Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The Columbia Arena Company, formed in 2021, and uses the accrual basis of accounting and incremental budgeting. They are the primary facility used

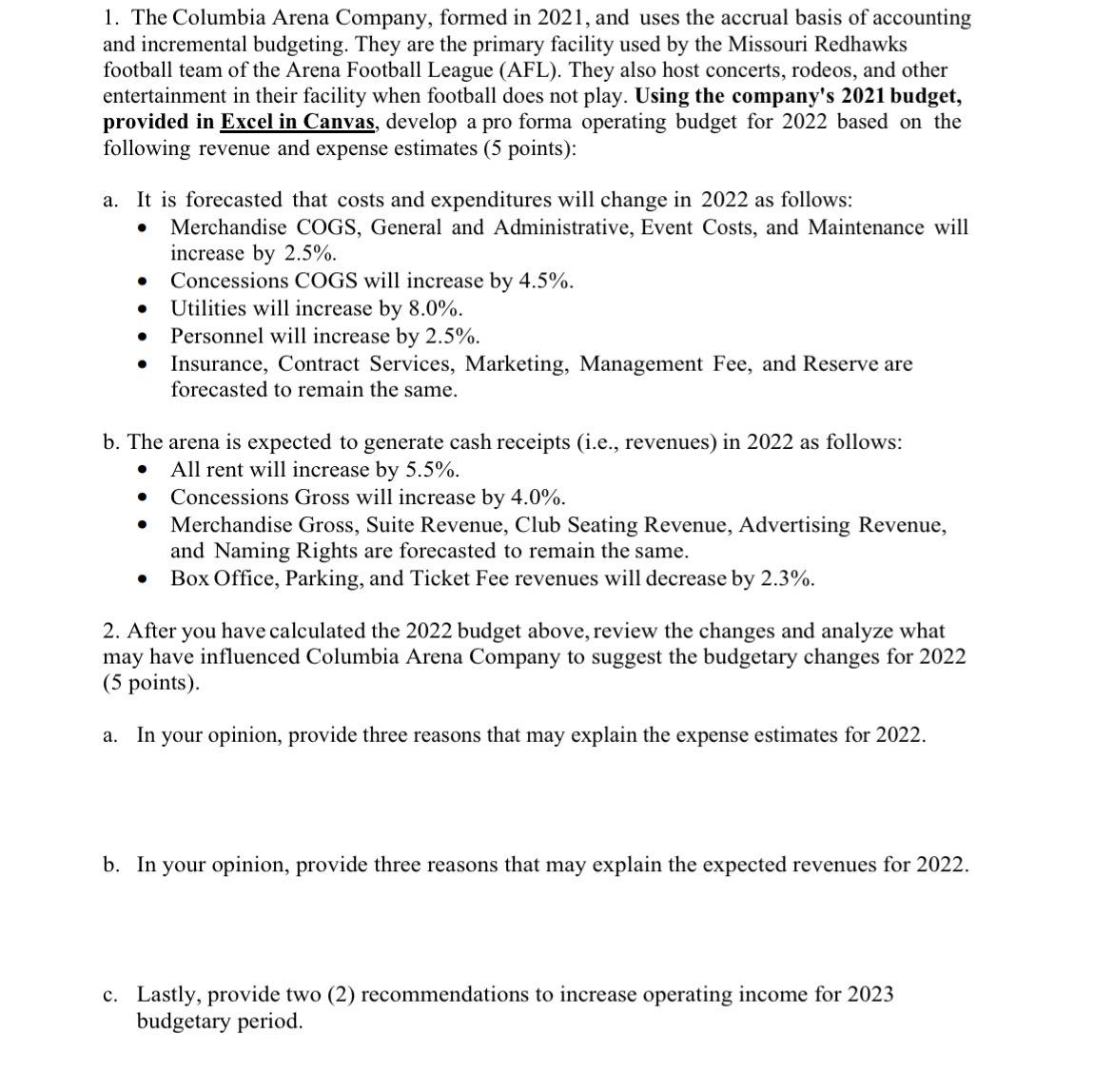

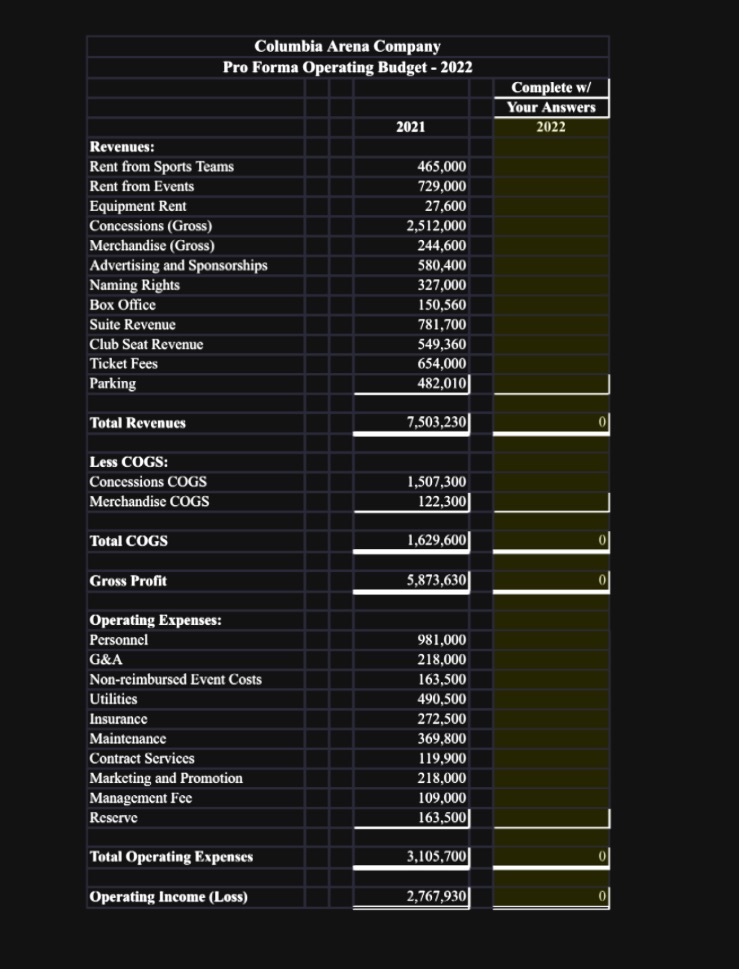

1. The Columbia Arena Company, formed in 2021, and uses the accrual basis of accounting and incremental budgeting. They are the primary facility used by the Missouri Redhawks football team of the Arena Football League (AFL). They also host concerts, rodeos, and other entertainment in their facility when football does not play. Using the company's 2021 budget, provided in Excel in Canvas, develop a pro forma operating budget for 2022 based on the following revenue and expense estimates (5 points): a. It is forecasted that costs and expenditures will change in 2022 as follows: Merchandise COGS, General and Administrative, Event Costs, and Maintenance will increase by 2.5%. Concessions COGS will increase by 4.5%. Utilities will increase by 8.0%. Personnel will increase by 2.5%. Insurance, Contract Services, Marketing, Management Fee, and Reserve are forecasted to remain the same. b. The arena is expected to generate cash receipts (i.e., revenues) in 2022 as follows: All rent will increase by 5.5%. Concessions Gross will increase by 4.0%. Merchandise Gross, Suite Revenue, Club Seating Revenue, Advertising Revenue, and Naming Rights are forecasted to remain the same. Box Office, Parking, and Ticket Fee revenues will decrease by 2.3%. 