Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Suppose you have $20,000 in cash to invest. You decide to short sell $10,000 worth of Coca Cola stock and invest the proceeds

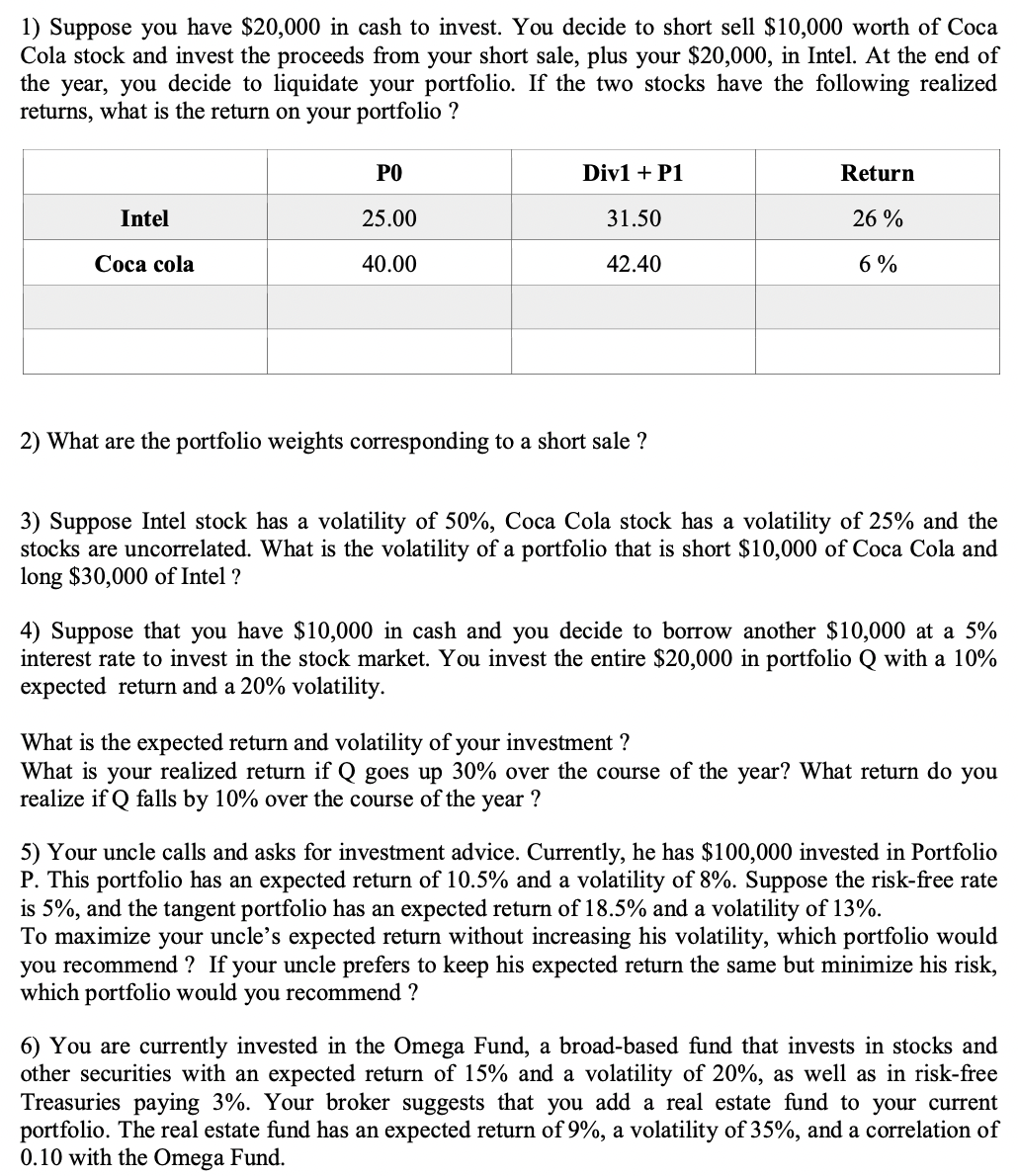

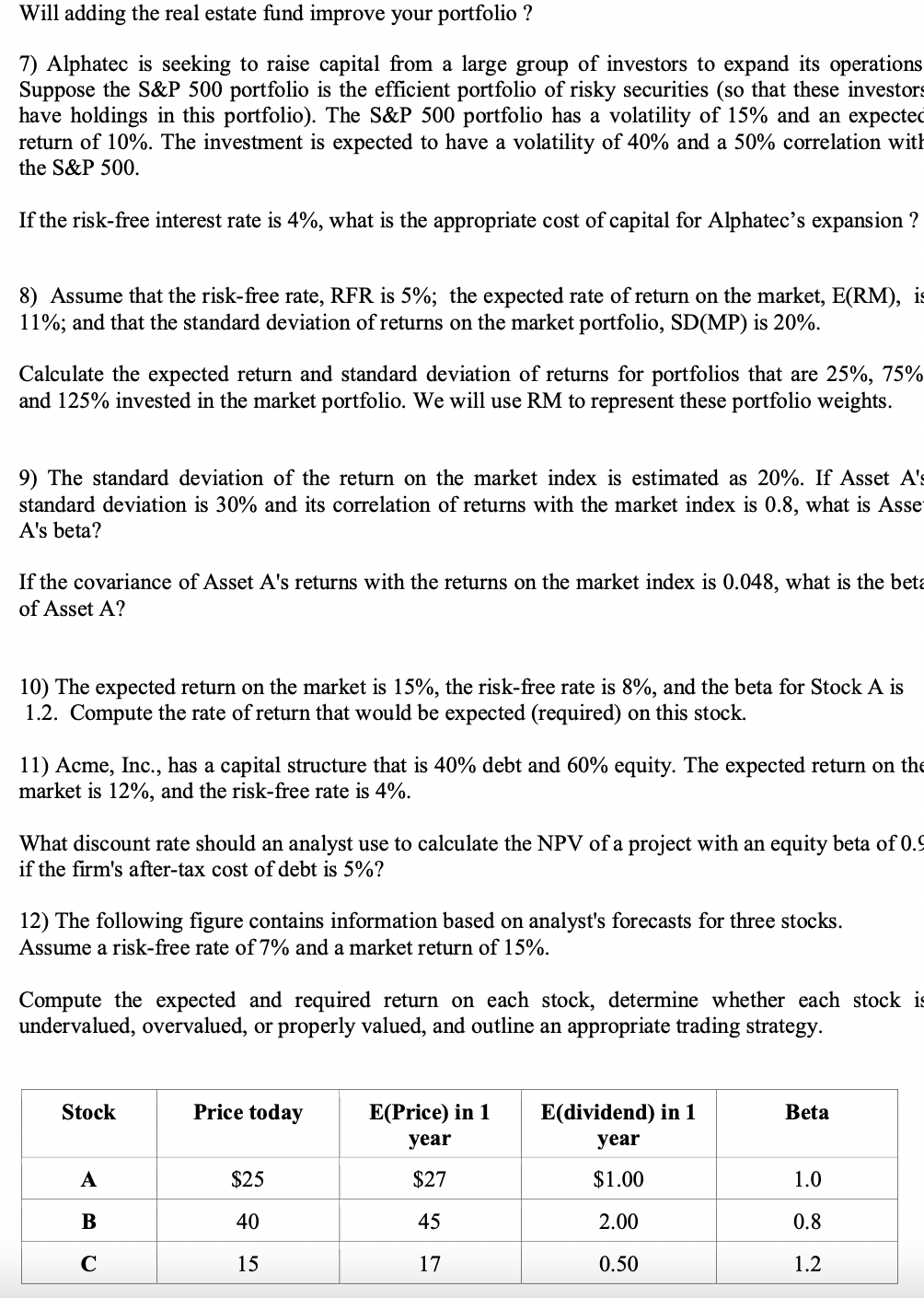

1) Suppose you have $20,000 in cash to invest. You decide to short sell $10,000 worth of Coca Cola stock and invest the proceeds from your short sale, plus your $20,000, in Intel. At the end of the year, you decide to liquidate your portfolio. If the two stocks have the following realized returns, what is the return on your portfolio ? Intel Coca cola 25.00 40.00 Div1 + P1 31.50 42.40 2) What are the portfolio weights corresponding to a short sale? Return 26 % 6% 3) Suppose Intel stock has a volatility of 50%, Coca Cola stock has a volatility of 25% and the stocks are uncorrelated. What is the volatility of a portfolio that is short $10,000 of Coca Cola and long $30,000 of Intel ? 4) Suppose that you have $10,000 in cash and you decide to borrow another $10,000 at a 5% interest rate to invest in the stock market. You invest the entire $20,000 in portfolio Q with a 10% expected return and a 20% volatility. What is the expected return and volatility of your investment ? What is your realized return if Q goes up 30% over the course of the year? What return do you realize if Q falls by 10% over the course of the year? 5) Your uncle calls and asks for investment advice. Currently, he has $100,000 invested in Portfolio P. This portfolio has an expected return of 10.5% and a volatility of 8%. Suppose the risk-free rate is 5%, and