Question

1) Suggest one possible fiscal policy to the Greek government to address the debt crisis. What effect would the policy have? 2)Why might the Greek

1) Suggest one possible fiscal policy to the Greek government to address the debt crisis. What effect would the policy have?

2)Why might the Greek government be experiencing such a large budget deficit?

3) The Minister of Finance has suggested that the Greek government cut public spending by 10%. What effect will this have on aggregate demand?

4) The Prime Minister would like to consider other options and has asked you to present an alternative to increase national income growth in Greece. What is your suggestion to the Prime Minister?

5) Given the recession that the Greek economy is facing, what is the most likely effect on the following economic indicators:

Imports

Unemployment

Inflation

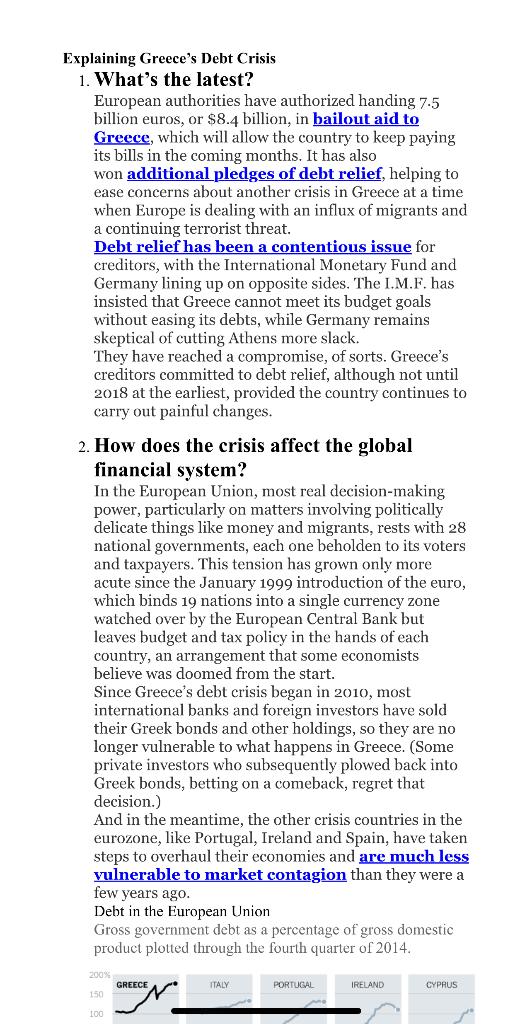

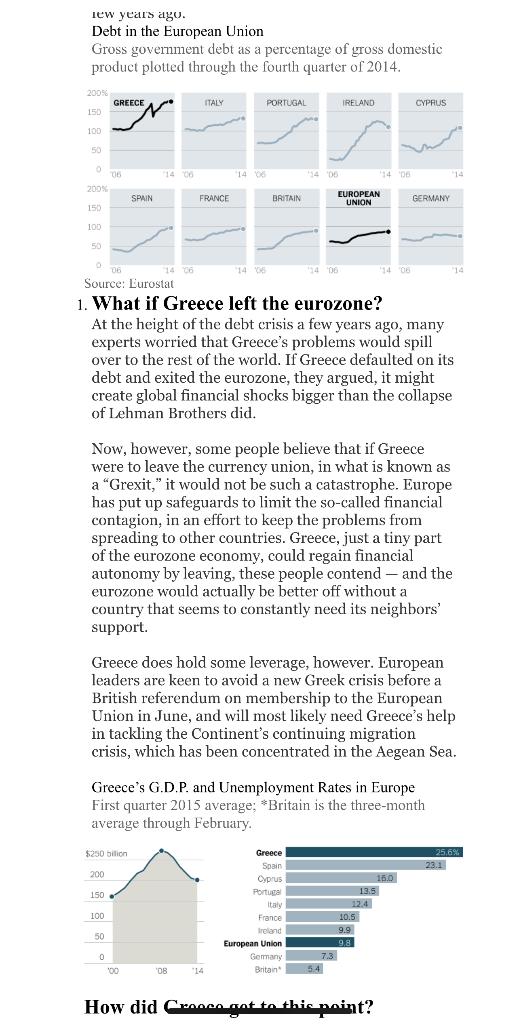

Explaining Greece's Debt Crisis 1. What's the latest? European authorities have authorized handing 7.5 billion euros, or $8.4 billion, in bailout aid to Greece, which will allow the country to keep paying its bills in the coming months. It has also won additional pledges of debt relief, helping to ease concerns about another crisis in Greece at a time when Europe is dealing with an influx of migrants and a continuing terrorist threat. Debt relief has been a contentious issue for creditors, with the International Monetary Fund and Germany lining up on opposite sides. The I.M.F. has insisted that Greece cannot meet its budget goals without easing its debts, while Germany remains skeptical of cutting Athens more slack. They have reached a compromise, of sorts. Greece's creditors committed to debt relief, although not until 2018 at the earliest, provided the country continues to carry out painful changes. 2. How does the crisis affect the global financial system? In the European Union, most real decision-making power, particularly on matters involving politically delicate things like money and migrants, rests with 28 national governments, each one beholden to its voters and taxpayers. This tension has grown only more acute since the January 1999 introduction of the euro, which binds 19 nations into a single currency zone watched over by the European Central Bank but leaves budget and tax policy in the hands of each country, an arrangement that some economists believe was doomed from the start. Since Greece's debt crisis began in 2010, most international banks and foreign investors have sold their Greek bonds and other holdings, so they are no longer vulnerable to what happens in Greece. (Some private investors who subsequently plowed back into Greek bonds, betting on a comeback, regret that decision.) And in the meantime, the other crisis countries in the eurozone, like Portugal, Ireland and Spain, have taken. steps to overhaul their economies and are much less vulnerable to market contagion they were a few years ago. Debt in the European Union Gross government debt as a percentage of gross domestic product plotted through the fourth quarter of 2014. 200% 150 100 GREECE ITALY PORTUGAL IRELAND CYPRUS

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 5 1 The debt crisis that had arisen in Greek economy was due to the excessive expenditure of the Greek Government Since the reason of the crisis ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started