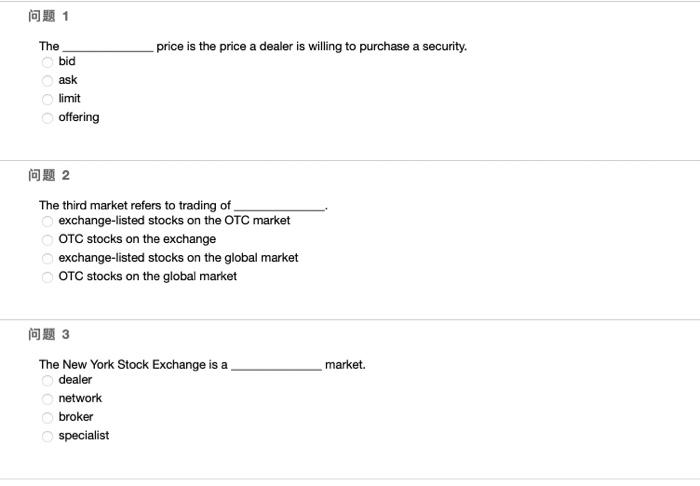

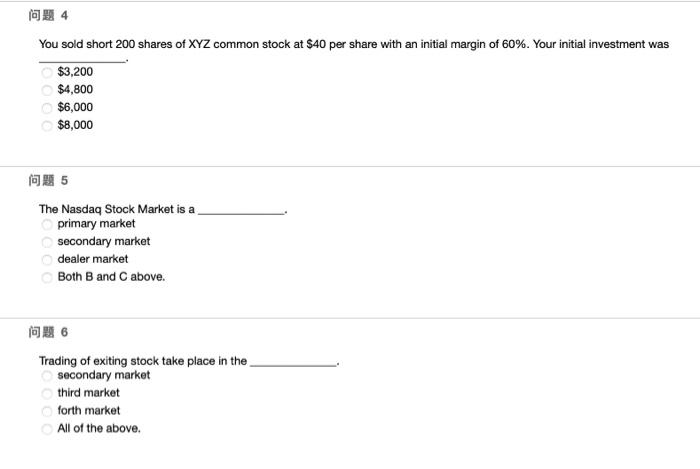

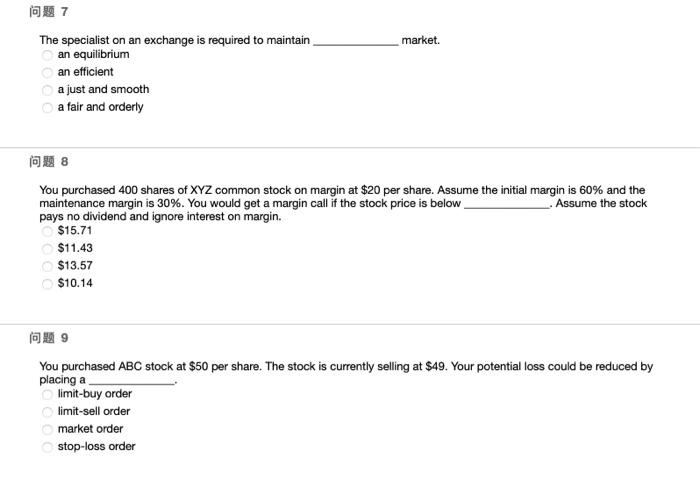

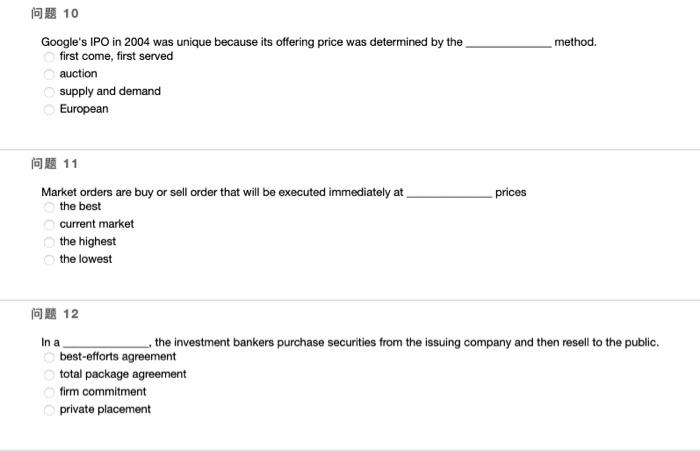

1 The bid ask limit offering price is the price a dealer is willing to purchase a security. 2 The third market refers to trading of exchange-listed stocks on the OTC market OOTC stocks on the exchange exchange-listed stocks on the global market OTC stocks on the global market 3 The New York Stock Exchange is a dealer network broker specialist market. 4 You sold short 200 shares of XYZ common stock at $40 per share with an initial margin of 60%. Your initial investment was $3,200 $4,800 $6,000 $8,000 5 The Nasdaq Stock Market is a primary market secondary market dealer market Both B and C above. 6 Trading of exiting stock take place in the Osecondary market third market forth market All of the above. 7 market. The specialist on an exchange is required to maintain an equilibrium an efficient a just and smooth a fair and orderly 8 You purchased 400 shares of XYZ common stock on margin at $20 per share. Assume the initial margin is 60% and the maintenance margin is 30%. You would get a margin call if the stock price is below. Assume the stock pays no dividend and ignore interest on margin. $15.71 $11.43 $13.57 $10.14 9 You purchased ABC stock at $50 per share. The stock is currently selling at $49. Your potential loss could be reduced by placing a Olimit-buy order Olimit-sell order Omarket order stop-loss order 10 Google's IPO in 2004 was unique because its offering price was determined by the first come, first served auction supply and demand European 11 Market orders are buy or sell order that will be executed immediately at prices the best current market the highest the lowest 12 In a the investment bankers purchase securities from the issuing company and then resell to the public. best-efforts agreement total package agreement firm commitment private placement method. 13 Electronic Communication Networks are private computer networks that link buyers and sellers different stock exchanges different stock brokers O global stock exchanges 14 You purchased 100 shares of AAA common stock on margin for $40 per share. The initial margin is 60% and the stock pays no dividend. Your rate of return would be if you sell the stock at $43 per share. -12.5% -7.5% 7.5% 12.5% 15 In buying on margin, the margin is the of the investor's account. loan amount equity value None of the above. Ototal value