Answered step by step

Verified Expert Solution

Question

1 Approved Answer

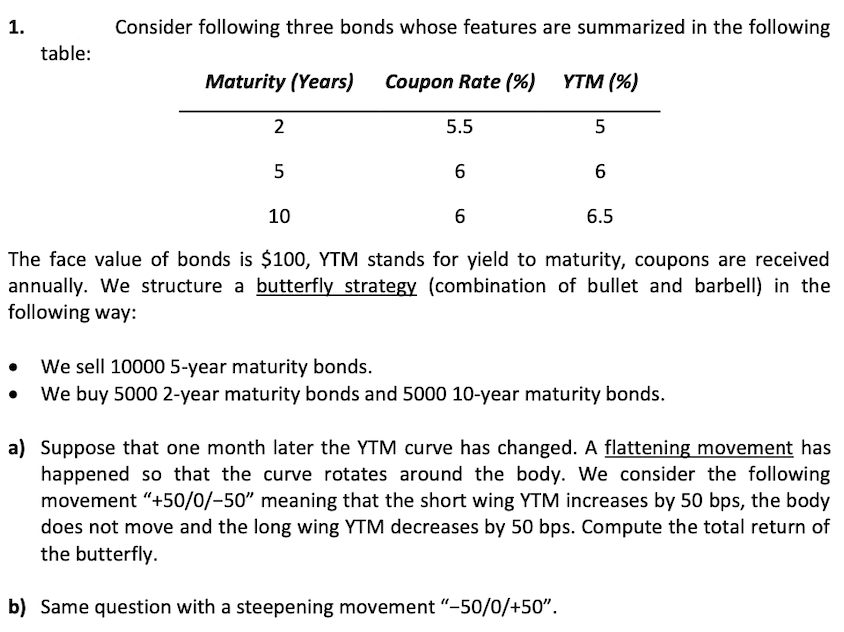

1. table: Consider following three bonds whose features are summarized in the following Maturity (Years) Coupon Rate (%) YTM (%) 2 5 5.5 6

1. table: Consider following three bonds whose features are summarized in the following Maturity (Years) Coupon Rate (%) YTM (%) 2 5 5.5 6 6 5 6 10 6.5 The face value of bonds is $100, YTM stands for yield to maturity, coupons are received annually. We structure a butterfly strategy (combination of bullet and barbell) in the following way: We sell 10000 5-year maturity bonds. We buy 5000 2-year maturity bonds and 5000 10-year maturity bonds. a) Suppose that one month later the YTM curve has changed. A flattening movement has happened so that the curve rotates around the body. We consider the following movement "+50/0/-50" meaning that the short wing YTM increases by 50 bps, the body does not move and the long wing YTM decreases by 50 bps. Compute the total return of the butterfly. b) Same question with a steepening movement "-50/0/+50".

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the total return of the butterfly in a flattening movement 50050 we first need to calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started