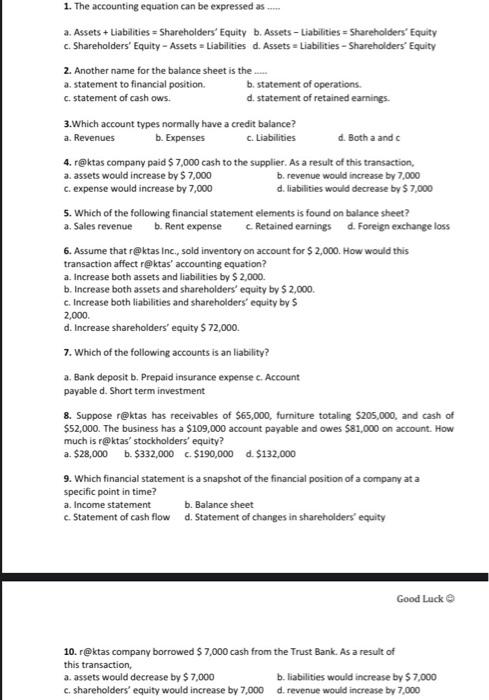

1. The accounting equation can be expressed as a. Assets + Liabilities - Shareholders' Equity b. Assets - Liabilities - Shareholders' Equity c. Shareholders' Equity - Assets = Liabilities d. Assets = Liabilities - Shareholders' Equity 2. Another name for the balance sheet is the ... a.statement to financial position b. statement of operations c.statement of cash ows. d. statement of retained earnings. 3.Which account types normally have a credit balance? a. Revenues b. Expenses c. Liabilities d. Botha and 4. r@ktas company paid $ 7,000 cash to the supplier. As a result of this transaction, a. assets would increase by $ 7,000 b. revenue would increase by 7,000 C. expense would increase by 7,000 d. liabilities would decrease by $ 7,000 5. Which of the following financial statement elements is found on balance sheet? a. Sales revenue b. Rent expense Retained earnings d. Foreign exchange loss 6. Assume that r@ktas Inc., sold inventory on account for $ 2,000. How would this transaction affect r@ktas' accounting equation? a. Increase both assets and liabilities by $ 2,000 b. Increase both assets and shareholders' equity by $ 2,000 C. Increase both liabilities and shareholders' equity by 5 2,000 d. Increase shareholders' equity $ 72,000 7. Which of the following accounts is an liability? a. Bank deposit b. Prepaid insurance expense c. Account payabled. Short term investment 8. Suppose r@ktas has receivables of $65,000, furniture totaling $205,000, and cash of $52,000. The business has a $109,000 account payable and owes $81,000 on account. How much is r@ktas' stockholders' equity? a. $28,000 b. $332,000 $190,000 d $132,000 9. Which financial statement is a snapshot of the financial position of a company at a specific point in time? a. Income statement b. Balance sheet c. Statement of cash flow d. Statement of changes in shareholders' equity Good Luck this transaction, 10. r@ktas company borrowed $7,000 cash from the Trust Bank. As a result of a. assets would decrease by $ 7,000 b. liabilities would increase by $ 7,000 c. shareholders' equity would increase by 7,000 d. revenue would increase by 7,000