Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Best-Glove, is a maker of disposable domestic-use gloves. The firm is considering the purchase of a production machine. This investment requires an initial

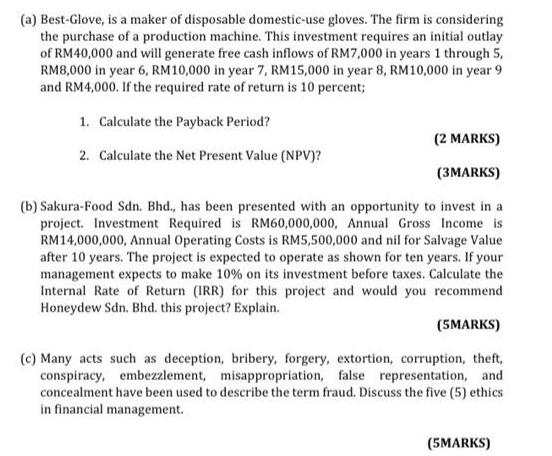

(a) Best-Glove, is a maker of disposable domestic-use gloves. The firm is considering the purchase of a production machine. This investment requires an initial outlay of RM40,000 and will generate free cash inflows of RM7,000 in years 1 through 5, RM8,000 in year 6, RM10,000 in year 7, RM15,000 in year 8, RM10,000 in year 9 and RM4,000. If the required rate of return is 10 percent; 1. Calculate the Payback Period? 2. Calculate the Net Present Value (NPV)? (2 MARKS) (3MARKS) (b) Sakura-Food Sdn. Bhd., has been presented with an opportunity to invest in a project. Investment Required is RM60,000,000, Annual Gross Income is RM14,000,000, Annual Operating Costs is RM5,500,000 and nil for Salvage Value after 10 years. The project is expected to operate as shown for ten years. If your management expects to make 10% on its investment before taxes. Calculate the Internal Rate of Return (IRR) for this project and would you recommend Honeydew Sdn. Bhd. this project? Explain. (5MARKS) (c) Many acts such as deception, bribery, forgery, extortion, corruption, theft, conspiracy, embezzlement, misappropriation, false representation, and concealment have been used to describe the term fraud. Discuss the five (5) ethics in financial management. (5MARKS)

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Pay back Period RM 40 000 RM 7 000 RM 8 000 RM 10 000 RM 15 000 RM 10 000 RM 4 000 5 71 Years 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started