Answered step by step

Verified Expert Solution

Question

1 Approved Answer

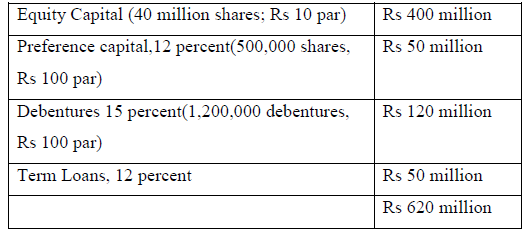

1. The capital structure of XYZ Ltd is: TABLE GVEN BELOW The next expected dividend per share is Rs 1.5. The dividend per share is

1. The capital structure of XYZ Ltd is:

TABLE GVEN BELOW

The next expected dividend per share is Rs 1.5. The dividend per share is expected to grow at the rate of 8 percent. The market price per share is Rs 50. Preference share redeemable after 10 years is currently selling for Rs 90 per share. Debentures redeemable after 5 years are selling for Rs 80 per debenture. Calculate the weighted average cost of capital in book value terms.Please explained in not more than 1000 words.Tax rate is 50 percent

Rs 400 million Rs 50 million Equity Capital (40 million shares: Rs 10 par) Preference capital, 12 percent(500,000 shares, Rs 100 par) Debentures 15 percent(1,200,000 debentures, Rs 100 par) Term Loans, 12 percent Rs 120 million Rs 50 million Rs 620 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started