Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose that the growth rate is expected to be 3.00%. In this case, the stocks forecasted intrinsic value would be?( the same as, less

1.

Suppose that the growth rate is expected to be 3.00%. In this case, the stocks forecasted intrinsic value would be?(the same as, less than, greater than) its current price, and the stock would be a.?(sell, buy).

2&3.

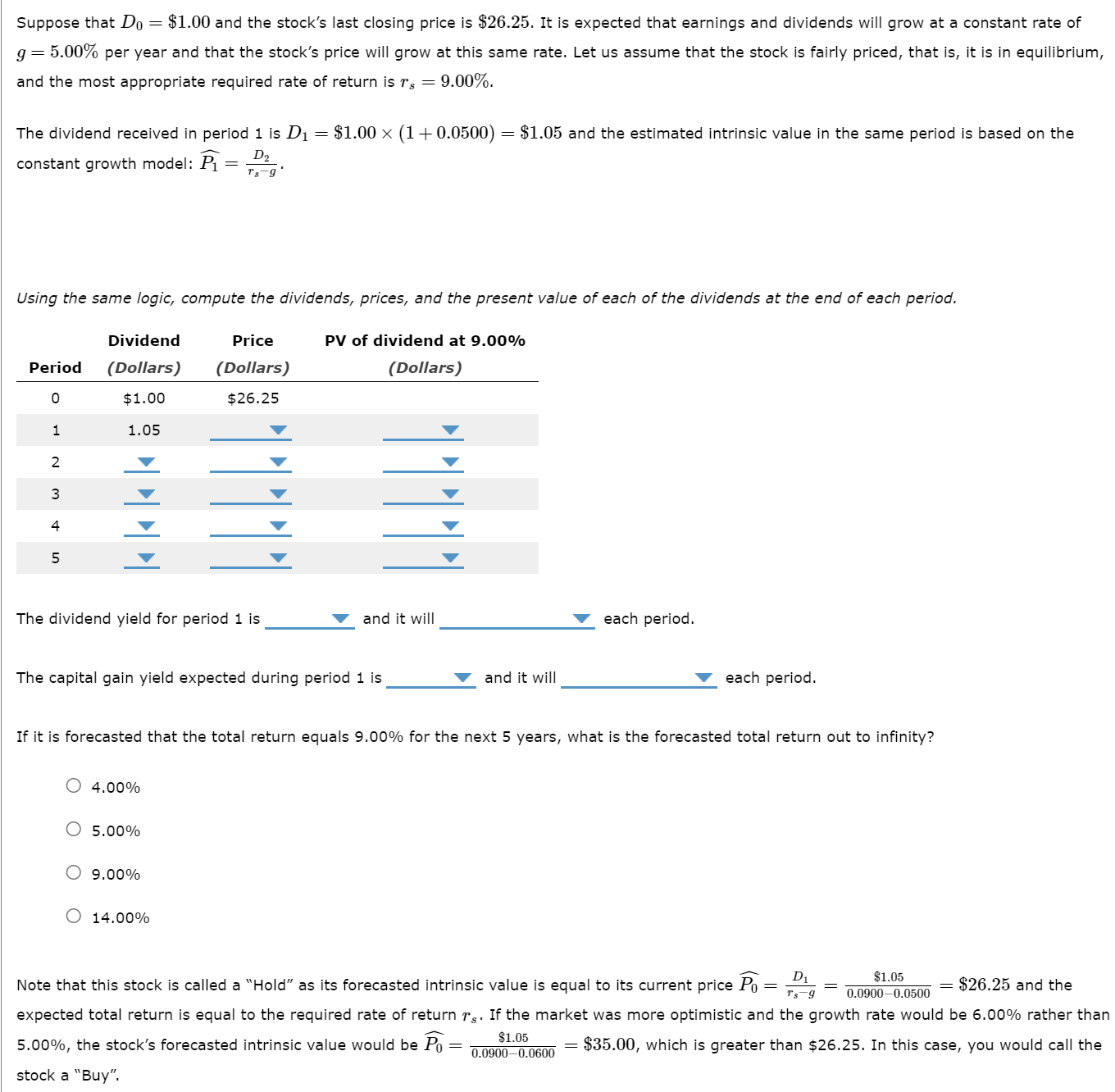

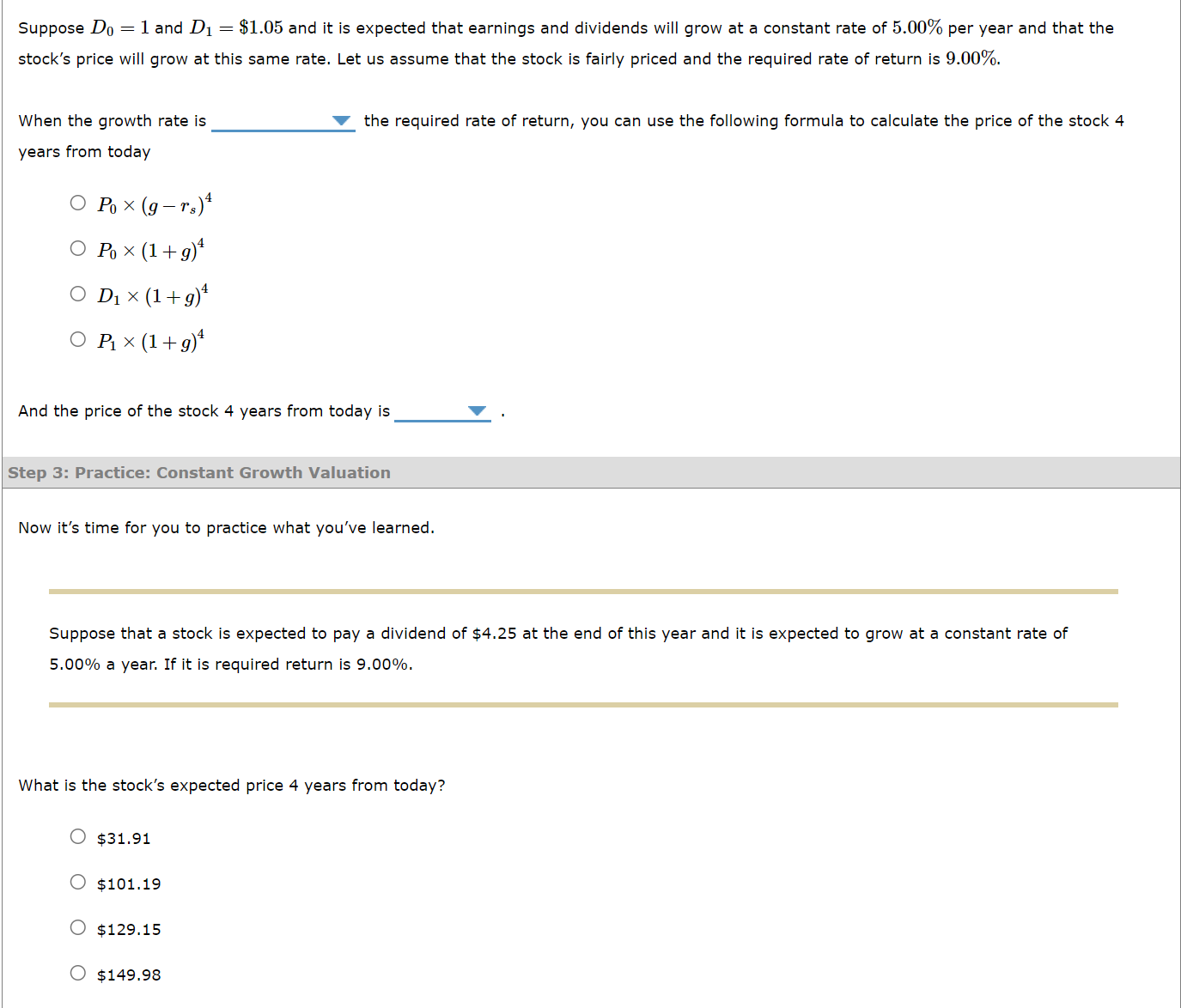

Suppose that D0=$1.00 and the stock's last closing price is $26.25. It is expected that earnings and dividends will grow at a constant rate of g=5.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is rs=9.00%. The dividend received in period 1 is D1=$1.00(1+0.0500)=$1.05 and the estimated intrinsic value in the same period is based on the constant growth model: P1=rsgD2. Using the same logic, compute the dividends, prices, and the present value of each of the dividends at the end of each period. The dividend yield for period 1 is and it will each period. The capital gain yield expected during period 1 is and it will each period. If it is forecasted that the total return equals 9.00% for the next 5 years, what is the forecasted total return out to infinity? 4.00% 5.00% 9.00% 14.00% Note that this stock is called a "Hold" as its forecasted intrinsic value is equal to its current price P0=rsgD1=0.09000.0500$1.05=$26.25 and the expected total return is equal to the required rate of return rs. If the market was more optimistic and the growth rate would be 6.00% rather than 5.00%, the stock's forecasted intrinsic value would be P0=0.09000.0600$1.05=$35.00, which is greater than $26.25. In this case, you would call the stock a "Buy". Suppose D0=1 and D1=$1.05 and it is expected that earnings and dividends will grow at a constant rate of 5.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced and the required rate of return is 9.00%. When the growth rate is years from today P0(grs)4P0(1+g)4D1(1+g)4P1(1+g)4 the required rate of return, you can use the following formula to calculate the price of the stock 4 And the price of the stock 4 years from today is Step 3: Practice: Constant Growth Valuation Now it's time for you to practice what you've learned. Suppose that a stock