Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Suppose you purchase a property today that is worth $100,000. You expect real estate prices to appreciate at a rate of 10% per

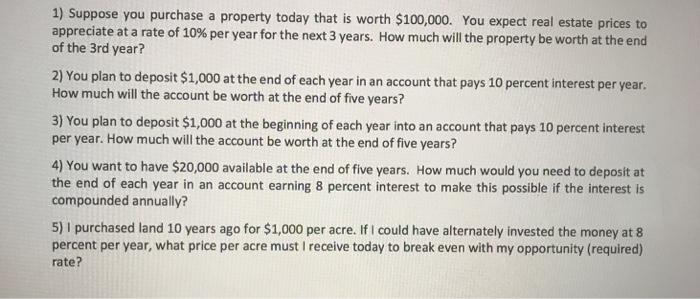

1) Suppose you purchase a property today that is worth $100,000. You expect real estate prices to appreciate at a rate of 10% per year for the next 3 years. How much will the property be worth at the end of the 3rd year? 2) You plan to deposit $1,000 at the end of each year in an account that pays 10 percent interest per year. How much will the account be worth at the end of five years? 3) You plan to deposit $1,000 at the beginning of each year into an account that pays 10 percent interest per year. How much will the account be worth at the end of five years? 4) You want to have $20,000 available at the end of five years. How much would you need to deposit at the end of each year in an account earning 8 percent interest to make this possible if the interest is compounded annually? 5) I purchased land 10 years ago for $1,000 per acre. If I could have alternately invested the money at 8 percent per year, what price per acre must I receive today to break even with my opportunity (required) rate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started