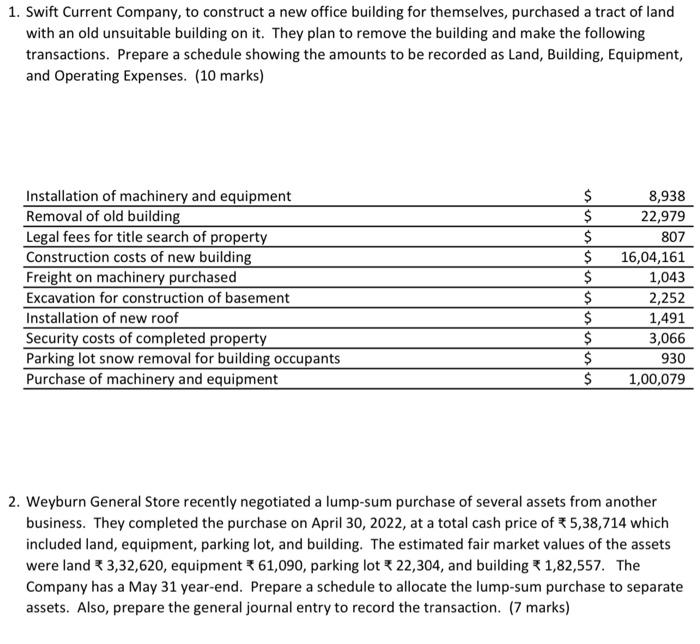

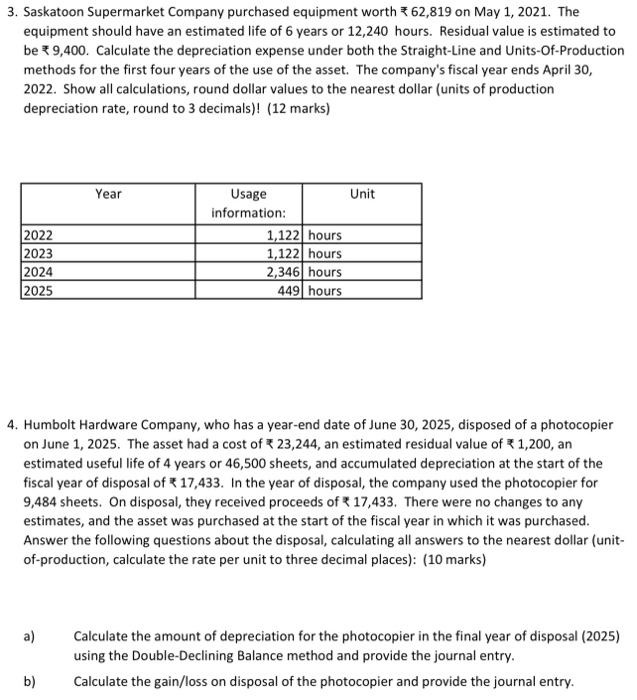

1. Swift Current Company, to construct a new office building for themselves, purchased a tract of land with an old unsuitable building on it. They plan to remove the building and make the following transactions. Prepare a schedule showing the amounts to be recorded as Land, Building, Equipment, and Operating Expenses. (10 marks) 2. Weyburn General Store recently negotiated a lump-sum purchase of several assets from another business. They completed the purchase on April 30, 2022, at a total cash price of 5,38,714 which included land, equipment, parking lot, and building. The estimated fair market values of the assets were land 3,32,620, equipment 61,090, parking lot 22,304, and building 1,82, 557. The Company has a May 31 year-end. Prepare a schedule to allocate the lump-sum purchase to separate assets. Also, prepare the general journal entry to record the transaction. (7 marks) 3. Saskatoon Supermarket Company purchased equipment worth 62,819 on May 1,2021 . The equipment should have an estimated life of 6 years or 12,240 hours. Residual value is estimated to be 9,400. Calculate the depreciation expense under both the Straight-Line and Units-Of-Production methods for the first four years of the use of the asset. The company's fiscal year ends April 30, 2022. Show all calculations, round dollar values to the nearest dollar (units of production depreciation rate, round to 3 decimals)! (12 marks) 4. Humbolt Hardware Company, who has a year-end date of June 30, 2025, disposed of a photocopier on June 1,2025 . The asset had a cost of 23,244 , an estimated residual value of 1,200, an estimated useful life of 4 years or 46,500 sheets, and accumulated depreciation at the start of the fiscal year of disposal of 17,433. In the year of disposal, the company used the photocopier for 9,484 sheets. On disposal, they received proceeds of 17,433. There were no changes to any estimates, and the asset was purchased at the start of the fiscal year in which it was purchased. Answer the following questions about the disposal, calculating all answers to the nearest dollar (unitof-production, calculate the rate per unit to three decimal places): (10 marks) a) Calculate the amount of depreciation for the photocopier in the final year of disposal (2025) using the Double-Declining Balance method and provide the journal entry. b) Calculate the gain/loss on disposal of the photocopier and provide the journal entry