Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Tang Co. is expected to pay a $21 dividend next year. The dividend will decline by 10 percent annually for the following three

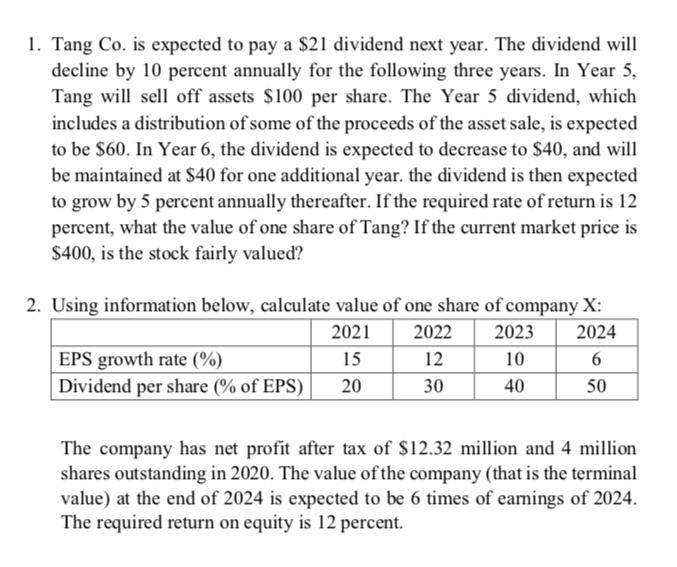

1. Tang Co. is expected to pay a $21 dividend next year. The dividend will decline by 10 percent annually for the following three years. In Year 5, Tang will sell off assets $100 per share. The Year 5 dividend, which includes a distribution of some of the proceeds of the asset sale, is expected to be $60. In Year 6, the dividend is expected to decrease to $40, and will be maintained at $40 for one additional year. the dividend is then expected to grow by 5 percent annually thereafter. If the required rate of return is 12 percent, what the value of one share of Tang? If the current market price is $400, is the stock fairly valued? 2. Using information below, calculate value of one share of company X: 2024 2021 2022 2023 EPS growth rate (%) 15 12 10 6 Dividend per share (% of EPS) 20 30 40 50 The company has net profit after tax of $12.32 million and 4 million shares outstanding in 2020. The value of the company (that is the terminal value) at the end of 2024 is expected to be 6 times of earnings of 2024. The required return on equity is 12 percent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

DY3 1 2 3 DN DO DP DQ a Tang Co Year Dividend Terminal value Net Cash Flow 1 2100 S 2100 4 2 1890 18...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started