00 income tax expense Profit/(loss) after tax 2800 2100

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the adjustment for the inventory we can use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started