Answered step by step

Verified Expert Solution

Question

1 Approved Answer

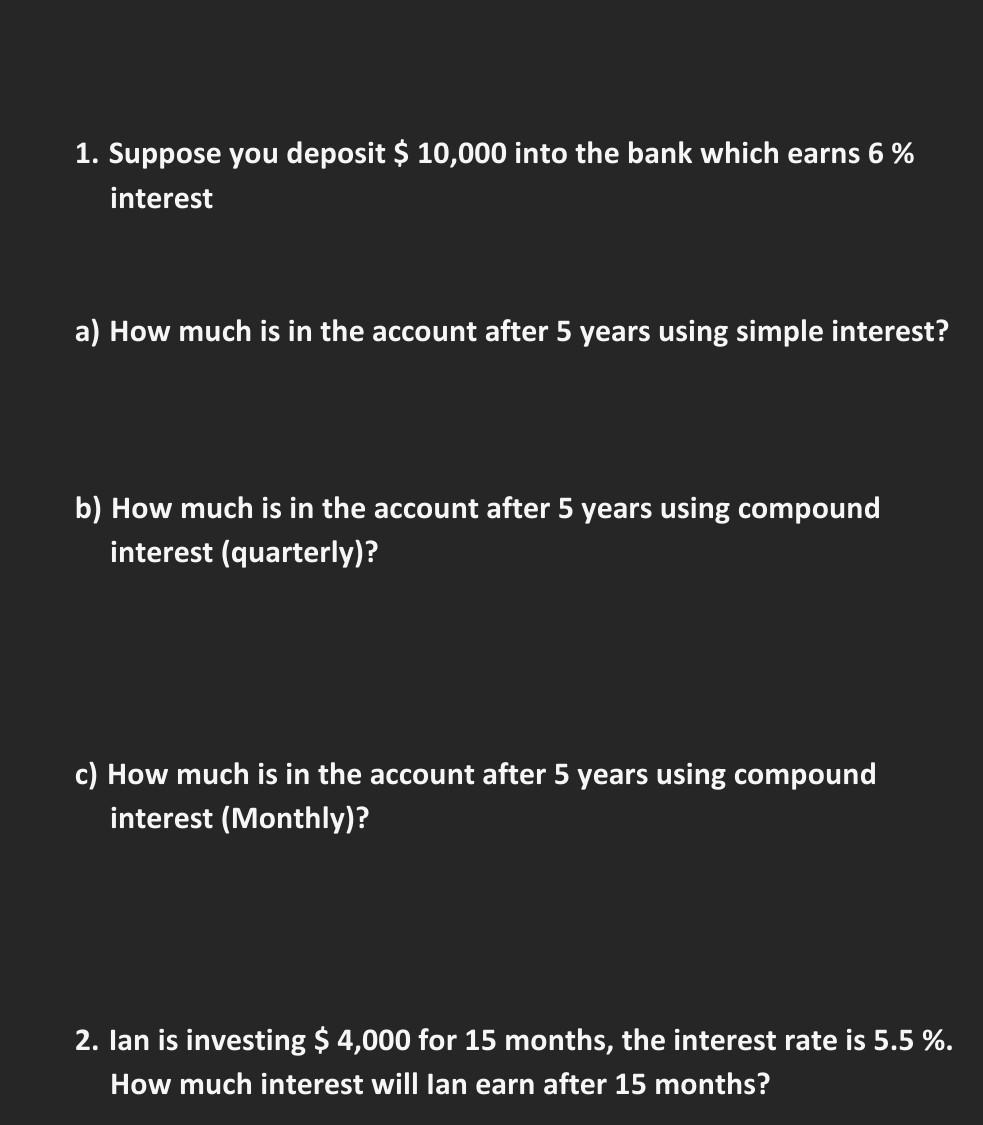

1. Suppose you deposit $10,000 into the bank which earns 6% interest a) How much is in the account after 5 years using simple interest?