the tangent portfolio has an expected return of 18.5% and a volatility of 13%. To maximize your uncle's expected return without increasing his volatility, which portfolio would you recommend? If your uncle prefers to keep his expected return the same but minimize his risk, which portfolio would you recommend ? 6) You are currently invested in the Omega Fund, a broad-based fund that invests in stocks and other securities with an expected return of 15% and a volatility of 20%, as well as in risk-free Treasuries paying 3%. Your broker suggests that you add a real estate fund to your current portfolio. The real estate fund has an expected return of 9%, a volatility of 35%, and a correlation of 0.10 with the Omega Fund. Will adding the real estate fund improve your portfolio ? 7) Alphatec is seeking to raise capital from a large group of investors to expand its operations Suppose the S&P 500 portfolio is the efficient portfolio of risky securities (so that these investors have holdings in this portfolio). The S&P 500 portfolio has a volatility of 15% and an expected return of 10%. The investment is expected to have a volatility of 40% and a 50% correlation with the S&P 500. If the risk-free interest rate is 4%, what is the appropriate cost of capital for Alphatec's expansion ? 8) Assume that the risk-free rate, RFR is 5%; the expected rate of return on the market, E(RM), is 11%; and that the standard deviation of returns on the market portfolio, SD(MP) is 20%. Calculate the expected return and standard deviation of returns for portfolios that are 25%, 75% and 125% invested in the market portfolio. We will use RM to represent these portfolio weights. 