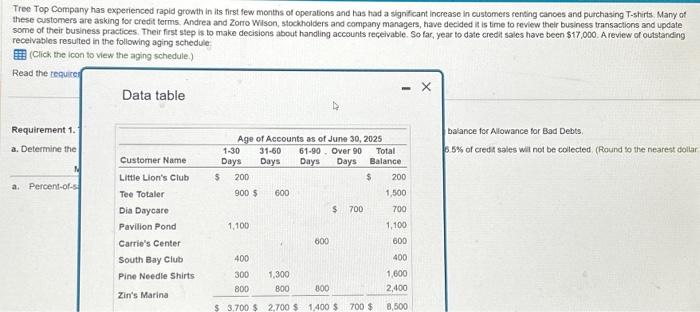

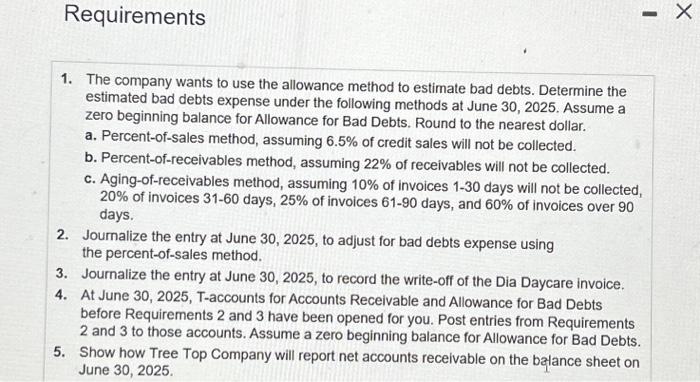

1. The company wants to use the allowance method to estimate bad debts. Determine the estimated bad debts expense under the following methods at June 30,2025 . Assume a zero beginning balance for Allowance for Bad Debts. Round to the nearest dollar. a. Percent-of-sales method, assuming 6.5% of credit sales will not be collected. b. Percent-of-receivables method, assuming 22% of receivables will not be collected. c. Aging-of-receivables method, assuming 10% of invoices 130 days will not be collected, 20% of invoices 3160 days, 25% of invoices 6190 days, and 60% of invoices over 90 days. 2. Journalize the entry at June 30,2025 , to adjust for bad debts expense using the percent-of-sales method. 3. Journalize the entry at June 30,2025 , to record the write-off of the Dia Daycare invoice. 4. At June 30,2025,T-accounts for Accounts Receivable and Allowance for Bad Debts before Requirements 2 and 3 have been opened for you. Post entries from Requirements 2 and 3 to those accounts. Assume a zero beginning balance for Allowance for Bad Debts. 5. Show how Tree Top Company will report net accounts receivable on the bylance sheet on June 30,2025 Tree Top Company has experienced rapid growth in its first few months of operasions and has had a significant inciease in customers renting canoes and purchasing T-shirts. Many of these customers are asking for credit terms. Andrea and Zorro Wilson, stockholders and company managers, have decided it is time to review their business transactions and update some of their business practioes. Their first step is to make decisions about handling accounts reccivable. So far, year to date credit sales have been $17,000. A review of outstanoing recelvables resulted in the following aging schedule: (Click the icon to view the aging schedule.) Read the Requirement 1. The company wants to use the allowance method to estimase bad debts. Assume a zeto beginning balance for Alowance for Bad Debts a. Determine the estimated bad debts expense under the percent-of-sales methods at June 30,2025 . Assume that 6.5% of credit sales will not be collected (Pound to the nearest dollar Tree Top Company has experienced rapid growth in its first few months of operations and has had a significant increase in customers renting canoes and purchasing T-shirts. Many of these customers are asking tor credit ferms. Andrea and Zorro Wison, stockhoiders and company managers, have decided it is time to review their busincss transactions and update some of their business practices. Their first step is to make decisions about handling accounts reeivable. So far, year to date credit sales have been $17,000. A review of outstanding recelvables resulted in the following aging schedule: (Click the icon to view the aging schedule.) Read the required Data table balance for Alowance for Bod Debts. 5.5\% of credt sales wal not be colected. (Round to the nearest dollar