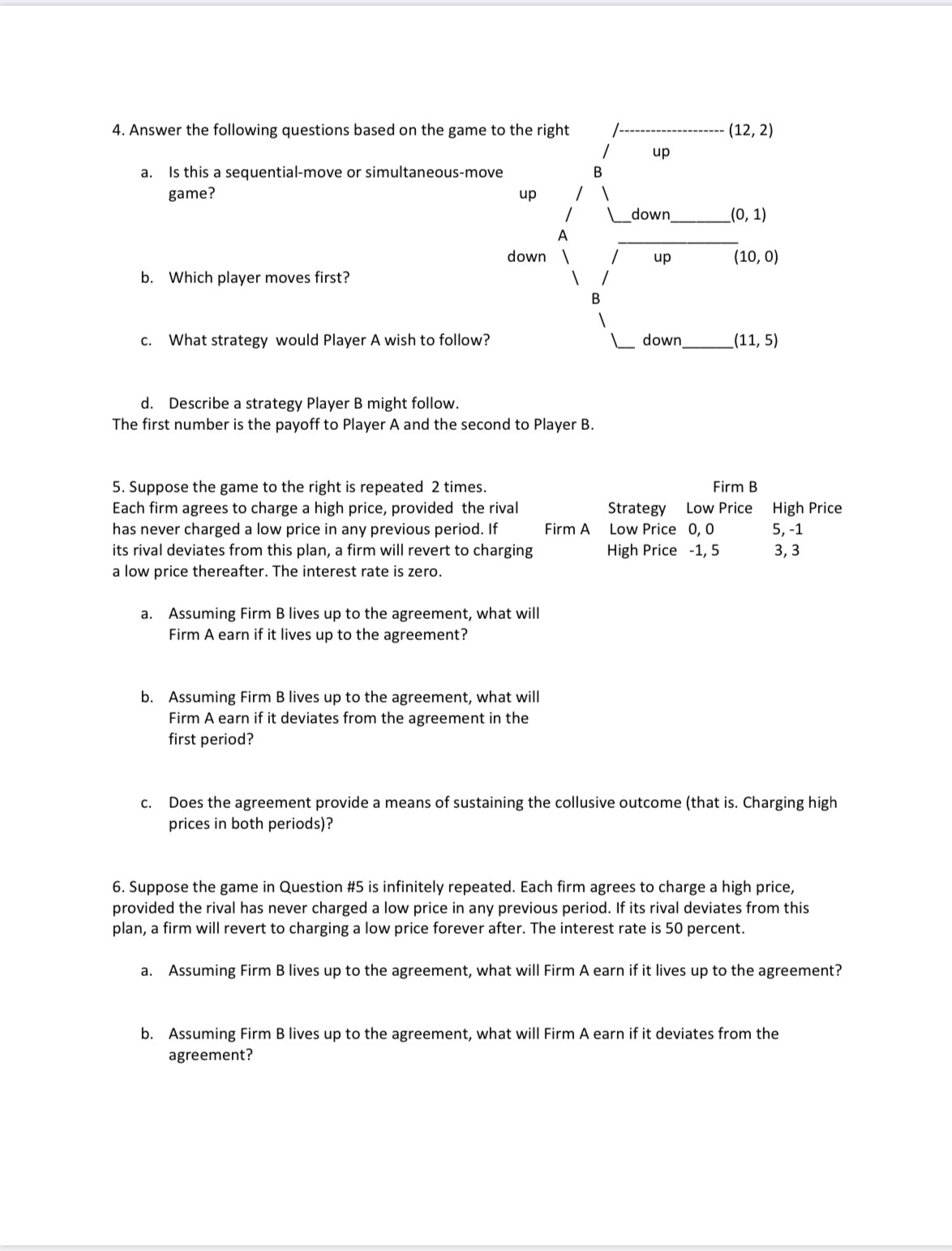

1, Suppose two firms compete in a homogeneous product market and produce at constant marginal cost of $5. Whichever firm has the lower price will have all of the customers. a. What prices would be charged in this Bertrand oligopoly? b. What would be the rms economic profits? 2.a. In a Sweezy oligopoly ikinked demand model]. If your competitor should raise their price what would be your firm's price strategy? b.Assuming part { a lis occurring what elasticity characteristic would the product show in this type of market? c. What happens to the output of a firm if its marginal cost rises in a Sweezy oligopoly? d. If your competitor lowers their price what would be your price strategy in this Sweezy model? e. Why could the actions of part i d ) lead to a disaster to both competing firms? 3. Answer the following questions based on the one-shot simultaneous move game to the right. The first number in each cell is the payoff to Player A and the second number is the payoff to Player 3. a. What is the secure strategy for Player A? Player B Strategy Left Right Player A Up 1. 5 2, 4 b. Does player B have a dominant strategy? Down 3, 6 4, 7 If so what is it? c. There is one Nash equilibrium. What is it? 4. Answer the following questions based on the game to the right I -------------------- {12, 2) I up a. Is this a sequential-move or simultaneous-move B game? up I \\ / \\_down_{0, 1) A down \\ / up (10, 0) b. Which player moves first? \\ l B \\ c. What strategy would Player A wish to follow? \\_ down(11, 5) d. Describe a strategy Player B might follow. The first number is the payoff to Player A and the second to Player B. 5. Suppose the game to the right is repeated 2 times. Firm B Each firm agrees to charge a high price, provided the rival Strategy Low Price High Price has never charged a low price in any previous period. If Firm A Low Price 0, 0 5, -1 its rival deviates from this plan, a firm will revert to charging High Price -1, 5 3, 3 a low price thereafter. The interest rate is zero. a. Assuming Firm B lives up to the agreement, what will Firm A earn if it lives up to the agreement? b. Assuming Firm B lives up to the agreement, what will Firm A earn if it deviates from the agreement in the first period? c. Does the agreement provide a means of sustaining the collusive outcome {that is. Charging high prices in both periods)? 6. Suppose the game in Question #5 is infinitely repeated. Each firm agrees to charge a high price, provided the rival has never charged a low price in any previous period. If its rival deviates from this plan, a firm will revert to charging a low price forever after. The interest rate is 50 percent. a. Assuming Firm B lives up to the agreement, what will Firm A earn if it lives up to the agreement? b. Assuming Firm B lives up to the agreement, what will Firm A earn if it deviates from the agreement? c. Does the agreement provide a means of sustaining the collusive outcome (that is, charging high prices in all periods}? Extra Credit {2 points} Your firm must decide whether or not to introduce a new product. If you introduce the new product, your rival will have to decide whether to clone the new product, or not. If you don't introduce the new product, you and your rival will earn $1 million each. If you do introduce the new product, and your rival clones it, you will lose $5 million and your rival will earn $20 million. If you introduce the new product and your rival does not clone it you will make $100 million and your rival will make 50. Should you introduce the new product