Answered step by step

Verified Expert Solution

Question

1 Approved Answer

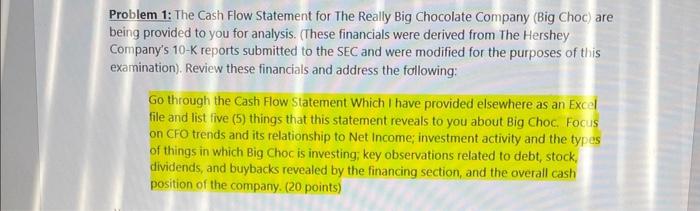

1: The Cash Flow Statement for The Really Big Chocolate Company (Big Choc) are being provided to you for analysis. (These financials were derived from

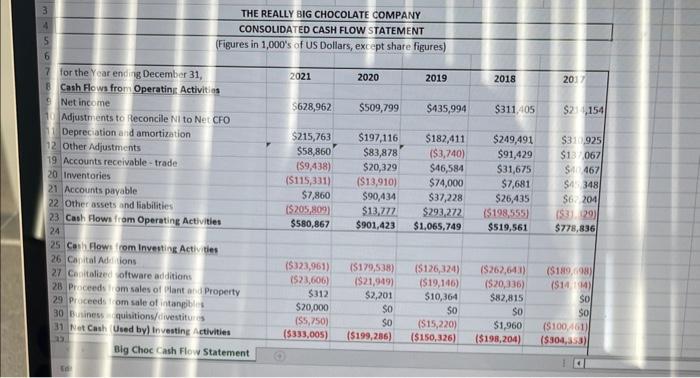

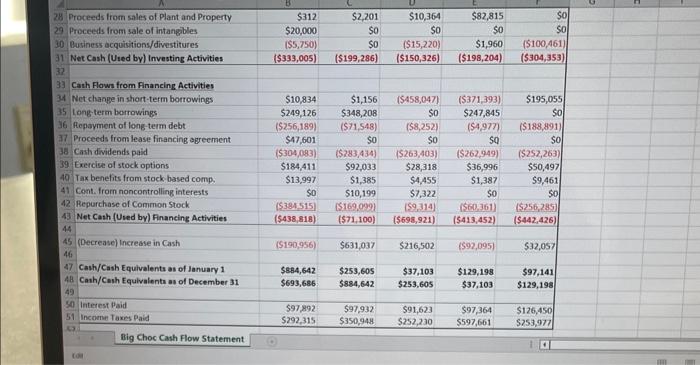

1: The Cash Flow Statement for The Really Big Chocolate Company (Big Choc) are being provided to you for analysis. (These financials were derived from The Hershey Company's 10-K reports submitted to the SEC and were modified for the purposes of this examination). Review these financials and address the following: Go through the Cash Flow Statement Which I have provided elsewhere as an Excel file and list five (5) things that this statement reveals to you about Big Choc. Focus on CFO trends and its relationship to Net Income; investment activity and the types of things in which Big Choc is investing; key observations related to debt, stock, dividends, and buybacks revealed by the financing section, and the overall cash position of the company. (20 points) 3 4 S 6 7 for the Year ending December 31, THE REALLY BIG CHOCOLATE COMPANY CONSOLIDATED CASH FLOW STATEMENT (Figures in 1,000's of US Dollars, except share figures) 2021 2020 2019 2018 2017 B Cash Flows from Operating Activities Net income $628,962 $509,799 $435,994 $311,405 $234,154 Adjustments to Reconcile NI to Net CFO Depreciation and amortization $215,763 $197,116 $182,411 $249,491 $310,925, 12 Other Adjustments $58,860 $83,878 ($3,740) $91,429 $13/067 19 Accounts receivable-trade ($9,438) $20,329 $46,584 $31,675 S467 20 Inventories 21 Accounts payable ($115,331) ($13,910) $74,000 $7,681 $4 348 $7,860 $90,434 $37,228 $26,435 $6 204 22 Other assets and liabilities ($205,809) $13,777 $293,272 ($198,555) ($3) 129) 23 Cash Flows from Operating Activities $580,867 $901,423 $1,065,749 $519,561 $778,836 24 25 Cash Flows from Investing Activities 26 Capital Additions ($323,961) ($179,538) ($126,324) ($262,643) ($189,098) 27 Capitalized software additions (523,606) ($21,949) ($19,146) ($20,336) ($144) 28 Proceeds from sales of Plant and Property $312 $2,201 $10,364 $82,815 So 29 Proceeds com sale of intangibles $20,000 $0 50 50 30 Business quisitions/divestitures ($5,750) 50 31 Net Cash (Used by) Investing Activities ($333,005) ($199,286) ($15,220) ($150,326) $1,960 ($198,204) ($100,461) ($304,353) 23. Big Choc Cash Flow Statement 28 Proceeds from sales of Plant and Property 29 Proceeds from sale of intangibles 30 Business acquisitions/divestitures $312 $2,201 $10,364 $82,815 So $20,000 So $0 $0 $0 ($5,750) $0 ($15,220) 31 Net Cash (Used by) Investing Activities ($333,005) ($199,286) ($150,326) $1,960 ($198,204) ($100,461) ($304,353) 32 33 Cash Flows from Financing Activities 34 Net change in short-term borrowings 35 Long-term borrowings $10,834 $1,156 ($458,047) ($371,393) $195,055 $249,126 $348,208 $0 $247,845 36 Repayment of long-term debt ($256,189) ($71,548) ($8,252) ($4,977) ($188,891) 37 Proceeds from lease financing agreement $47,601 $0 SQ So 38 Cash dividends paid ($304,083) ($283,434) ($263,403) ($262,949) ($252,263) 39 Exercise of stock options $184,411 $92,033 $28,318 40 Tax benefits from stock-based comp. 41 Cont. from noncontrolling interests $13,997 $0 $1,385 $4,455 $36,996 $1,387 $50,497 $9,461 42 Repurchase of Common Stock ($384.515) $10,199 ($169,099) 43 Net Cash (Used by) Financing Activities ($438,818) ($71,100) ($698,921) $7,322 ($9,314) ($60.361) ($256,285) ($413,452) ($442,426) So 50 44 45 (Decrease) Increase in Cash 46 ($190,956) $631,037 $216,502 ($92,095) $32,057 47 Cash/Cash Equivalents as of January 1 $884,642 $253,605 $37,103 $129,198 $97,141 48 Cash/Cash Equivalents as of December 31 $693,686 $884,642 $253,605 $37,103 $129,198 49 50 Interest Paid $97,892 $97,932 $91,623 $97,364 $126,450 51 Income Taxes Paid $292,315 $350,948 $252,230 $597,661 $253,977 Big Choc Cash Flow Statement