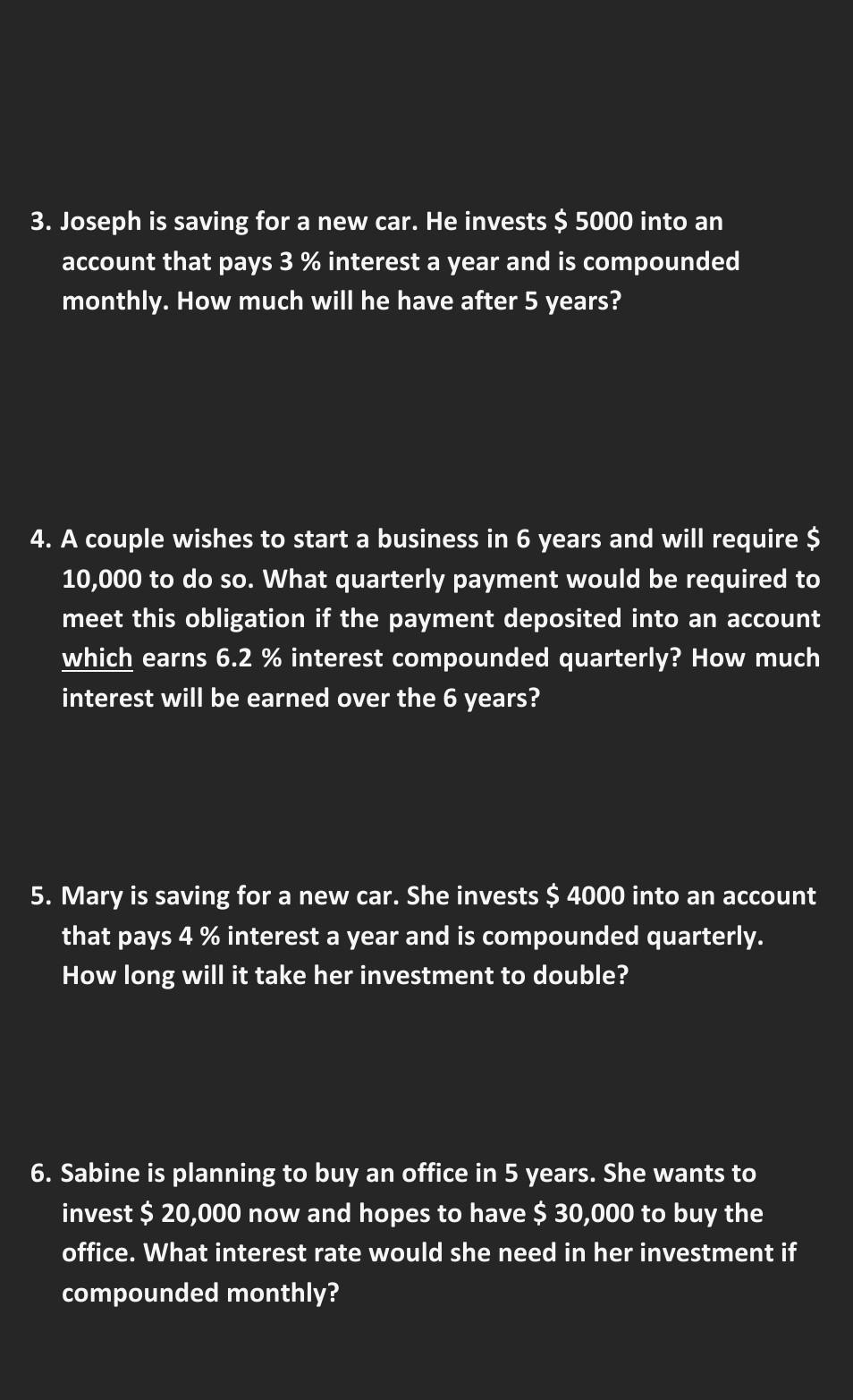

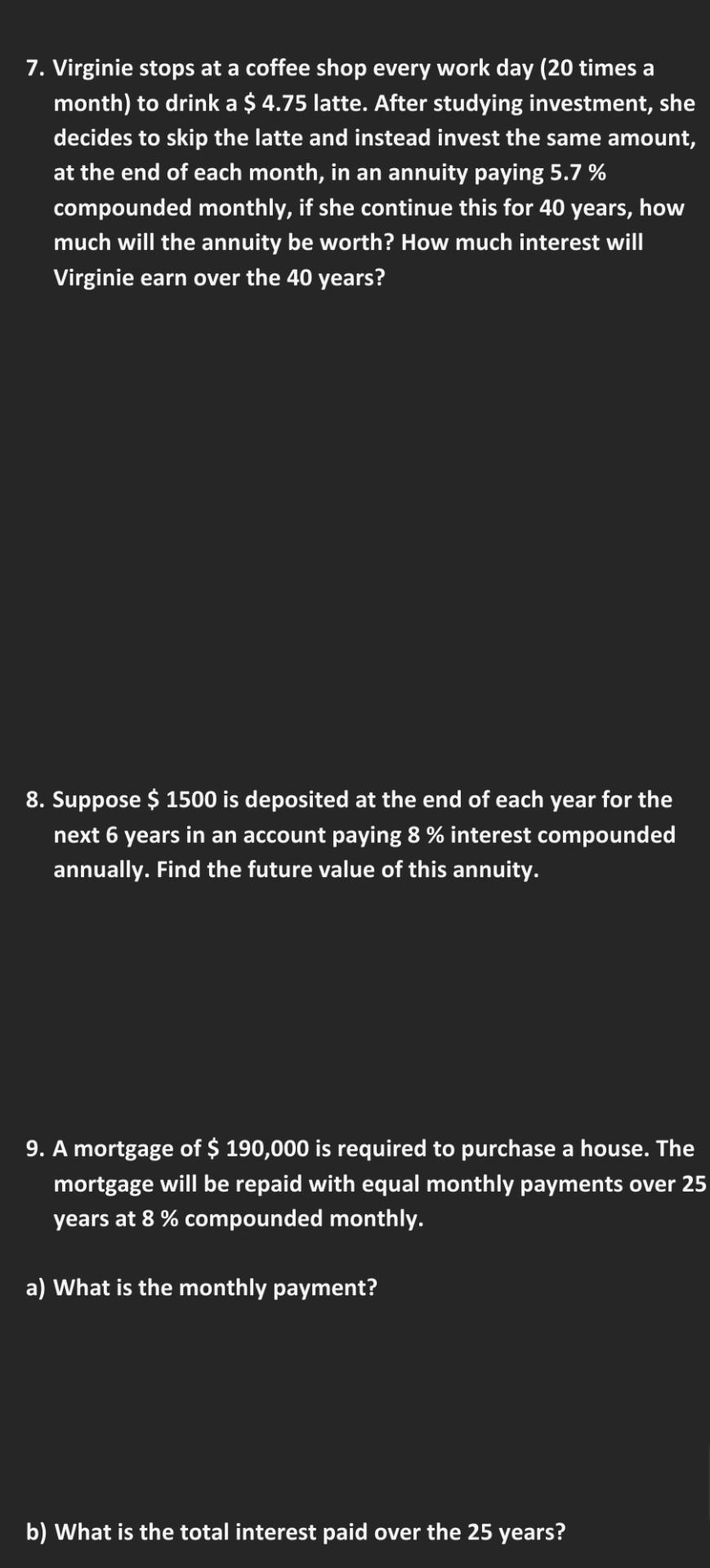

1. Suppose you deposit $10,000 into the bank which earns 6% interest a) How much is in the account after 5 years using simple interest? b) How much is in the account after 5 years using compound interest (quarterly)? c) How much is in the account after 5 years using compound interest (Monthly)? 2. Ian is investing $4,000 for 15 months, the interest rate is 5.5%. How much interest will lan earn after 15 months? 3. Joseph is saving for a new car. He invests $5000 into an account that pays 3% interest a year and is compounded monthly. How much will he have after 5 years? 4. A couple wishes to start a business in 6 years and will require \$ 10,000 to do so. What quarterly payment would be required to meet this obligation if the payment deposited into an account which earns 6.2% interest compounded quarterly? How much interest will be earned over the 6 years? 5. Mary is saving for a new car. She invests $4000 into an account that pays 4% interest a year and is compounded quarterly. How long will it take her investment to double? 6. Sabine is planning to buy an office in 5 years. She wants to invest $20,000 now and hopes to have $30,000 to buy the office. What interest rate would she need in her investment if compounded monthly? 7. Virginie stops at a coffee shop every work day ( 20 times a month) to drink a \$ 4.75 latte. After studying investment, she decides to skip the latte and instead invest the same amount, at the end of each month, in an annuity paying 5.7% compounded monthly, if she continue this for 40 years, how much will the annuity be worth? How much interest will Virginie earn over the 40 years? 8. Suppose $1500 is deposited at the end of each year for the next 6 years in an account paying 8% interest compounded annually. Find the future value of this annuity. 9. A mortgage of $190,000 is required to purchase a house. The mortgage will be repaid with equal monthly payments over 25 years at 8% compounded monthly. a) What is the monthly payment? b) What is the total interest paid over the 25 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started