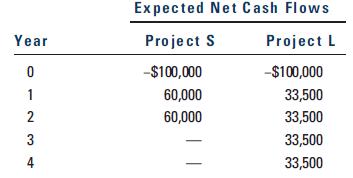

In an unrelated analysis, you have the opportunity to choose between the following two mutually exclusive projects:

Question:

In an unrelated analysis, you have the opportunity to choose between the following two mutually exclusive projects:

The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have a 10% cost of capital.

(1) What is each project’s initial NPV without replication?

(2) What is each project’s equivalent annual annuity?

(3) Now apply the replacement chain approach to determine the projects’ extended NPVs. Which project should be chosen?

(4) Now assume that the cost to replicate Project S in 2 years will increase to $105,000 because of inflationary pressures. How should the analysis be handled now, and which project should be chosen?

Step by Step Answer:

Corporate Finance A Focused Approach

ISBN: 978-1439078082

4th Edition

Authors: Michael C. Ehrhardt, Eugene F. Brigham