Answered step by step

Verified Expert Solution

Question

1 Approved Answer

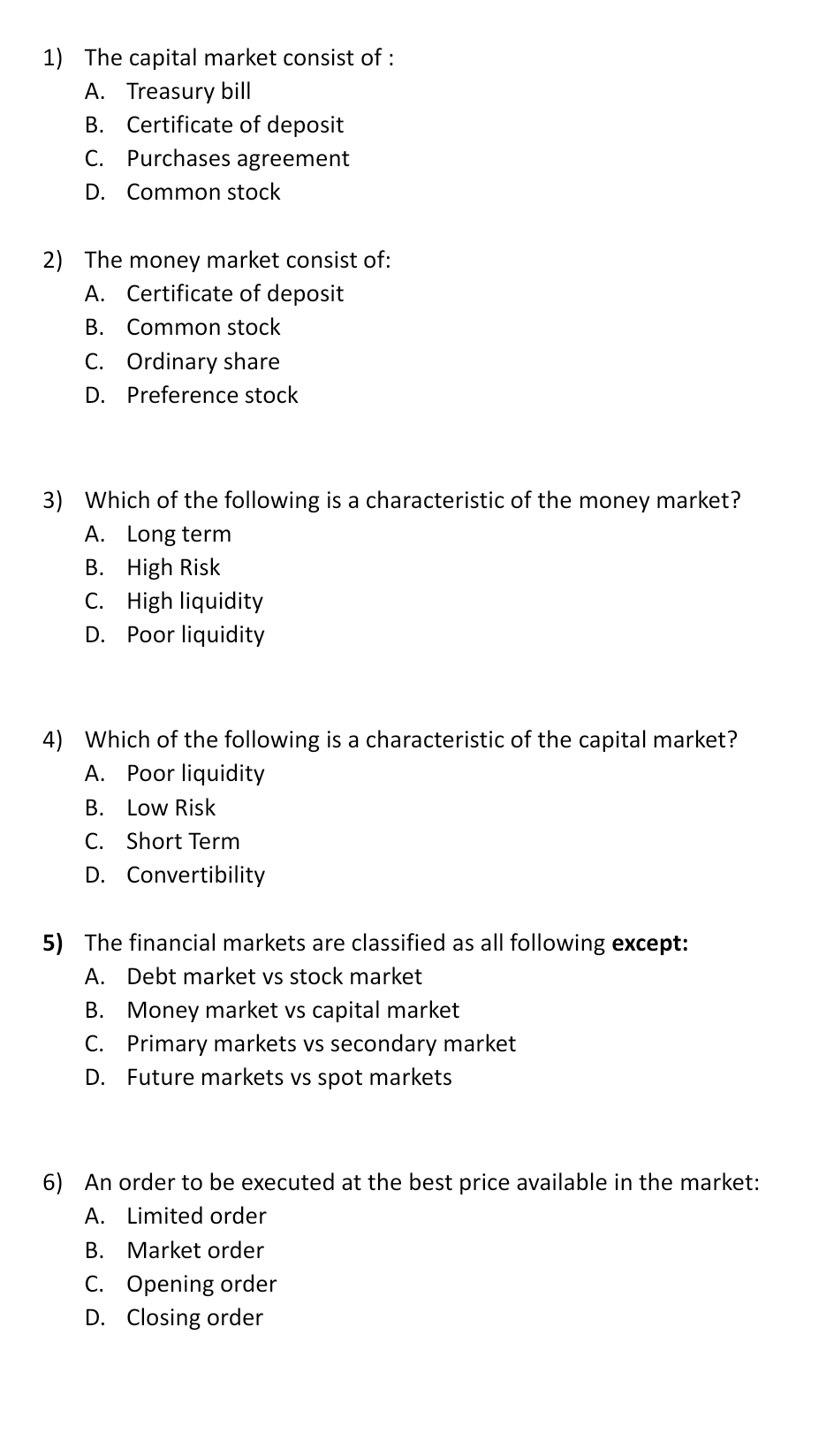

1) The capital market consist of: A. Treasury bill B. Certificate of deposit C. Purchases agreement D. Common stock 2) The money market consist of:

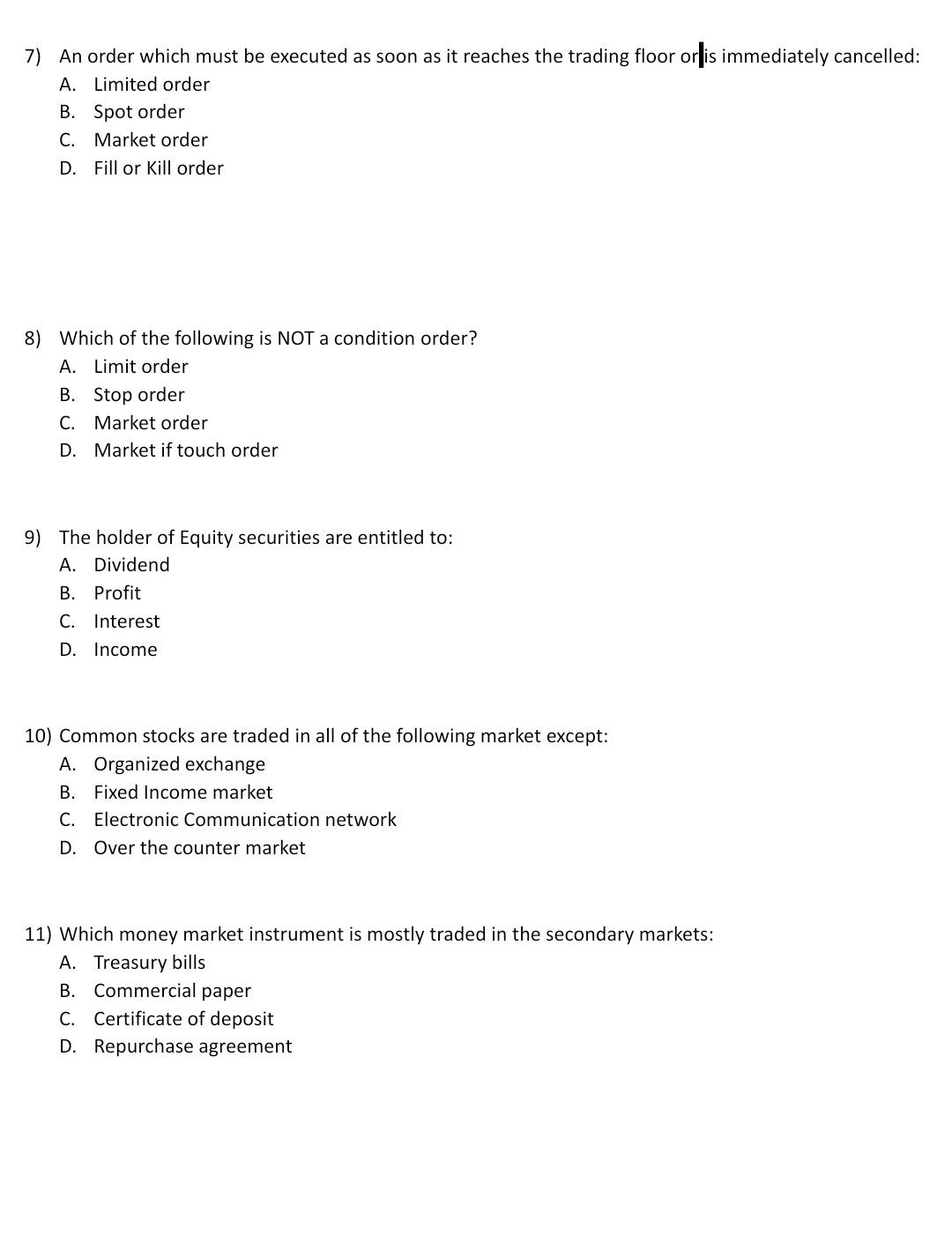

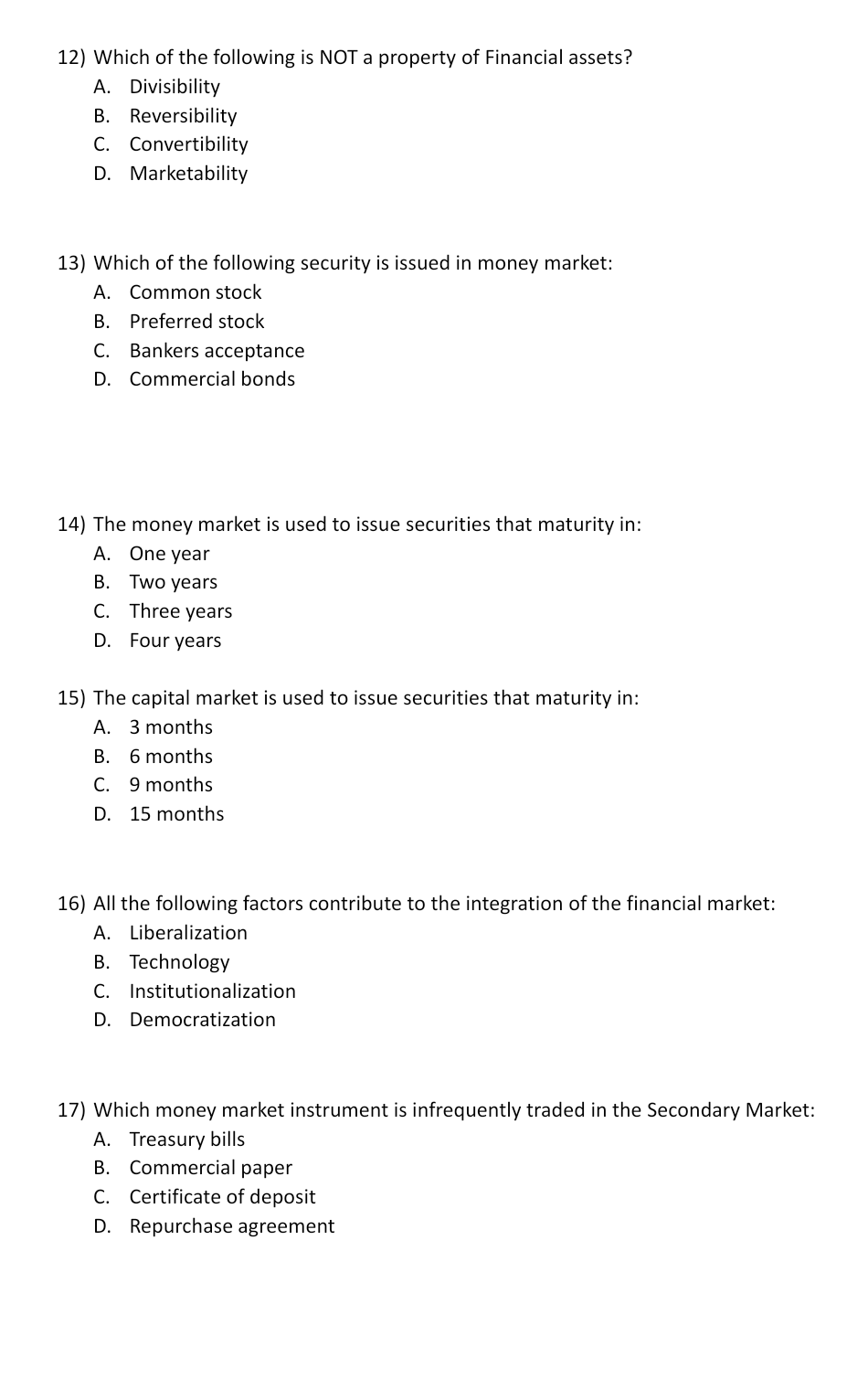

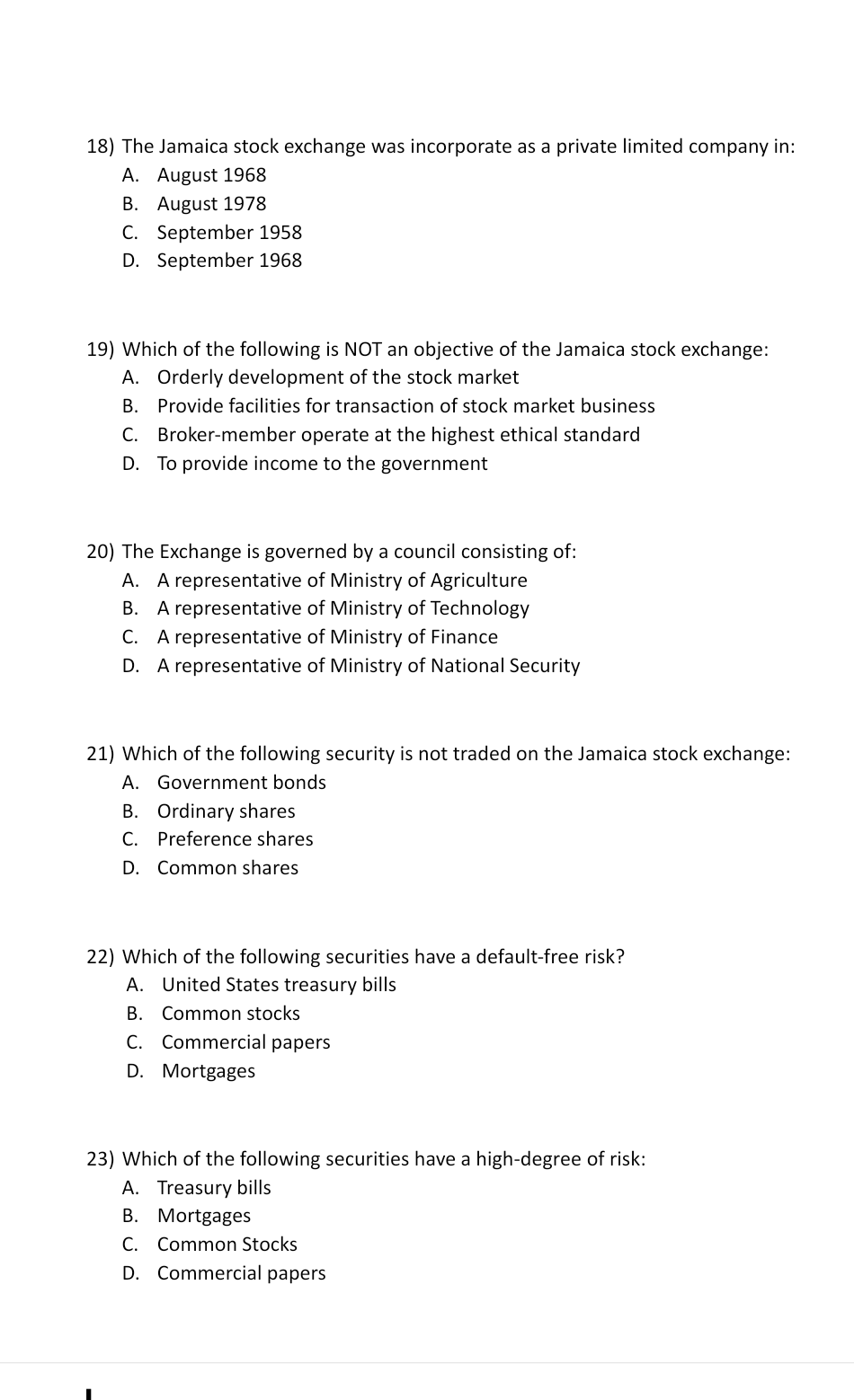

1) The capital market consist of: A. Treasury bill B. Certificate of deposit C. Purchases agreement D. Common stock 2) The money market consist of: A. Certificate of deposit B. Common stock C. Ordinary share D. Preference stock 3) Which of the following is a characteristic of the money market? A. Long term B. High Risk C. High liquidity D. Poor liquidity 4) Which of the following is a characteristic of the capital market? A. Poor liquidity B. Low Risk C. Short Term D. Convertibility 5) The financial markets are classified as all following except: A. Debt market vs stock market B. Money market vs capital market C. Primary markets vs secondary market D. Future markets vs spot markets 6) An order to be executed at the best price available in the market: A. Limited order B. Market order C. Opening order D. Closing order 7) An order which must be executed as soon as it reaches the trading floor orlis immediately cancelled: A. Limited order B. Spot order C. Market order D. Fill or kill order 8) Which of the following is NOT a condition order? A. Limit order B. Stop order C. Market order D. Market if touch order 9) The holder of Equity securities are entitled to: A. Dividend B. Profit