is expected to pay a dividend of $4.25 at the end of this year and it is expected to grow at a constant rate of 5.00% a year. If it is required return is 9.00%. What is the stock's expected price 4 years from today? $31.91$101.19$129.15$149.98 Suppose that D0=$1.00 and the stock's last closing price is $26.25. It is expected that earnings and dividends will grow at a constant rate of g=5.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is rs=9.00%. The dividend received in period 1 is D1=$1.00(1+0.0500)=$1.05 and the estimated intrinsic value in the same period is based on the constant growth model: P1=rsgD2. Using the same logic, compute the dividends, prices, and the present value of each of the dividends at the end of each period. The dividend yield for period 1 is and it will each period. The capital gain yield expected during period 1 is and it will each period. If it is forecasted that the total return equals 9.00% for the next 5 years, what is the forecasted total return out to infinity? 4.00% 5.00% 9.00% 14.00% Note that this stock is called a "Hold" as its forecasted intrinsic value is equal to its current price P0=rsgD1=0.09000.0500$1.05=$26.25 and the expected total return is equal to the required rate of return rs. If the market was more optimistic and the growth rate would be 6.00% rather than 5.00%, the stock's forecasted intrinsic value would be P0=0.09000.0600$1.05=$35.00, which is greater than $26.25. In this case, you would call the stock a "Buy". Suppose D0=1 and D1=$1.05 and it is expected that earnings and dividends will grow at a constant rate of 5.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced and the required rate of return is 9.00%. When the growth rate is years from today P0(grs)4P0(1+g)4D1(1+g)4P1(1+g)4 the required rate of return, you can use the following formula to calculate the price of the stock 4 And the price of the stock 4 years from today is Step 3: Practice: Constant Growth Valuation Now it's time for you to practice what you've learned. Suppose that a stock is expected to pay a dividend of $4.25 at the end of this year and it is expected to grow at a constant rate of 5.00% a year. If it is required return is 9.00%. What is the stock's expected price 4 years from today? $31.91$101.19$129.15$149.98

