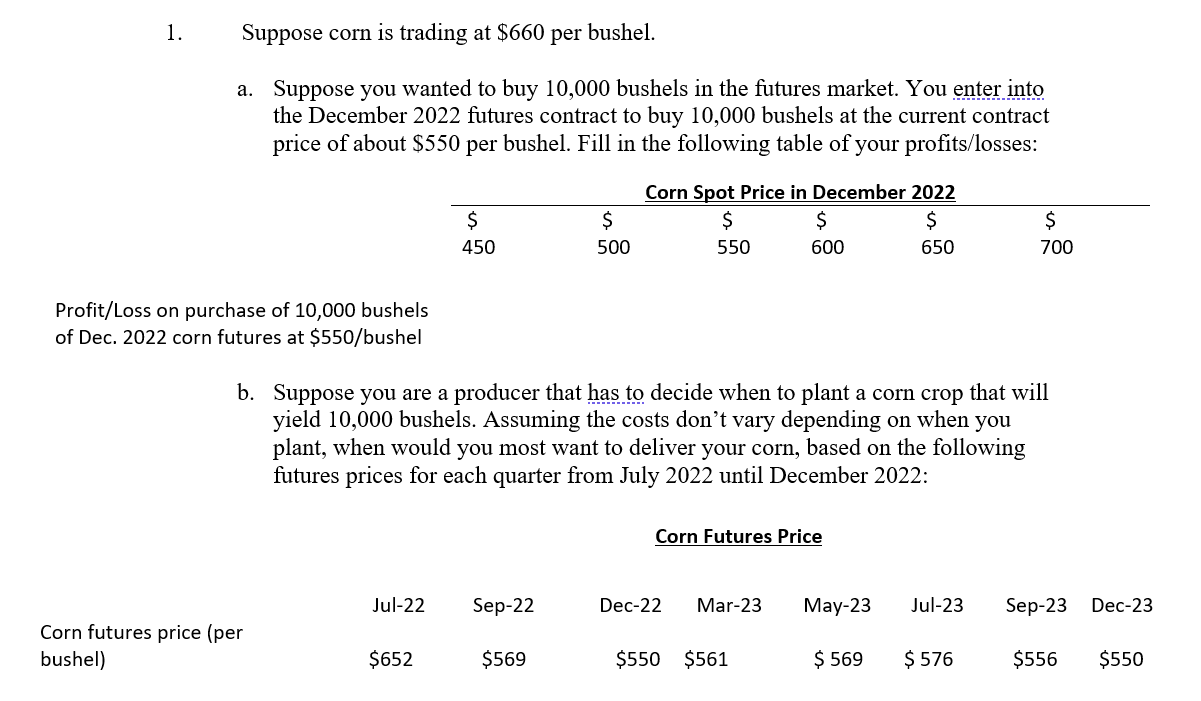

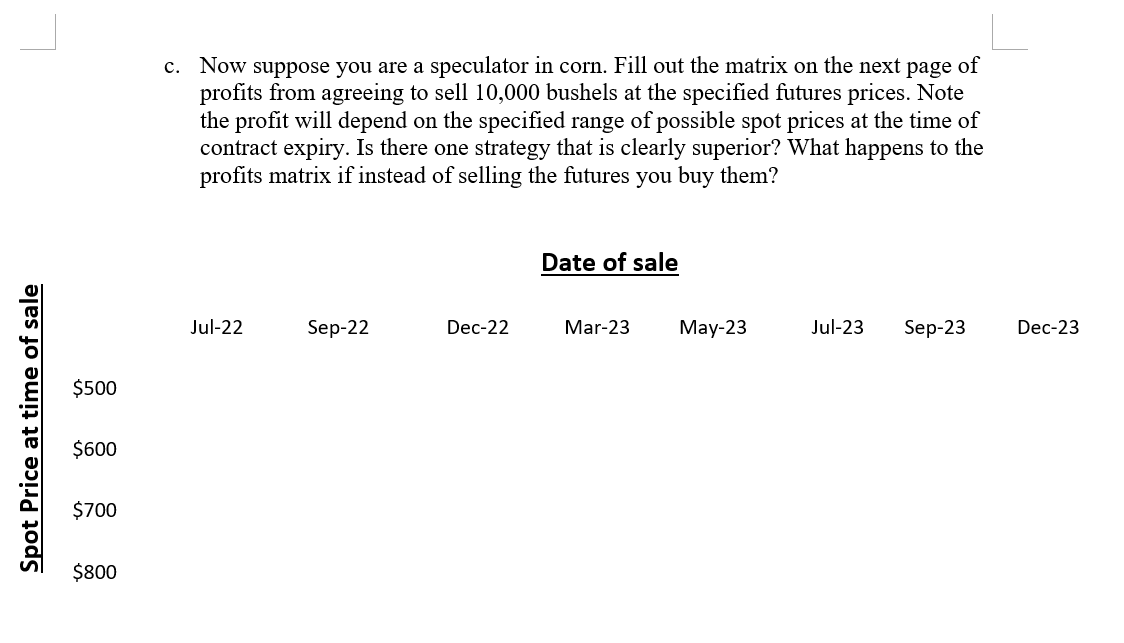

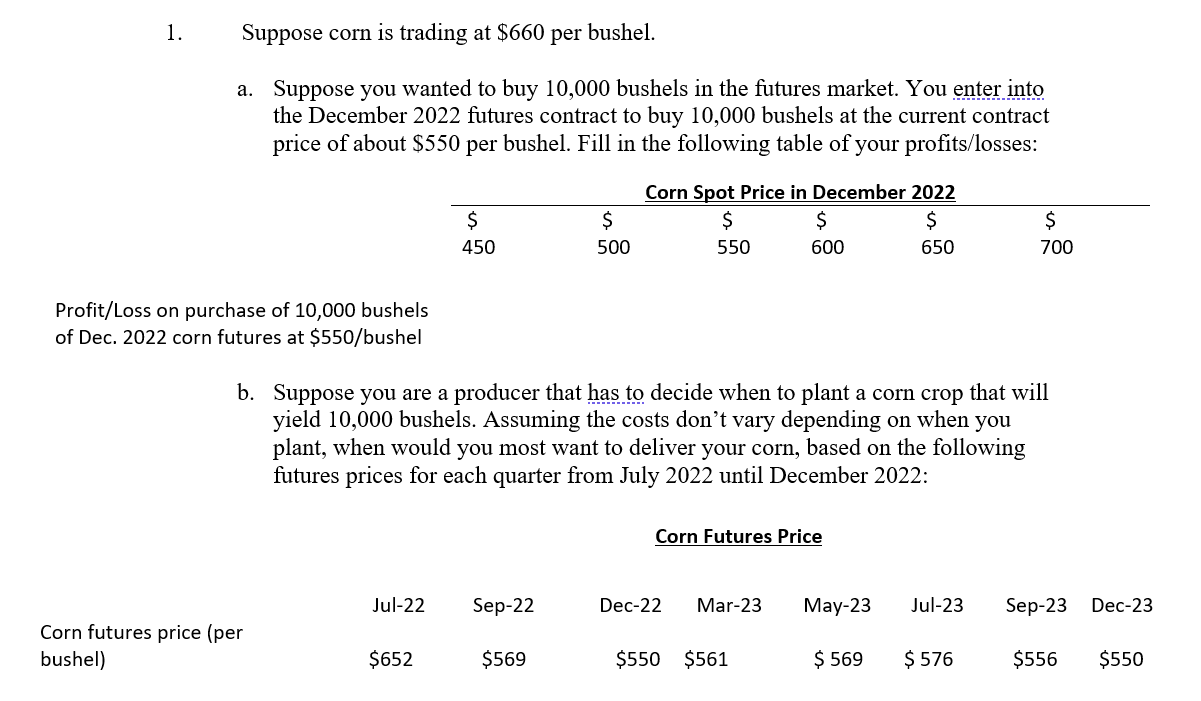

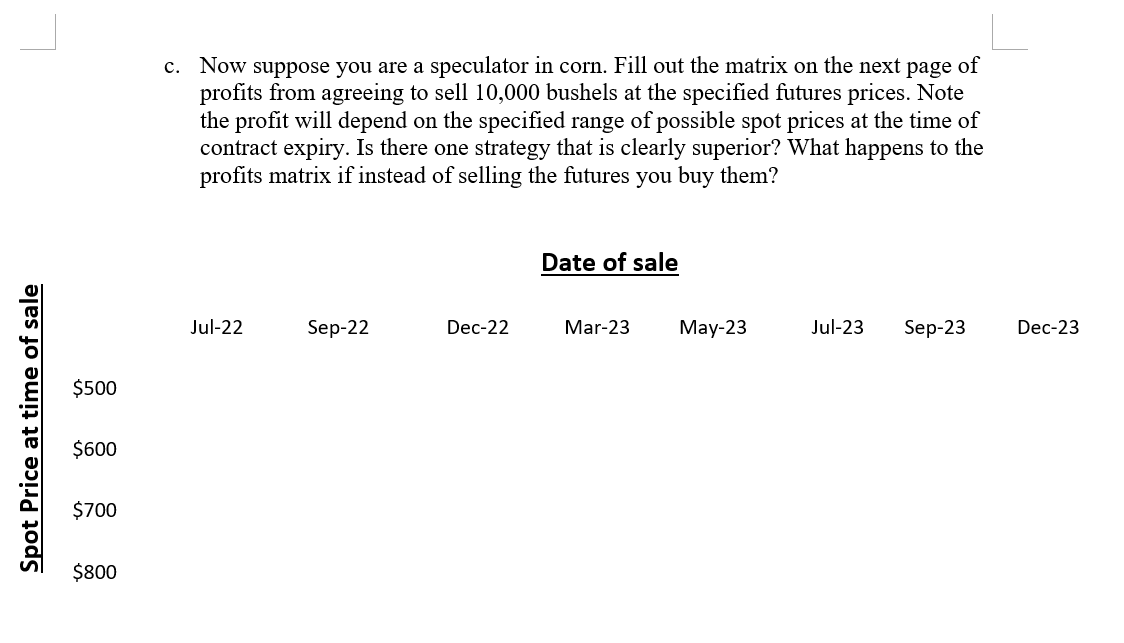

1. Suppose corn is trading at $660 per bushel. a. Suppose you wanted to buy 10,000 bushels in the futures market. You enter into the December 2022 futures contract to buy 10,000 bushels at the current contract price of about $550 per bushel. Fill in the following table of your profits/losses: $ 450 $ 500 Corn Spot Price in December 2022 $ $ $ 550 600 650 $ 700 Profit/Loss on purchase of 10,000 bushels of Dec. 2022 corn futures at $550/bushel b. Suppose you are a producer that has to decide when to plant a corn crop that will yield 10,000 bushels. Assuming the costs don't vary depending on when you plant, when would you most want to deliver your corn, based on the following futures prices for each quarter from July 2022 until December 2022: Corn Futures Price Jul-22 Sep-22 Dec-22 Mar-23 May-23 Jul-23 Sep-23 Dec-23 Corn