9) The standard deviation of the return on the market index is estimated as 20%. If Asset A's standard deviation is 30% and its correlation of returns with the market index is 0.8, what is Asse A's beta? If the covariance of Asset A's returns with the returns on the market index is 0.048, what is the beta of Asset A? 10) The expected return on the market is 15%, the risk-free rate is 8%, and the beta for Stock A is 1.2. Compute the rate of return that would be expected (required) on this stock. 11) Acme, Inc., has a capital structure that is 40% debt and 60% equity. The expected return on the market is 12%, and the risk-free rate is 4%. What discount rate should an analyst use to calculate the NPV of a project with an equity beta of 0.9 if the firm's after-tax cost of debt is 5%? 12) The following figure contains information based on analyst's forecasts for three stocks. Assume a risk-free rate of 7% and a market return of 15%. Compute the expected and required return on each stock, determine whether each stock is undervalued, overvalued, or properly valued, and outline an appropriate trading strategy. Stock A B Price today $25 40 15 E(Price) in 1 year $27 45 17 E(dividend) in 1 year $1.00 2.00 0.50 Beta 1.0 0.8 1.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Return on portfolio Amount invested in Intel Increase in value of Intel Amount received from short sale of Coca Cola Amount needed to close short position 30000 126 10000106 10000140 37800 10600 140...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started