Suppose that D0=$1.00 and the stock's last closing price is $26.25. It is expected that earnings and dividends will grow at a constant rate of g=5.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is rs=9.00%. The dividend received in period 1 is D1=$1.00(1+0.0500)=$1.05 and the estimated intrinsic value in the same period is based on the constant growth model: P1=rsgD2. Using the same logic, compute the dividends, prices, and the present value of each of the dividends at the end of each period. The dividend yield for period 1 is and it will each period. The capital gain yield expected during period 1 is and it will each period. If it is forecasted that the total return equals 9.00% for the next 5 years, what is the forecasted total return out to infinity? 4.00% 5.00% 9.00% 14.00% Note that this stock is called a "Hold" as its forecasted intrinsic value is equal to its current price P0=rsgD1=0.09000.0500$1.05=$26.25 and the expected total return is equal to the required rate of return rs. If the market was more optimistic and the growth rate would be 6.00% rather than 5.00%, the stock's forecasted intrinsic value would be P0=0.09000.0600$1.05=$35.00, which is greater than $26.25. In this case, you would call the stock a "Buy". Suppose D0=1 and D1=$1.05 and it is expected that earnings and dividends will grow at a constant rate of 5.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced and the required rate of return is 9.00%. When the growth rate is years from today P0(grs)4P0(1+g)4D1(1+g)4P1(1+g)4 the required rate of return, you can use the following formula to calculate the price of the stock 4 And the price of the stock 4 years from today is Step 3: Practice: Constant Growth Valuation Now it's time for you to practice what you've learned. Suppose that a stock is expected to pay a dividend of $4.25 at the end of this year and it is expected to grow at a constant rate of 5.00% a year. If it is required return is 9.00%. What is the stock's expected price 4 years from today? $31.91$101.19$129.15$149.98 Suppose that D0=$1.00 and the stock's last closing price is $26.25. It is expected that earnings and dividends will grow at a constant rate of g=5.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is rs=9.00%. The dividend received in period 1 is D1=$1.00(1+0.0500)=$1.05 and the estimated intrinsic value in the same period is based on the constant growth model: P1=rsgD2. Using the same logic, compute the dividends, prices, and the present value of each of the dividends at the end of each period. The dividend yield for period 1 is and it will each period. The capital gain yield expected during period 1 is and it will each period. If it is forecasted that the total return equals 9.00% for the next 5 years, what is the forecasted total return out to infinity? 4.00% 5.00% 9.00% 14.00% Note that this stock is called a "Hold" as its forecasted intrinsic value is equal to its current price P0=rsgD1=0.09000.0500$1.05=$26.25 and the expected total return is equal to the required rate of return rs. If the market was more optimistic and the growth rate would be 6.00% rather than 5.00%, the stock's forecasted intrinsic value would be P0=0.09000.0600$1.05=$35.00, which is greater than $26.25. In this case, you would call the stock a "Buy". Suppose D0=1 and D1=$1.05 and it is expected that earnings and dividends will grow at a constant rate of 5.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced and the required rate of return is 9.00%. When the growth rate is years from today P0(grs)4P0(1+g)4D1(1+g)4P1(1+g)4 the required rate of return, you can use the following formula to calculate the price of the stock 4 And the price of the stock 4 years from today is Step 3: Practice: Constant Growth Valuation Now it's time for you to practice what you've learned. Suppose that a stock is expected to pay a dividend of $4.25 at the end of this year and it is expected to grow at a constant rate of 5.00% a year. If it is required return is 9.00%. What is the stock's expected price 4 years from today? $31.91$101.19$129.15$149.98 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started