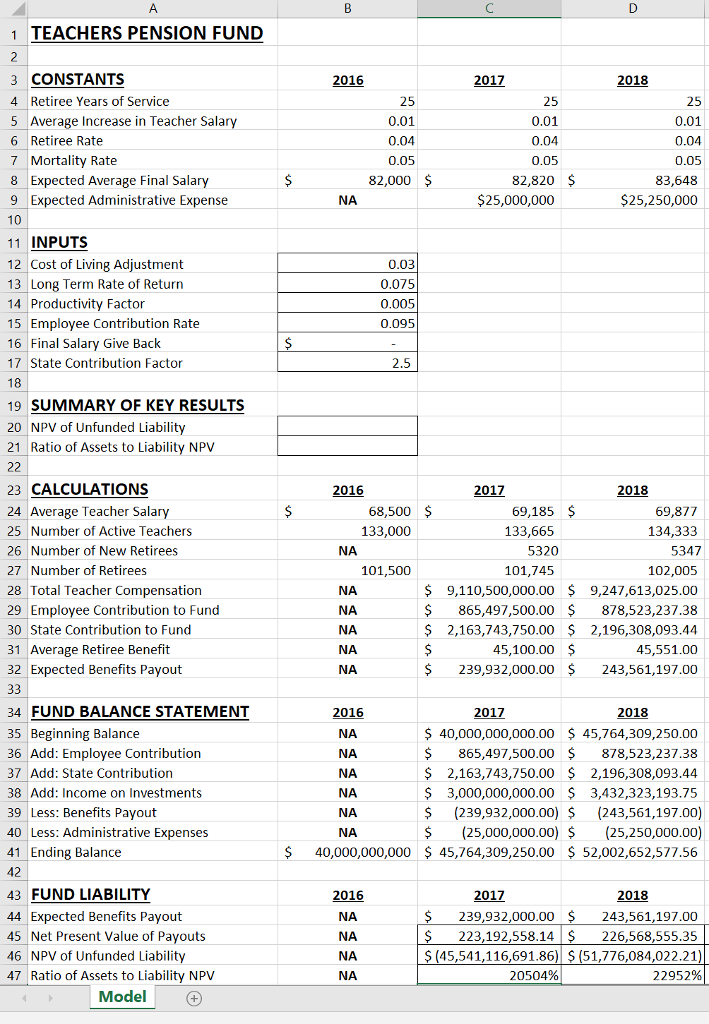

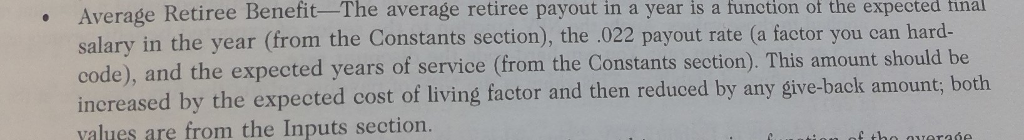

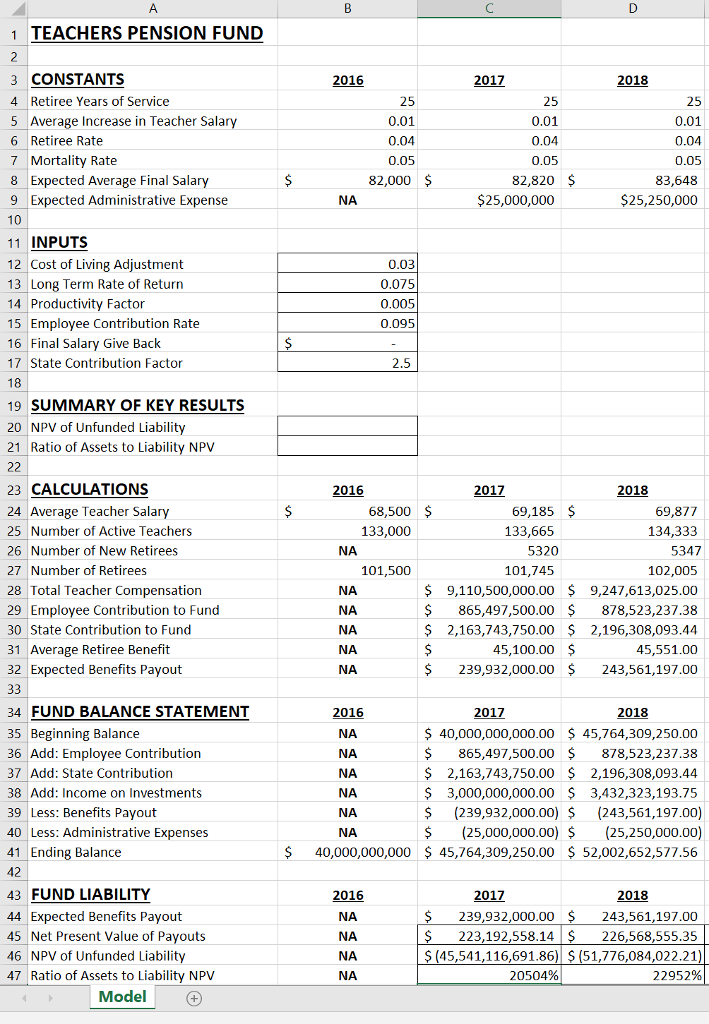

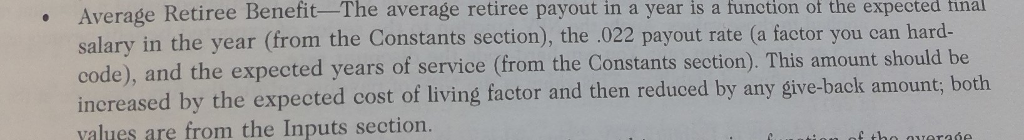

1 TEACHERS PENSION FUND 3 CONSTANTS 4 Retiree Years of Service 5 Average Increase in Teacher Salary 6 Retiree Rate 7 Mortality Rate 8 Expected Average Final Salary 9 Expected Administrative Expense 2017 0.01 0.04 0.05 82,000 0.01 0.01 0.04 0.05 83,648 $25,250,000 0.05 82,820 $ $25,000,000 11 INPUTS 12 Cost of Living Adjustment 13 Long Term Rate of Return 14 Productivity Factor 15 Employee Contribution Rate 16 Final Salary Give Back 17 State Contribution Factor 0.075 0.005 0.095 19 SUMMARY OF KEY RESULTS 20 NPV of Unfunded Liability 21 Ratio of Assets to Liability NPV 23 CALCULATIONS 24 Average Teacher Salary 25 Number of Active Teachers 26 Number of New Retirees 27 Number of Retirees 28 Total Teacher Compensation 29 Employee Contribution to Fund 30 State Contribution to Fund 31 Average Retiree Benefit 32 Expected Benefits Payout 2017 69,185 $ 68,500 133,000 69,877 134,333 5347 102,005 $ 9,110,500,000.00 $ 9,247,613,025.00 $865,497,500.00 $ 878,523,237.38 $ 2,163,743,750.00 $ 2,196,308,093.44 45,551.00 $239,932,000.00 243,561,197.00 133,665 5320 101,745 101,500 NA 5,100.00 $ NA 018 34 FUND BALANCE STATEMENT 35 Beginning Balance 36 Add: Epoe Contribution 37 Add: State Contribution 38 Add: Income on Investments 39 Less: Benefits Payout 40 Less: Administrative Expenses 41 Ending Balance 2016 NA NA $ 40,000,000,000.00 45,764,309,250.00 $ 865,497,500.00$878,523,237.38 $ 2,163,743,750.00 $ 2,196,308,093.44 $3,000,000,000.00 3,432,323,193.75 $ (239,932,000.00) $ (243,561,197.00) $(25,000,000.00) $ (25,250,000.00) 40,000,000,000 45,764,309,250.00 52,002,652,577.56 NA NA 016 43 FUND LIABILITY 44 Expected Benefits Payout 45 Net Present Value of Payouts 46 NPV of Unfunded Liability 47 Ratio of Assets to Liability NPV 018 NA 243,561,197.00 226,568,555.35 