Question

1. Suppose that investors demand an interest rate of 5% on a 3-year treasury bonds. What would be the price of the treasury bond?

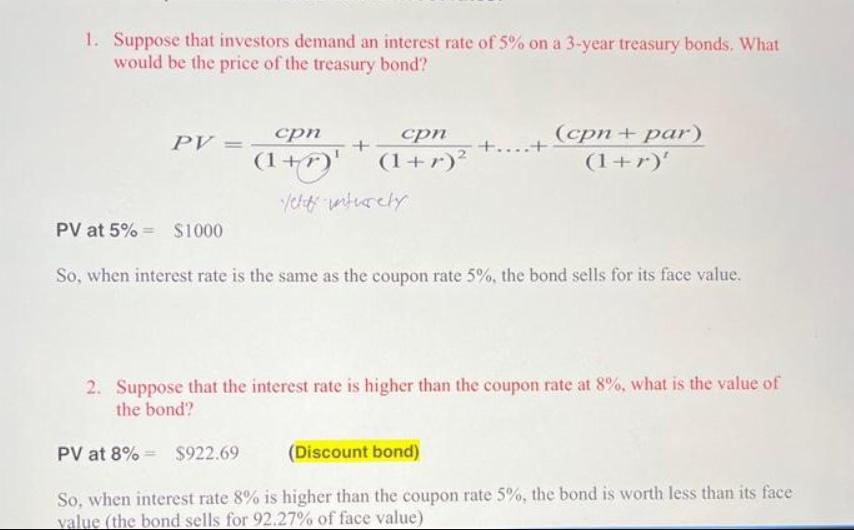

1. Suppose that investors demand an interest rate of 5% on a 3-year treasury bonds. What would be the price of the treasury bond? PV = cpn (1+1) + cpn (1+r) /cliff unturely ..+ (cpn+par) (1+r)' PV at 5%= $1000 So, when interest rate is the same as the coupon rate 5%, the bond sells for its face value. 2. Suppose that the interest rate is higher than the coupon rate at 8%, what is the value of the bond? PV at 8% $922.69 (Discount bond) So, when interest rate 8% is higher than the coupon rate 5%, the bond is worth less than its face value (the bond sells for 92.27% of face value)

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 PRICE OF THE BOND PRICE F1rn where F is the face value 1000 r is the coupon rate 5 n is number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxes And Business Strategy A Planning Approach

Authors: Myron Scholes, Mark Wolfson, Merle Erickson, Michelle Hanlon

5th Edition

132752670, 978-0132752671

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App