Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Susan has been engaged by ABC Ltd to prepare its income tax return. Susan knows that ABC Ltd and her husband had entered

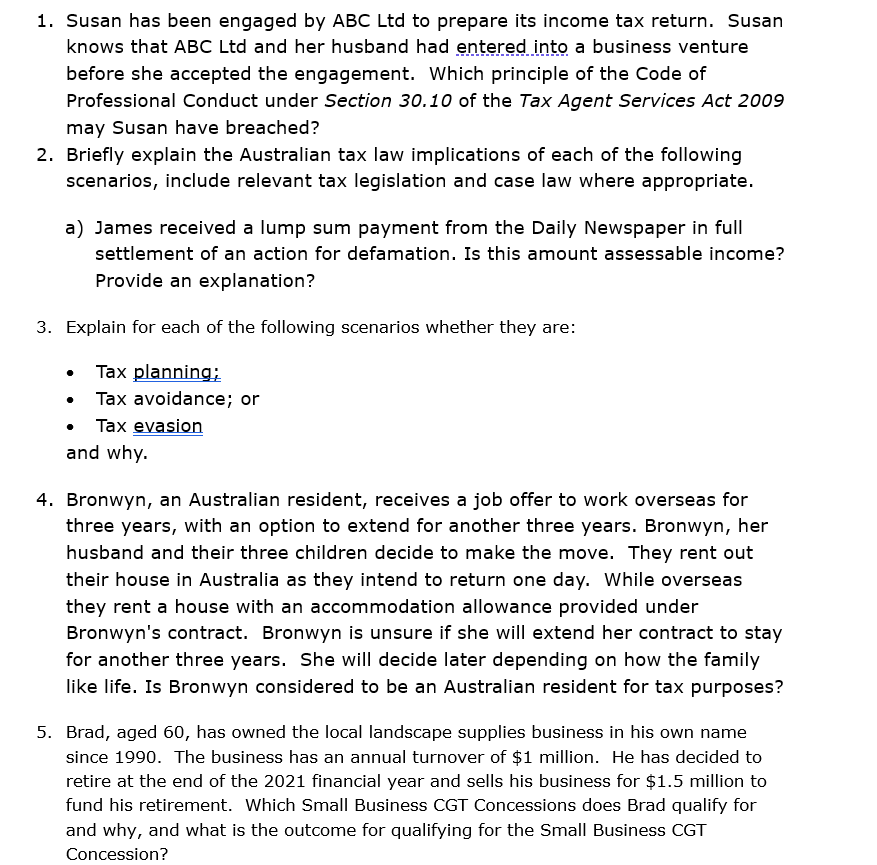

1. Susan has been engaged by ABC Ltd to prepare its income tax return. Susan knows that ABC Ltd and her husband had entered into a business venture before she accepted the engagement. Which principle of the Code of Professional Conduct under Section 30.10 of the Tax Agent Services Act 2009 may Susan have breached? 2. Briefly explain the Australian tax law implications of each of the following scenarios, include relevant tax legislation and case law where appropriate. a) James received a lump sum payment from the Daily Newspaper in full settlement of an action for defamation. Is this amount assessable income? Provide an explanation? 3. Explain for each of the following scenarios whether they are: Tax planning; Tax avoidance; or Tax evasion and why. 4. Bronwyn, an Australian resident, receives a job offer to work overseas for three years, with an option to extend for another three years. Bronwyn, her husband and their three children decide to make the move. They rent out their house in Australia as they intend to return one day. While overseas they rent a house with an accommodation allowance provided under Bronwyn's contract. Bronwyn is unsure if she will extend her contract to stay for another three years. She will decide later depending on how the family like life. Is Bronwyn considered to be an Australian resident for tax purposes? 5. Brad, aged 60, has owned the local landscape supplies business in his own name since 1990. The business has an annual turnover of $1 million. He has decided to retire at the end of the 2021 financial year and sells his business for $1.5 million to fund his retirement. Which Small Business CGT Concessions does Brad qualify for and why, and what is the outcome for qualifying for the Small Business CGT Concession?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started