45,541,116,691.86) S (51,776,084,022.21 22952% 239,932,000.00 223,192,558.14 NA 20504% Model 1 TEACHERS PENSION FUND 3 CONSTANTS 4 Retiree Years of Service 5 Average Increase in Teacher Salary 6 Retiree Rate 7 Mortality Rate 8 Expected Average Final Salary 9 Expected Administrative Expense 2017 0.01 0.04 0.05 82,000 0.01 0.01 0.04 0.05 83,648 $25,250,000 0.05 82,820 $ $25,000,000 11 INPUTS 12 Cost of Living Adjustment 13 Long Term Rate of Return 14 Productivity Factor 15 Employee Contribution Rate 16 Final Salary Give Back 17 State Contribution Factor 0.075 0.005 0.095 19 SUMMARY OF KEY RESULTS 20 NPV of Unfunded Liability 21 Ratio of Assets to Liability NPV 23 CALCULATIONS 24 Average Teacher Salary 25 Number of Active Teachers 26 Number of New Retirees 27 Number of Retirees 28 Total Teacher Compensation 29 Employee Contribution to Fund 30 State Contribution to Fund 31 Average Retiree Benefit 32 Expected Benefits Payout 2017 69,185 $ 68,500 133,000 69,877 134,333 5347 102,005 $ 9,110,500,000.00 $ 9,247,613,025.00 $865,497,500.00 $ 878,523,237.38 $ 2,163,743,750.00 $ 2,196,308,093.44 45,551.00 $239,932,000.00 243,561,197.00 133,665 5320 101,745 101,500 NA 5,100.00 $ NA 018 34 FUND BALANCE STATEMENT 35 Beginning Balance 36 Add: Epoe Contribution 37 Add: State Contribution 38 Add: Income on Investments 39 Less: Benefits Payout 40 Less: Administrative Expenses 41 Ending Balance 2016 NA NA $ 40,000,000,000.00 45,764,309,250.00 $ 865,497,500.00$878,523,237.38 $ 2,163,743,750.00 $ 2,196,308,093.44 $3,000,000,000.00 3,432,323,193.75 $ (239,932,000.00) $ (243,561,197.00) $(25,000,000.00) $ (25,250,000.00) 40,000,000,000 45,764,309,250.00 52,002,652,577.56 NA NA 016 43 FUND LIABILITY 44 Expected Benefits Payout 45 Net Present Value of Payouts 46 NPV of Unfunded Liability 47 Ratio of Assets to Liability NPV 018 NA 243,561,197.00 226,568,555.35 45,541,116,691.86) S (51,776,084,022.21 22952% 239,932,000.00 223,192,558.14 NA 20504% Model