C. Interest D. Income 10) Common stocks are traded in all of the following market except: A. Organized exchange B. Fixed Income market C. Electronic Communication network D. Over the counter market 11) Which money market instrument is mostly traded in the secondary markets: A. Treasury bills B. Commercial paper C. Certificate of deposit D. Repurchase agreement 12) Which of the following is NOT a property of Financial assets? A. Divisibility B. Reversibility C. Convertibility D. Marketability 13) Which of the following security is issued in money market: A. Common stock B. Preferred stock C. Bankers acceptance D. Commercial bonds 14) The money market is used to issue securities that maturity in: A. One year B. Two years C. Three years D. Four years 15) The capital market is used to issue securities that maturity in: A. 3 months B. 6 months C. 9 months D. 15 months 16) All the following factors contribute to the integration of the financial market: A. Liberalization B. Technology C. Institutionalization D. Democratization 17) Which money market instrument is infrequently traded in the Secondary Market: A. Treasury bills B. Commercial paper C. Certificate of deposit D. Repurchase agreement 18) The Jamaica stock exchange was incorporate as a private limited company in: A. August 1968 B. August 1978 C. September 1958 D. September 1968 19) Which of the following is NOT an objective of the Jamaica stock exchange: A. Orderly development of the stock market B. Provide facilities for transaction of stock market business C. Broker-member operate at the highest ethical standard D. To provide income to the government 20) The Exchange is governed by a council consisting of: A. A representative of Ministry of Agriculture B. A representative of Ministry of Technology C. A representative of Ministry of Finance D. A representative of Ministry of National Security 21) Which of the following security is not traded on the Jamaica stock exchange: A. Government bonds B. Ordinary shares C. Preference shares D. Common shares 22) Which of the following securities have a default-free risk? A. United States treasury bills B. Common stocks C. Commercial papers D. Mortgages 23) Which of the following securities have a high-degree of risk: A. Treasury bills B. Mortgages C. Common Stocks D. Commercial papers 24) Money Market instruments are: A. Common stock B. Preferred stock C. Loan stock D. Debt obligation 25) Commercial papers that are sold directly to investors by the issues are called: A. Dealer placed B. Direct placed C. Broker placed D. Institutional placed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started