Question

1. The company purchased $7,500,000 of raw material inventory on account. On account means that that suppliers have not yet been paid. That is Rocky

1. The company purchased $7,500,000 of raw material inventory on account. On account means that that suppliers have not yet been paid. That is Rocky Mountain Chocolate has an additional Account Payable for the inventory purchases.

2. During the year, the company incurred $6,000,000 of factory wages. When wages relate to the production of a companys inventory, the wage costs are added to the inventory account. For now, assume that the wages have not yet been paid.

3. The company sold inventory that cost $14,000,000 for a total of $22,000,000. Or that, $17,000,000 was received I cash and $5,000,000 was on account (that is, added to Accounts Receivable)

4. The company paid $8,200,000 to suppliers for inventory it had previously purchased on account. That is, it paid $8,200,000 of accounts payable.

5. The company collected $4,100,000 of accounts receivable.

6. The company incurred Sales and Marketing Expenses of $1,505,431, General and Administrative Expenses of $2,044,569, and Retail Operating Expenses of $1,750,000. They paid $2,000,000 in cash and $3,300,000 was added to Other Accrued Expenses.

7. The company paid $6,423,789 to employees for wages that had been previously accrued.

8. Rocky Mountain Chocolate Factory received $125,000 in cash from new franchisees. The company must provide services to the franchisees over the next five years. As such, the fees are considered Deferred income.

9. The company paid $498,832 for new property and equipment.

10, During the year, the company declared $2,407,167 of dividends on its common shares. They paid $2,403,458 during the fiscal year. The difference, $3,709 will be paid in the following fiscal year,

Based on the transactions recorded, please list at least three adjustments or reclassifications that might need to be made prior to preparing the final financial statements.

