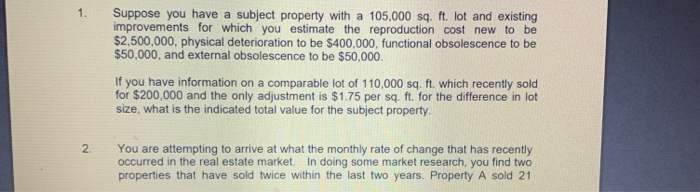

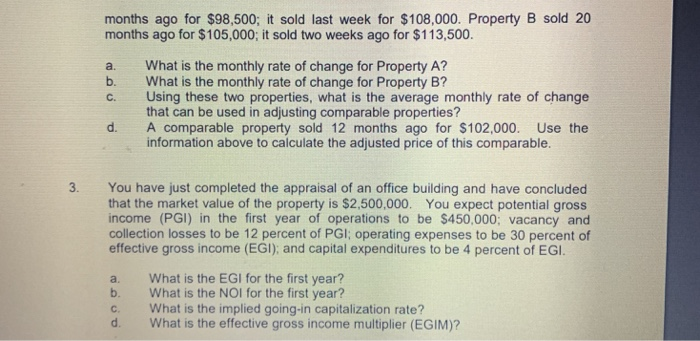

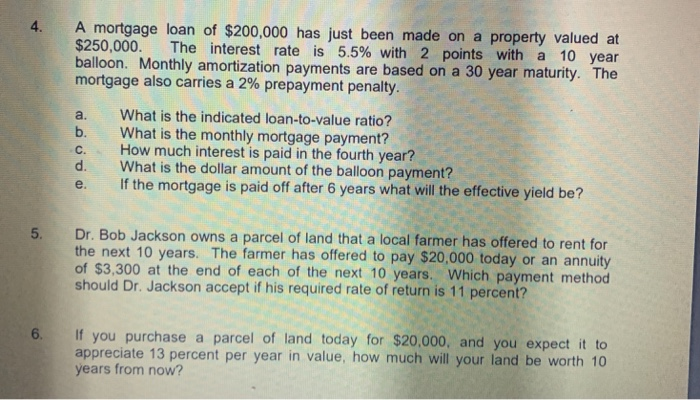

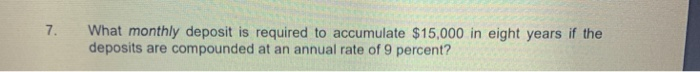

1. Suppose you have a subject property with a 105.000 sq. ft. lot and existing improvements for which you estimate the reproduction cost new to be $2,500,000, physical deterioration to be $400.000, functional obsolescence to be $50,000, and external obsolescence to be $50,000. If you have information on a comparable lot of 110,000 sq. ft. which recently sold for $200,000 and the only adjustment is $1.75 per sq. ft. for the difference in lot size, what is the indicated total value for the subject property. 2. You are attempting to arrive at what the monthly rate of change that has recently occurred in the real estate market. In doing some market research, you find two properties that have sold twice within the last two years. Property A sold 21 months ago for $98,500; it sold last week for $108,000. Property B sold 20 months ago for $105,000; it sold two weeks ago for $113,500. What is the monthly rate of change for Property A? What is the monthly rate of change for Property B? Using these two properties, what is the average monthly rate of change that can be used in adjusting comparable properties? A comparable property sold 12 months ago for $102,000. Use the information above to calculate the adjusted price of this comparable a. b. c. d. 3. You have just completed the appraisal of an office building and have concluded that the market value of the property is $2,500,000. You expect potential gross income (PGI) in the first year of operations to be $450,000; vacancy and collection losses to be 12 percent of PGI; operating expenses to be 30 percent of effective gross income (EGI); and capital expenditures to be 4 percent of EGI. a. What is the EGI for the first year? b. What is the NOI for the first year? c. What is the implied going-in capitalization rate? d. What is the effective gross income multiplier (EGIM)? 4. A mortgage loan of $200,000 has just been made on a property valued at $250,000. The interest rate is 5.5% with 2 po ints with a 10 year alloon. Monthly amortization payments are based on a 30 year maturity. The mortgage also carries a 2% prepayment penalty. a. What is the indicated loan-to-value ratio? b. What is the monthly mortgage payment? C.How much interest is paid in the fourth year? d. What is the dollar amount of the balloon payment? e. If the mortgage is paid off after 6 years what will the effective yield be? 5. Dr. Bob Jackson owns a parcel of land that a local farmer has offered to rent for the next 10 years. The farmer has offered to pay $20,000 today or an annuity of $3,300 at the end of each of the next 10 years. Which payment method 6. If you purchase a parcel of land today for $20,000, and you expect it to appreciate 13 percent per year in value, how much will your land be worth 10 years from now? 7. What monthly deposit is required to accumulate $15,000 in eight years if the deposits are compounded at an annual rate of 9 percent