2. After you have calculated the 2022 budget above, review the changes and analyze what may have influenced Columbia Arena Company to suggest the budgetary changes for 2022 (5 points). a. In your opinion, provide three reasons that may explain the expense estimates for 2022. b. In your opinion, provide three reasons that may explain the expected revenues for 2022. c. Lastly, provide two (2) recommendations to increase operating income for 2023 budgetary period. Columbia Arena Company Pro Forma Operating Budget - 2022 2021 Complete w/ Your Answers 2022 Revenues: Rent from Sports Teams Rent from Events 465,000 729,000 Equipment Rent 27,600 Concessions (Gross) 2,512,000 Merchandise (Gross) 244,600 Advertising and Sponsorships 580,400 Naming Rights 327,000 Box Office 150,560 Suite Revenue Club Seat Revenue Ticket Fees Parking 781,700 549,360 654,000 482,010 7,503,230 Total Revenues Less COGS: Concessions COGS 1,507,300 Merchandise COGS 122,300 Total COGS 1,629,600 Gross Profit 5,873,630 Operating Expenses: Personnel 981,000 G&A 218,000 Non-reimbursed Event Costs 163,500 Utilities 490,500 Insurance 272,500 Maintenance 369,800 Contract Services 119,900 Marketing and Promotion 218,000 Management Fee 109,000 Reserve 163,500 Total Operating Expenses 3,105,700 Operating Income (Loss) 2,767,930

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started