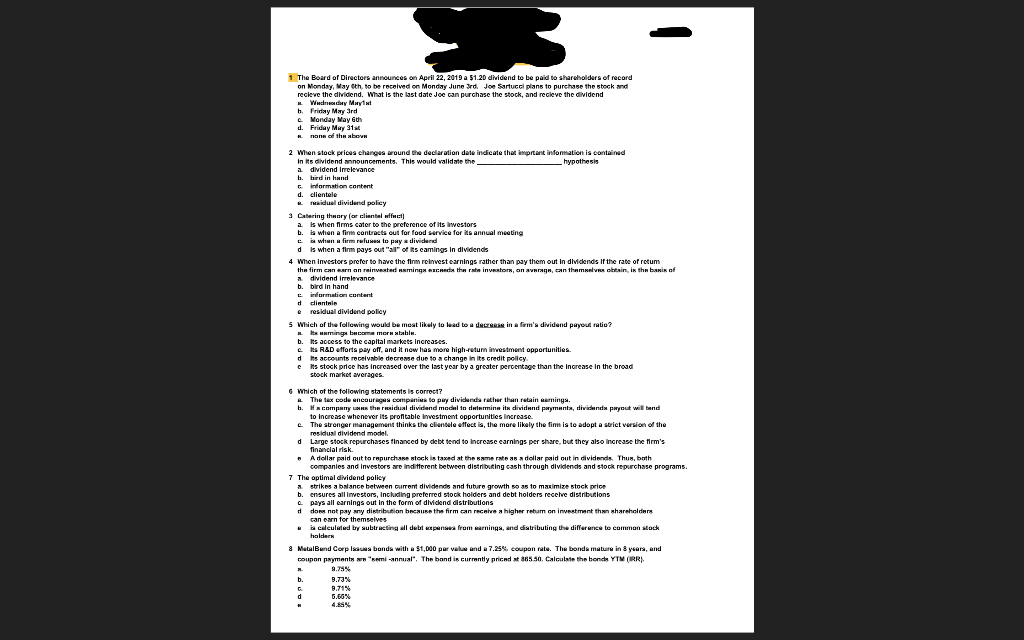

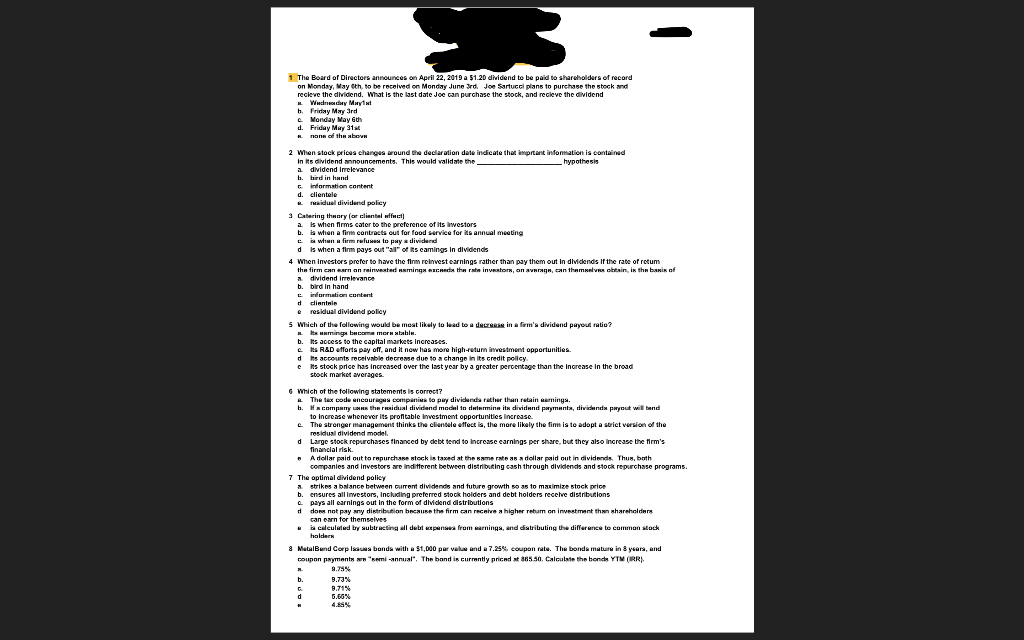

1 The Board of Directors announces on April 22, 2019 a $1.20 dividend to be paid to sharehodurs of record on Monday, May th, to be received on Monday June rd. Joe Sartuccl plans to purchase the sbock and recieve the dhidend. What is the last date Joe Gan purchase the stock, and recieve the dvidend h. Friday May 3rd a Monday May 6dh d. Friday Muy 31 2 whn sitock prices charges around the ddar ation date indicat that imprtant information is contained in Rs dividend a dvidend Irelevance h. bird in hund c information content d. clientele aiduel dividand poliey Cabering theory (ar cliantal wfwt a wen firms cater to the preferenoe of ts rwestors b. ia when a fie controcts out for food sarvice for s annual meeting d when a firm pays out"l ofs eamings in dividends 4 When Investors prefer to have the finm rcinvest carnings rather than pay them out in dividends If the rate of rctum In hand e residual dividend policy 5 Which olh fellewing would be moat likely to ead to a dcre in airm'a dividand payout ratio? b. saccess to the capital markets IncreascS. e HR&D forts pay off, and it now has more high-retum westmennt opportunities d Rs accounts recelvable decrease due to a change in its credit policy e Rs stock price has Increased ower the last year by a greater percentage than the Ingrease in the broad G Which ot the tolowing statements is correct? The tax code uncouragas Dampanies to pay dividends rather than retain garnings. to increase whenever its profitable Investment opportunities Increase The stronger ittanagensnt thinks the clierisele effect is, th more likely the firm is to adopt residual dividend model wiet version of the d Large stock repurchases tinanced by debt tendto Increase earnings per share, but they also Increase the firm's financial isk A dollar paid out to rnpurchase stock companies and invesbors are Iind tterent between distributing cash through dividends and stock repurchase programs. taxed at thn mne rM 35 dollar paid out in dividends. Thu , berth " 7 The optimal dividend policy . strikes a bance between current dividends nnd tutur" growth 50 35 to mmize 5tock price b. ensures all Inwestors, Incking preterred stock holders and debt holders recee distnbutions a pays all carnings out in the form of dlvidend distributions d doss not pay any distribution because the firm can recshe a higher reharn on investment than shareholdena calculaled by subtracting all debt "zepunaes fram "arninga, and distributing the differuncu to cummon atock a Metal Band Corp lkuas bonda with51.000 par vah" iard 7.25%, coupon The bond mature in ysars, and coupon rats. payments m''gemi-annual". The bond icurrently pnend at 36550. Calculate tho bonds YTM (SER). 9.75%