Answered step by step

Verified Expert Solution

Question

1 Approved Answer

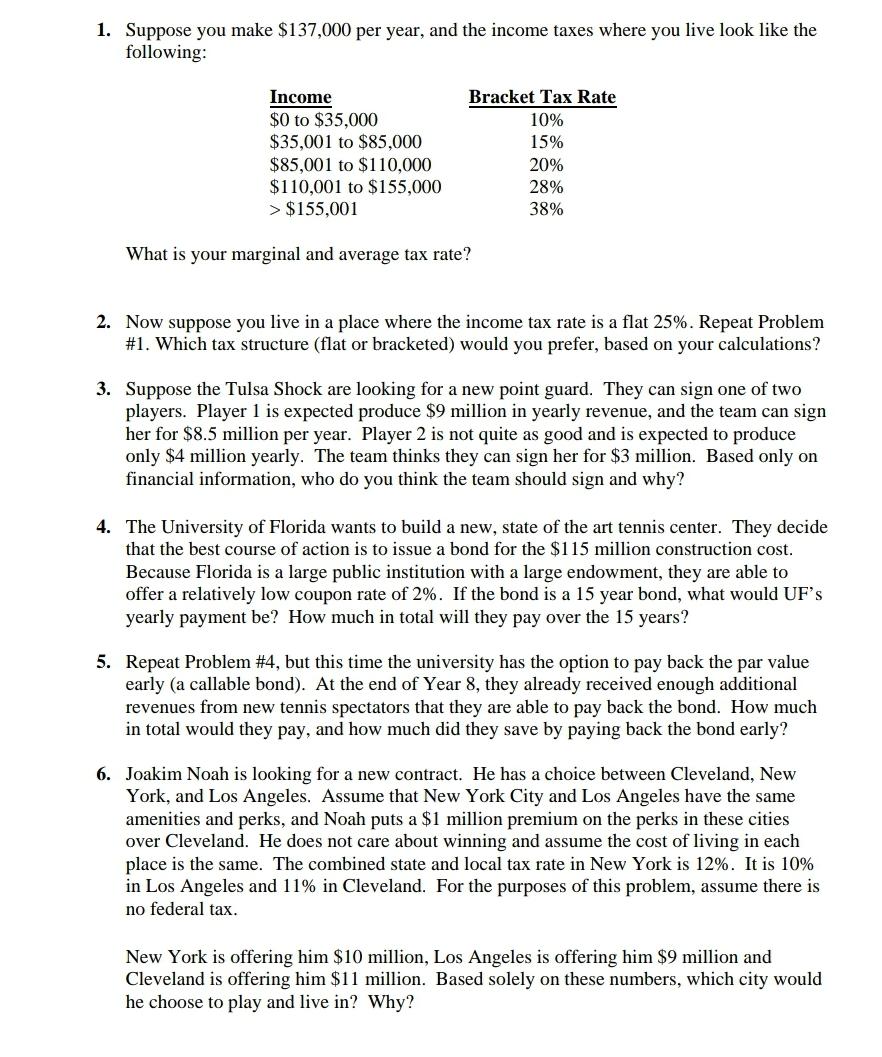

1. Suppose you make $137,000 per year, and the income taxes where you live look like the following: Income $0 to $35,000 $35,001 to

1. Suppose you make $137,000 per year, and the income taxes where you live look like the following: Income $0 to $35,000 $35,001 to $85,000 $85,001 to $110,000 $110,001 to $155,000 > $155,001 What is your marginal and average tax rate? Bracket Tax Rate 10% 15% 20% 28% 38% 2. Now suppose you live in a place where the income tax rate is a flat 25%. Repeat Problem #1. Which tax structure (flat or bracketed) would you prefer, based on your calculations? 3. Suppose the Tulsa Shock are looking for a new point guard. They can sign one of two players. Player 1 is expected produce $9 million in yearly revenue, and the team can sign her for $8.5 million per year. Player 2 is not quite as good and is expected to produce only $4 million yearly. The team thinks they can sign her for $3 million. Based only on financial information, who do you think the team should sign and why? 4. The University of Florida wants to build a new, state of the art tennis center. They decide that the best course of action is to issue a bond for the $115 million construction cost. Because Florida is a large public institution with a large endowment, they are able to offer a relatively low coupon rate of 2%. If the bond is a 15 year bond, what would UF's yearly payment be? How much in total will they pay over the 15 years? 5. Repeat Problem #4, but this time the university has the option to pay back the par value early (a callable bond). At the end of Year 8, they already received enough additional revenues from new tennis spectators that they are able to pay back the bond. How much in total would they pay, and how much did they save by paying back the bond early? 6. Joakim Noah is looking for a new contract. He has a choice between Cleveland, New York, and Los Angeles. Assume that New York City and Los Angeles have the same amenities and perks, and Noah puts a $1 million premium on the perks in these cities over Cleveland. He does not care about winning and assume the cost of living in each place is the same. The combined state and local tax rate in New York is 12%. It is 10% in Los Angeles and 11% in Cleveland. For the purposes of this problem, assume there is no federal tax. New York is offering him $10 million, Los Angeles is offering him $9 million and Cleveland is offering him $11 million. Based solely on these numbers, which city would he choose to play and live in? Why?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Marginal and Average Tax Rate Marginal Tax Rate You fall into the 28 tax bracket because your income exceeds 110000 but is less than 155000 So your ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started