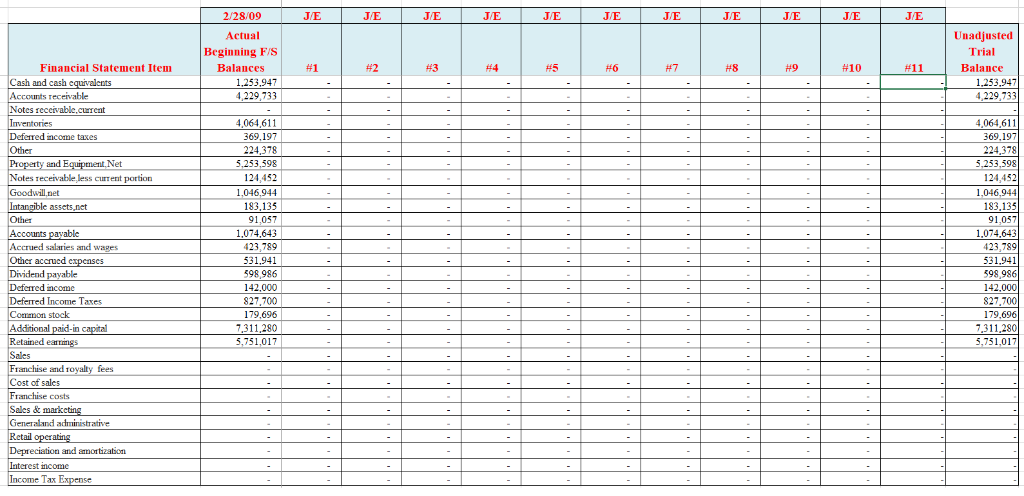

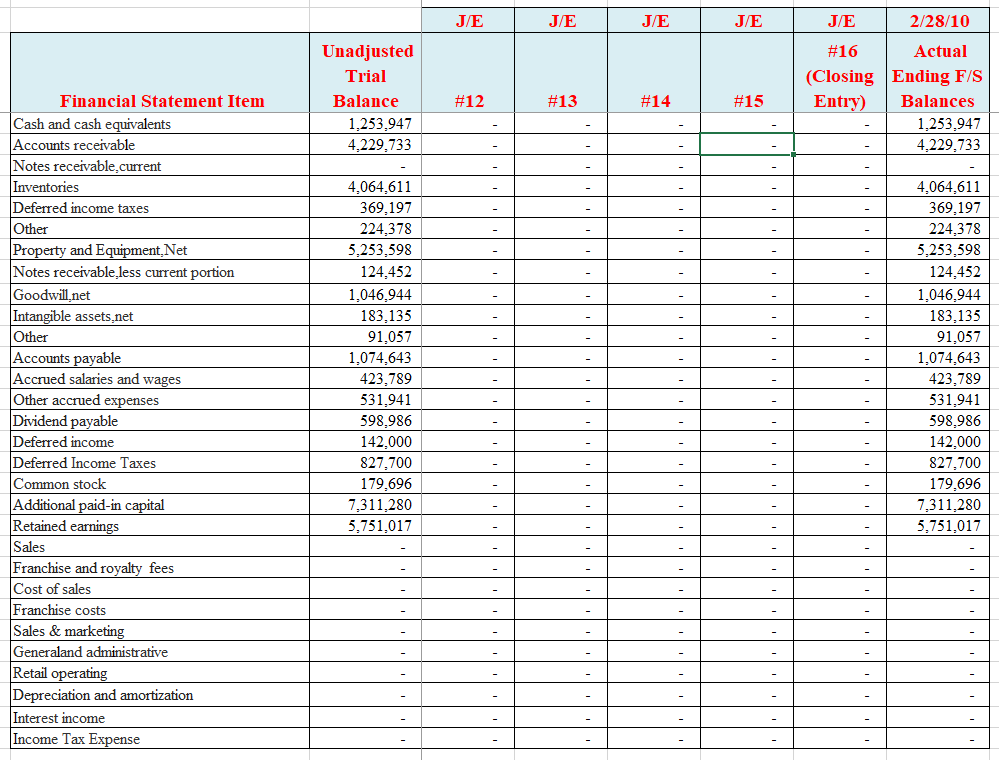

2/28/09 Actual Beginning F/S Balances J/E JIE JIE J/E J/E J/E JE JE JE JE JIE Unadjusted Trial Balance Financial Statement Item #1 #2 #3 #4 #5 #6 #9 #10 #11 1,253,947 4,229,733 ash and cash e 1,253,947 4,229,733 receivable s receivable.current 4,064,611 369,197 224,378 5,253,598 124.452 1046,944 183,135 91,057 1,074.643 23,789 531,941 598,986 142,000 827,700 179,696 7,311,280 5,751,017 Inventories 4,064,611 369,197 224,378 5,253,598 124,452 ncome taxes Pr and E receivable less current portion et 1,046,94 83,135 91,057 1,074,643 423,789 531,941 598,986 142,000 827,700 179,696 7,311,280 5,71,017 Intangible assets.net counts payable salaries and wages accrued e ble d Income Taxes stock Additional paid-in c Sales Franchise and 1 Cost of sales fees ranchuse costs Sales&mark Generaland administrative eciation and aamortization Interest income Income Tax J/E J/E J/E J/E J/E 2/28/10 Unadjusted Trial Balance #16 Actual (ClosingEnding F/S Balances Financial Statement Item #12 #13 #14 #15 Entry Cash and cash equivalents Accounts receivable Notes receivable,current Inventories Deferred income taxes Other Pr Notes receivable less current portion Goodwil.net Intangible assets.net Other Accounts payable Accrued salaries and wages Other accrued e Dividend payable Deferred income Deferred Income Taxes Common stock Additional paid-in c Retained earnings Sales Franchise and royalty fees Cost of sales Franchise costs Sales &marketin Generaland administrative Retail operatin Depreciation and amortization Interest income Income Tax E 1.253,947 4,229,733 1.253,947 4,229,733 4,064.611 369,197 224,378 5.253,598 124.452 1,046,944 183,135 91,057 1,074,643 423,789 531,941 598,986 142,000 827,700 179.696 7,311,280 5,751,017 4,064.611 369,197 224,378 5,253,598 124,452 1,046,944 183,135 91,057 1,074,643 423,789 531,941 598,986 142,000 827,700 179,696 7,311,280 5,751,017 and E Net

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started