Question

1. Suppose that a fund manager manages bond portfolio and concerns over bond price decline in the future. To hedge interest rate risk during the

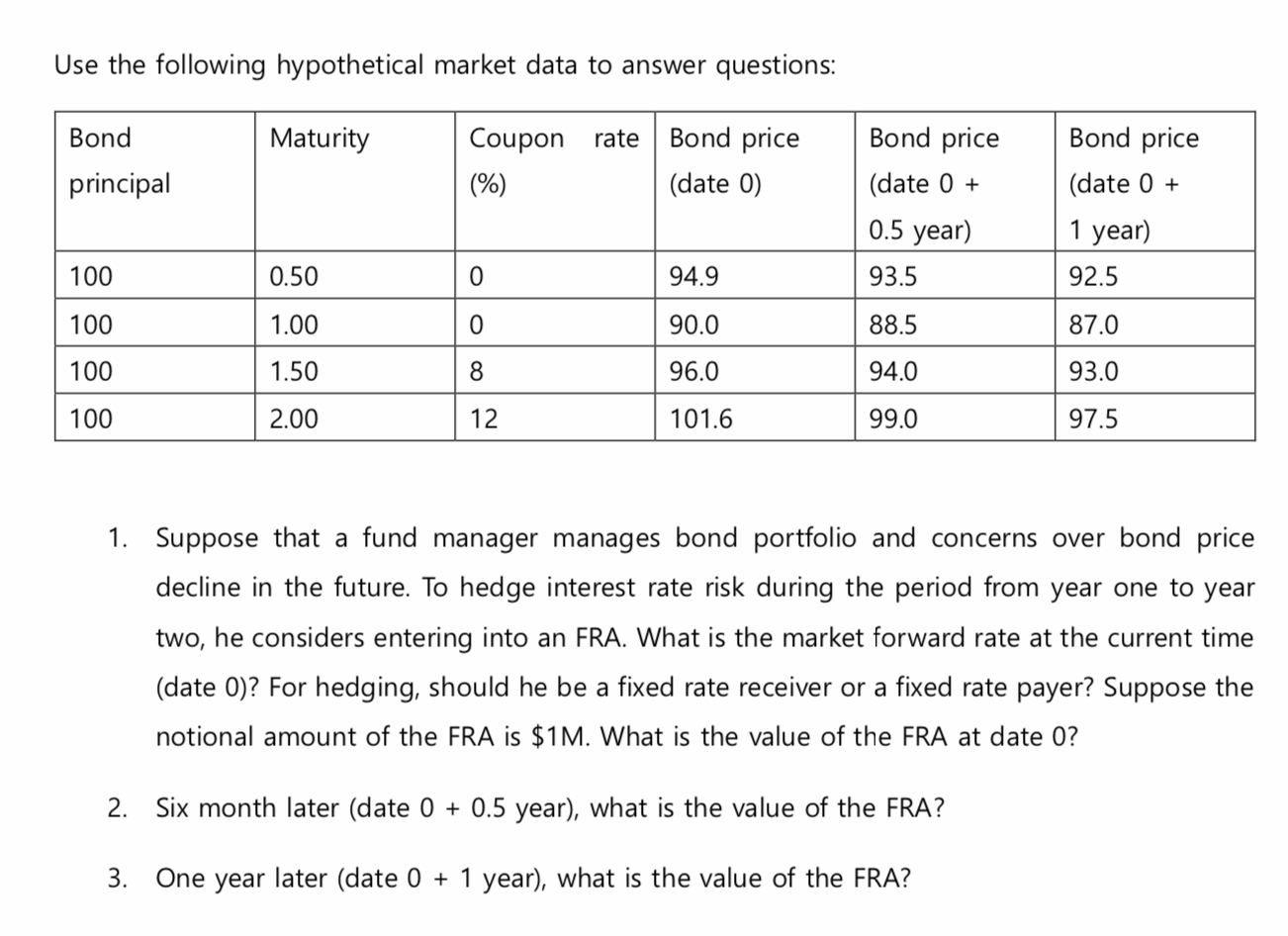

1. Suppose that a fund manager manages bond portfolio and concerns over bond price decline in the future. To hedge interest rate risk during the period from year one to year two, he considers entering into an FRA. What is the market forward rate at the current time (date 0)? For hedging, should he be a fixed rate receiver or a fixed rate payer? Suppose the notional amount of the FRA is $1M. What is the value of the FRA at date 0? 2. Six month later (date 0 + 0.5 year), what is the value of the FRA? 3. One year later (date 0 + 1 year), what is the value of the FRA?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started