Question

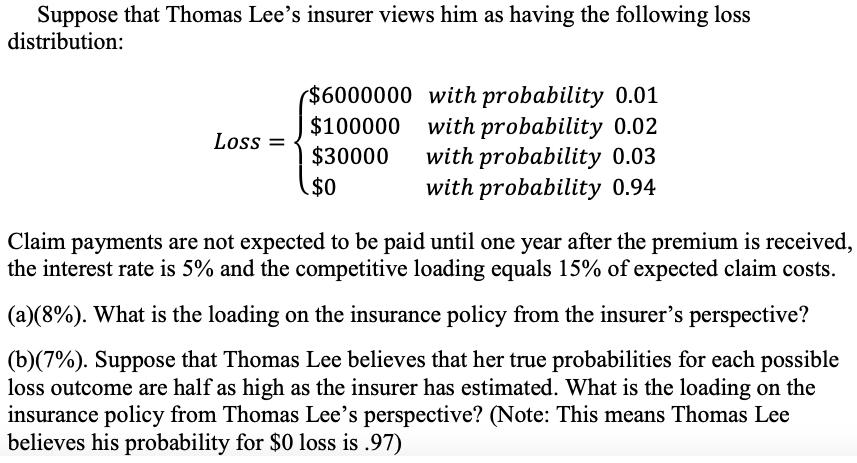

Suppose that Thomas Lee's insurer views him as having the following loss distribution: ($6000000 with probability 0.01 $100000 with probability 0.02 with probability 0.03

Suppose that Thomas Lee's insurer views him as having the following loss distribution: ($6000000 with probability 0.01 $100000 with probability 0.02 with probability 0.03 with probability 0.94 Loss = $30000 $0 0 Claim payments are not expected to be paid until one year after the premium is received, the interest rate is 5% and the competitive loading equals 15% of expected claim costs. (a)(8%). What is the loading on the insurance policy from the insurer's perspective? (b)(7%). Suppose that Thomas Lee believes that her true probabilities for each possible loss outcome are half as high as the insurer has estimated. What is the loading on the insurance policy from Thomas Lee's perspective? (Note: This means Thomas Lee believes his probability for $0 loss is .97)

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Finite Mathematics and Its Applications

Authors: Larry J. Goldstein, David I. Schneider, Martha J. Siegel, Steven Hair

12th edition

978-0134768588, 9780134437767, 134768582, 134437764, 978-0134768632

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App