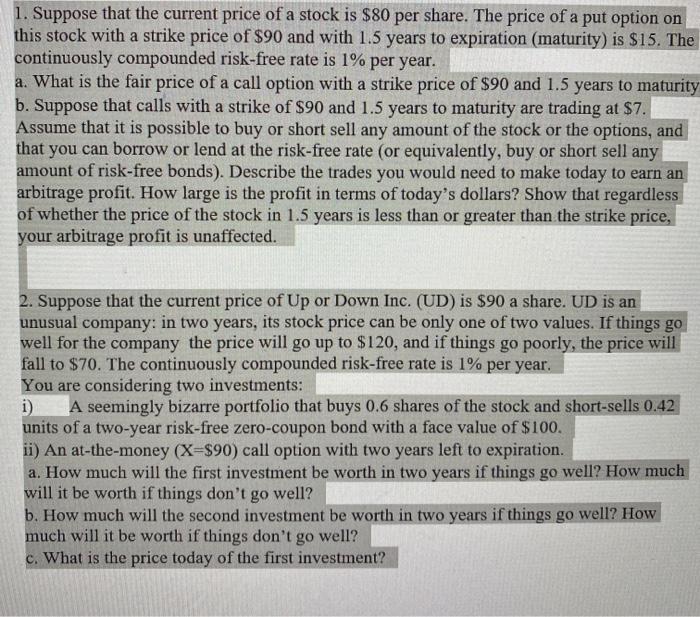

1. Suppose that the current price of a stock is $80 per share. The price of a put option on this stock with a strike price of $90 and with 1.5 years to expiration (maturity) is $15. The continuously compounded risk-free rate is 1% per year. a. What is the fair price of a call option with a strike price of $90 and 1.5 years to maturity b. Suppose that calls with a strike of $90 and 1.5 years to maturity are trading at $7. Assume that it is possible to buy or short sell any amount of the stock or the options, and that you can borrow or lend at the risk-free rate (or equivalently, buy or short sell any amount of risk-free bonds). Describe the trades you would need to make today to earn an arbitrage profit. How large is the profit in terms of today's dollars? Show that regardless of whether the price of the stock in 1.5 years is less than or greater than the strike price, your arbitrage profit is unaffected. 2. Suppose that the current price of Up or Down Inc. (UD) is $90 a share. UD is an unusual company in two years, its stock price can be only one of two values. If things go well for the company the price will go up to $120, and if things go poorly, the price will fall to $70. The continuously compounded risk-free rate is 1% per year. You are considering two investments: i) A seemingly bizarre portfolio that buys 0.6 shares of the stock and short-sells 0.42 units of a two-year risk-free zero-coupon bond with a face value of $100. ii) An at-the-money (X=$90) call option with two years left to expiration. a. How much will the first investment be worth in two years if things go well? How much will it be worth if things don't go well? b. How much will the second investment be worth in two years if things go well? How much will it be worth if things don't go well? c. What is the price today of the first investment? 1. Suppose that the current price of a stock is $80 per share. The price of a put option on this stock with a strike price of $90 and with 1.5 years to expiration (maturity) is $15. The continuously compounded risk-free rate is 1% per year. a. What is the fair price of a call option with a strike price of $90 and 1.5 years to maturity b. Suppose that calls with a strike of $90 and 1.5 years to maturity are trading at $7. Assume that it is possible to buy or short sell any amount of the stock or the options, and that you can borrow or lend at the risk-free rate (or equivalently, buy or short sell any amount of risk-free bonds). Describe the trades you would need to make today to earn an arbitrage profit. How large is the profit in terms of today's dollars? Show that regardless of whether the price of the stock in 1.5 years is less than or greater than the strike price, your arbitrage profit is unaffected. 2. Suppose that the current price of Up or Down Inc. (UD) is $90 a share. UD is an unusual company in two years, its stock price can be only one of two values. If things go well for the company the price will go up to $120, and if things go poorly, the price will fall to $70. The continuously compounded risk-free rate is 1% per year. You are considering two investments: i) A seemingly bizarre portfolio that buys 0.6 shares of the stock and short-sells 0.42 units of a two-year risk-free zero-coupon bond with a face value of $100. ii) An at-the-money (X=$90) call option with two years left to expiration. a. How much will the first investment be worth in two years if things go well? How much will it be worth if things don't go well? b. How much will the second investment be worth in two years if things go well? How much will it be worth if things don't go well? c. What is the price today of the first investment