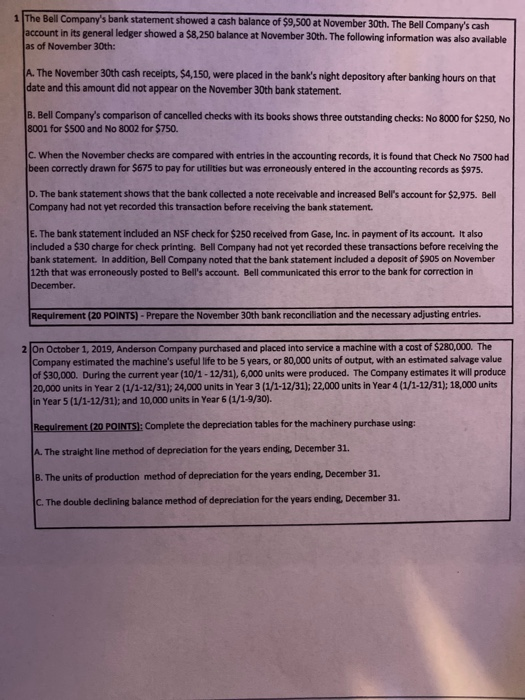

1 The Bell Company's bank statement showed a cash balance of $9,500 at November 30th. The Bell Company's cash account in its general ledger showed a $8,250 balance at November 30th. The following information was also available as of November 30th: A. The November 30th cash receipts, $4,150, were placed in the bank's night depository after banking hours on that date and this amount did not appear on the November 30th bank statement. B. Bell Company's comparison of cancelled checks with its books shows three outstanding checks: No 8000 for $250, No 8001 for $500 and No 8002 for $750. C. When the November checks are compared with entries in the accounting records, it is found that Check No 7500 had been correctly drawn for $675 to pay for utilities but was erroneously entered in the accounting records as $975. D. The bank statement shows that the bank collected a note receivable and increased Bell's account for $2,975. Bell Company had not yet recorded this transaction before receiving the bank statement. E. The bank statement included an NSF check for $250 received from Gase, Inc. in payment of its account. It also included a $30 charge for check printing. Bell Company had not yet recorded these transactions before receiving the bank statement. In addition, Bell Company noted that the bank statement included a deposit of $905 on November 12th that was erroneously posted to Bell's account. Bell communicated this error to the bank for correction in December. Requirement (20 POINTS) - Prepare the November 30th bank reconciliation and the necessary adjusting entries. 2 On October 1, 2019. Anderson Company purchased and placed into service a machine with a cost of $280,000. The Company estimated the machine's useful life to be 5 years, or 80,000 units of output, with an estimated salvage value of $30,000. During the current year (10/1 - 12/31), 6,000 units were produced. The Company estimates it will produce 20,000 units in Year 2 (1/1-12/31); 24,000 units in Year 3 (1/1-12/31): 22,000 units in Year 4 (1/1-12/31): 18,000 units in Year 5 (1/1-12/31); and 10,000 units in Year 6 (1/1-9/30). Requirement (20 POINTS): Complete the depreciation tables for the machinery purchase using: A. The straight line method of depreciation for the years ending. December 31. B. The units of production method of depreciation for the years ending, December 31. C. The double declining balance method of depreciation for the years ending, December 31