futures price (per bushel) $652 $569 $550 $561 $ 569 $ 576 $556 $550 c. Now suppose you are a speculator in corn. Fill out the matrix on the next page of profits from agreeing to sell 10,000 bushels at the specified futures prices. Note the profit will depend on the specified range of possible spot prices at the time of contract expiry. Is there one strategy that is clearly superior? What happens to the profits matrix if instead of selling the futures you buy them? Date of sale Jul-22 Sep-22 Dec-22 Mar-23 May-23 Jul-23 Sep-23 Dec-23 $500 Spot Price at time of sale $600 $700 $800 1. Suppose corn is trading at $660 per bushel. a. Suppose you wanted to buy 10,000 bushels in the futures market. You enter into the December 2022 futures contract to buy 10,000 bushels at the current contract price of about $550 per bushel. Fill in the following table of your profits/losses: $ 450 $ 500 Corn Spot Price in December 2022 $ $ $ 550 600 650 $ 700 Profit/Loss on purchase of 10,000 bushels of Dec. 2022 corn futures at $550/bushel b. Suppose you are a producer that has to decide when to plant a corn crop that will yield 10,000 bushels. Assuming the costs don't vary depending on when you plant, when would you most want to deliver your corn, based on the following futures prices for each quarter from July 2022 until December 2022: Corn Futures Price Jul-22 Sep-22 Dec-22 Mar-23 May-23 Jul-23 Sep-23 Dec-23 Corn futures price (per bushel) $652 $569 $550 $561 $ 569 $ 576 $556 $550 c. Now suppose you are a speculator in corn. Fill out the matrix on the next page of profits from agreeing to sell 10,000 bushels at the specified futures prices. Note the profit will depend on the specified range of possible spot prices at the time of contract expiry. Is there one strategy that is clearly superior? What happens to the profits matrix if instead of selling the futures you buy them? Date of sale Jul-22 Sep-22 Dec-22 Mar-23 May-23 Jul-23 Sep-23 Dec-23 $500 Spot Price at time of sale $600 $700 $800