Answered step by step

Verified Expert Solution

Question

1 Approved Answer

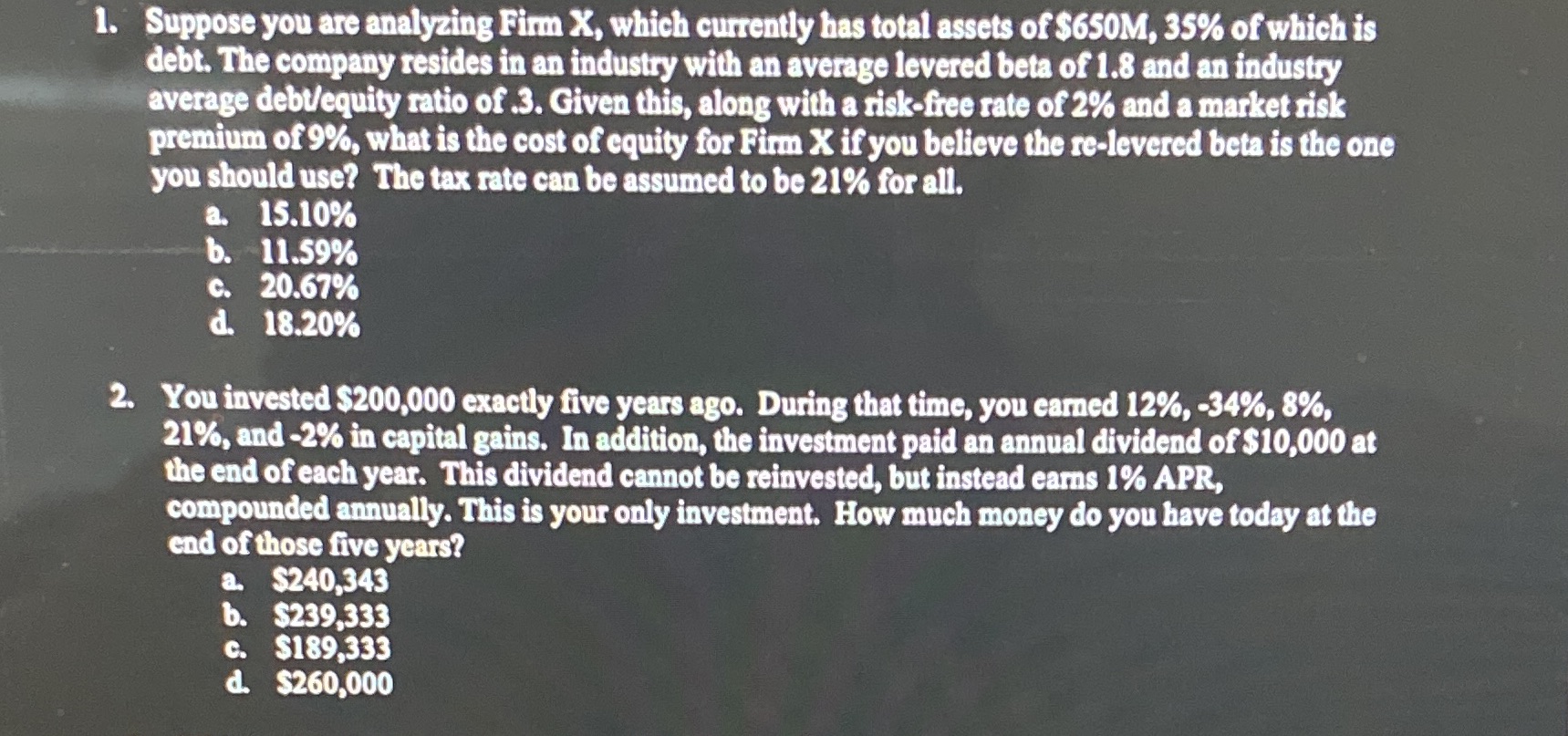

1. Suppose you are analyzing Firm X, which currently has total assets of $650M, 35% of which is debt. The company resides in an

1. Suppose you are analyzing Firm X, which currently has total assets of $650M, 35% of which is debt. The company resides in an industry with an average levered beta of 1.8 and an industry average debt/equity ratio of .3. Given this, along with a risk-free rate of 2% and a market risk premium of 9%, what is the cost of equity for Firm X if you believe the re-levered beta is the one you should use? The tax rate can be assumed to be 21% for all. a. 15.10% b. 11.59% c. 20.67% d. 18.20% 2. You invested $200,000 exactly five years ago. During that time, you earned 12%, -34%, 8%, 21%, and -2% in capital gains. In addition, the investment paid an annual dividend of $10,000 at the end of each year. This dividend cannot be reinvested, but instead earns 1% APR, compounded annually. This is your only investment. How much money do you have today at the end of those five years? a. $240,343 b. $239,333 c. $189,333 d. $260,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the cost of equity for Firm X we can use the Capital Asset Pricing Model CAPM formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66422fd2e5359_984756.pdf

180 KBs PDF File

66422fd2e5359_984756.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started