Answered step by step

Verified Expert Solution

Question

1 Approved Answer

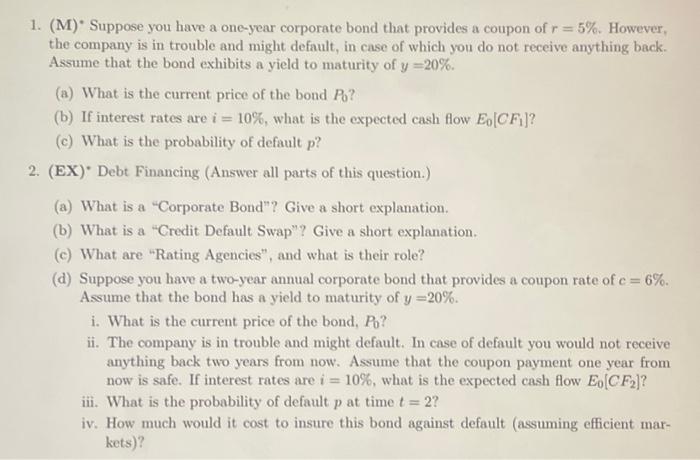

1. Suppose you have a one-year corporate bond that provides a coupon of r = 5%. However, the company is in trouble and might default,

1. Suppose you have a one-year corporate bond that provides a coupon of r = 5%. However, the company is in trouble and might default, in case of which you do not receive anything back. Assume that the bond exhibits a yield to maturity of y=20%.

(a) What is the current price of the bond Po?

(b) If interest rates are i= 10%, what is the expected cash flow Eo [CF1]?

(c) What is the probability of default p?

2. Suppose you have a two-year annual corporate bond that provides a coupon rate of c = 6%. Assume that the bond has a yield to maturity of y=20%

i. What is the current price of the bond, Po?

ii. The company is in trouble and might default. In case of default you would not receive anything back two years from now. Assume that the coupon payment one year from now is safe. If interest rates are i= 10%, what is the expected cash flow Eo [CF2]?

iii. What is the probability of default p at time t = 2?

iv. How much would it cost to insure this bond against default (assuming efficient mar- kets)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started