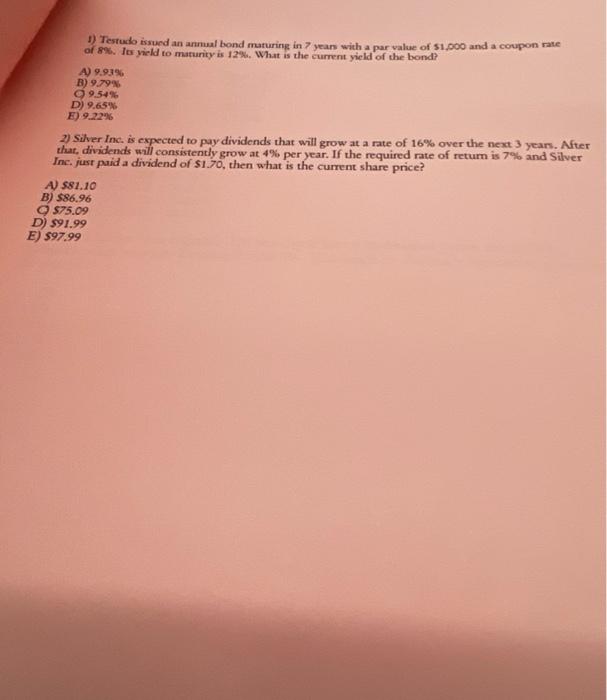

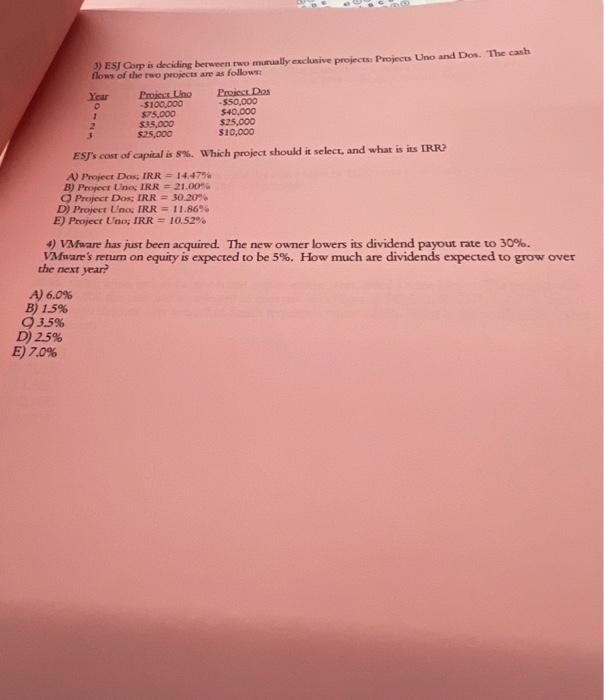

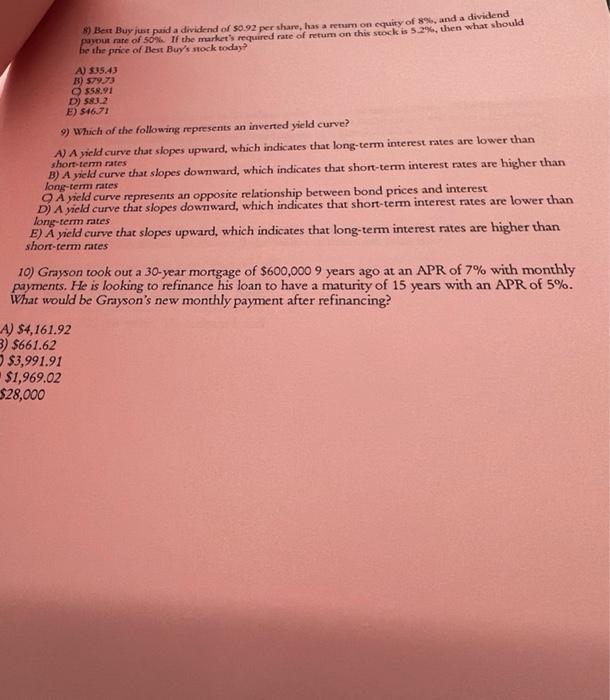

1) Testudo issund an armul bond maturing in 7 yean with a par value of 51,000 and a coupon rate of 896 . Itr yield to maturity is 12\%4. What is the current yield of the bond? A) 9.939 B) 9.79% C) 9.5496 D) 9.6508 F) 9.2246 2) Siher Inc. is expected to pay dividends that will grow at a rate of 16% over the next 3 years. After that, dividends will consistently grow at 4% per year. If the required rate of return is 7% and 5 ilver Inc. just puid a dividend of $1.70, then what is the current share price? A) 581,10 B) 586.96 C) 575.09 D) 591.99 2) 597.99 3) ESJ Comp is deciding between two murually exclusive projects) Project Uno and Dot. The cash flows of the rwo projects are as follows ESF's cost of capital is 5%. Which project should it select, and what is its IRR? A) Propect Das, IR.R=14,475 in B) Proper Vinos IRR =21.00 in C) Pruject Doss IRR=30.20% D) Project Lnos IRR =11.86% E) Project Uno; IRR =10.52% 4) VMuare has just been acquired. The new owner lowers its dividend payout mate to 30%. Vaware's retum on equity is expected to be 5%. How much are dividends expected to grow over the next year? A) 6.0% B) 1.5% 3.5% D) 25% 7,006 8) Bent Buy just puid a dividend of 50.92 per share, has a retum on equiry of 8%, and a dividend payout nare of 50% if the market? required rate of retum on this stock is 529 , then what should be the price of Beat Buy's stock today? A) 33.43 B) 57973 C) 558:91 D) 583 E) sich1 9) Which of the following represents an inverted yield curve? A) A yield curve that slopes upward, which indicates that long-term interest mates are lower than B) A yield curve that slopes downward, which indicates that short-tern interest rates are higher than short-tem rates Q A yield curve represents an opposite relationship between bond prices and interest long-tem rates D) A yicld curve that slopes downward, which indicates that short-term interest rates are lower than lorg-tern mates E) A yield curve that slopes upward, which indicates that long-term interest rates are higher than short-term rates 10) Grayson took out a 30-year mortgage of $600,0009 years ago at an APR of 7% with monthly payments. He is looking to refinance his loan to have a maturity of 15 years with an APR of 5%. What would be Grason's new monthly payment after refinancing? 1)$4,161.92$661.62$3,991.91$1,969.0228,000 8) Ber Buy jurt paid a dividend of 50.92 per share, has a meurn on equicy of 8%6, and a dividend payoun nute of 50%. If the murket"s required rate of retum on this swock is 5.296 , then what should be the price of Bert Buy/s stock today? A) 535,43 B) 579.73 (. 558.91 D) 583.2 E) 546,71 9) Which of the following represents an inverted yicld curve? A) A vield curve that slopes upward, which indicates that long-term interest rates are lower than B) A yield curve that slopes downward, which indicates that short-tem interest rates are higher than shorteferm rates long-term rites Q A yeld curve represents an opposite relationship between bond prices and interest D) A yield curve that slopes downward, which indicates that short-term interest rates are lower than long-term rates E) A yield curve that slopes upward, which indicates that long-term interest mates are higher than short-term rates 10) Grayson took out a 30-year mortgage of $600,0009 years ago at an APR of 7% with monthly payments. Fle is looking to refinance his loan to have a maturity of 15 years with an APR of 5%. What would be Grayson's new monthly payment after refinancing? A) $4,161.92 $661.62$3,991.91$1,969.02$28,000