Question

1. T, a single taxpayer, has a salary of $200,000 in the current year. T also has the following transactions all involving the sale of

1. T, a single taxpayer, has a salary of $200,000 in the current year. T also has the following transactions all involving the sale of capital assets: 1) a gain of $15,000 on a "collectible" held for 2 years; and 2) a gain of $20,000 on stock held for 15 months.

a) determine the amount of T's net capital gain.

b) At what rate will the components of T's net capital gain be taxed?

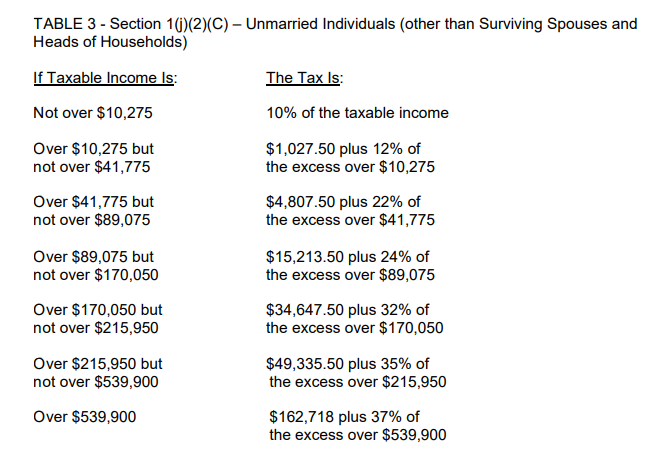

c) Using the following table and diregarding any deductions (including standard deduction and personal exemption), what is T's tax liability in the current year?

2. S, a single taxpayer, is a high-income taxpayer with a salary of $500,000 in the current year. S also has the following transactions involving the sale of capital assets: 1) a gain of $120,000 on stock held for 15 months and 2) a loss of $20,000 on stock held for 3 years. Disregarding any deductions (including the standard deduction) and using the table above, what is S's tax liability under section 1 in the current year?

TABLE 3 - Section 1(j)(2)(C) - Unmarried Individuals (other than Surviving Spouses and Heads of Households)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started