1: The Cash Flow Statement for The Really Big Chocolate Company (Big Choc) are being provided to you for analysis. (These financials were derived from The Hershey Company's 10-K reports submitted to the SEC and were modified for the purposes of this examination). Review these financials and address the following: Go through the Cash Flow Statement Which I have provided elsewhere as an Excel file and list five (5) things that this statement reveals to you about Big Choc. Focus on CFO trends and its relationship to Net Income; investment activity and the types of things in which Big Choc is investing; key observations related to debt, stock, dividends, and buybacks revealed by the financing section, and the overall cash position of the company. (20 points) 3 4 S 6 7 for the Year ending December 31, THE REALLY BIG CHOCOLATE COMPANY CONSOLIDATED CASH FLOW STATEMENT (Figures in 1,000's of US Dollars, except share figures) 2021 2020 2019 2018 2017 B Cash Flows from Operating Activities Net income $628,962 $509,799 $435,994 $311,405 $234,154 Adjustments to Reconcile NI to Net CFO Depreciation and amortization $215,763 $197,116 $182,411 $249,491 $310,925, 12 Other Adjustments $58,860 $83,878 ($3,740) $91,429 $13/067 19 Accounts receivable-trade ($9,438) $20,329 $46,584 $31,675 S467 20 Inventories 21 Accounts payable ($115,331) ($13,910) $74,000 $7,681 $4 348 $7,860 $90,434 $37,228 $26,435 $6 204 22 Other assets and liabilities ($205,809) $13,777 $293,272 ($198,555) ($3) 129) 23 Cash Flows from Operating Activities $580,867 $901,423 $1,065,749 $519,561 $778,836 24 25 Cash Flows from Investing Activities 26 Capital Additions ($323,961) ($179,538) ($126,324) ($262,643) ($189,098) 27 Capitalized software additions (523,606) ($21,949) ($19,146) ($20,336) ($144) 28 Proceeds from sales of Plant and Property $312 $2,201 $10,364 $82,815 So 29 Proceeds com sale of intangibles $20,000 $0 50 50 30 Business quisitions/divestitures ($5,750) 50 31 Net Cash (Used by) Investing Activities ($333,005) ($199,286) ($15,220) ($150,326) $1,960 ($198,204) ($100,461) ($304,353) 23. Big Choc Cash Flow Statement 28 Proceeds from sales of Plant and Property 29 Proceeds from sale of intangibles 30 Business acquisitions/divestitures $312 $2,201 $10,364 $82,815 So $20,000 So $0 $0 $0 ($5,750) $0 ($15,220) 31 Net Cash (Used by) Investing Activities ($333,005) ($199,286) ($150,326) $1,960 ($198,204) ($100,461) ($304,353) 32 33 Cash Flows from Financing Activities 34 Net change in short-term borrowings 35 Long-term borrowings $10,834 $1,156 ($458,047) ($371,393) $195,055 $249,126 $348,208 $0 $247,845 36 Repayment of long-term debt ($256,189) ($71,548) ($8,252) ($4,977) ($188,891) 37 Proceeds from lease financing agreement $47,601 $0 SQ So 38 Cash dividends paid ($304,083) ($283,434) ($263,403) ($262,949) ($252,263) 39 Exercise of stock options $184,411 $92,033 $28,318 40 Tax benefits from stock-based comp. 41 Cont. from noncontrolling interests $13,997 $0 $1,385 $4,455 $36,996 $1,387 $50,497 $9,461 42 Repurchase of Common Stock ($384.515) $10,199 ($169,099) 43 Net Cash (Used by) Financing Activities ($438,818) ($71,100) ($698,921) $7,322 ($9,314) ($60.361) ($256,285) ($413,452) ($442,426) So 50 44 45 (Decrease) Increase in Cash 46 ($190,956) $631,037 $216,502 ($92,095) $32,057 47 Cash/Cash Equivalents as of January 1 $884,642 $253,605 $37,103 $129,198 $97,141 48 Cash/Cash Equivalents as of December 31 $693,686 $884,642 $253,605 $37,103 $129,198 49 50 Interest Paid $97,892 $97,932 $91,623 $97,364 $126,450 51 Income Taxes Paid $292,315 $350,948 $252,230 $597,661 $253,977 Big Choc Cash Flow Statement Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started