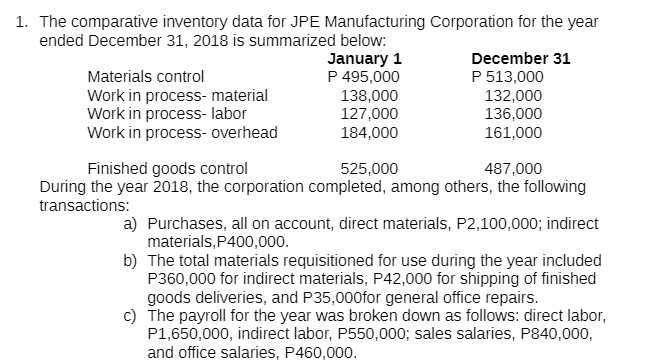

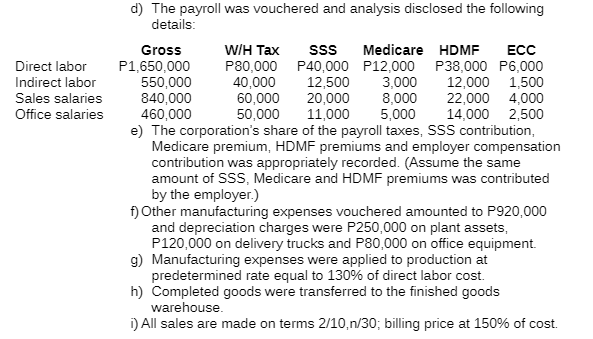

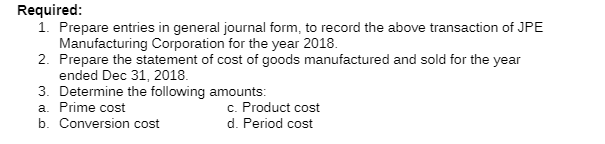

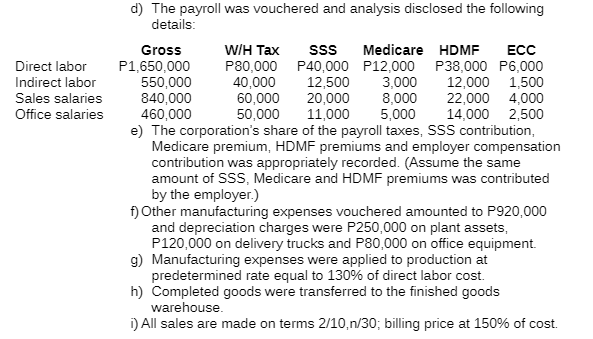

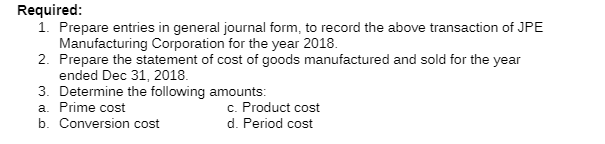

1. The comparative inventory data for JPE Manufacturing Corporation for the year ended December 31, 2018 is summarized below: January 1 December 31 Materials control P 495,000 P 513,000 Work in process- material 138,000 132,000 Work in process- labor 127,000 136,000 Work in process-overhead 184,000 161,000 Finished goods control 525,000 487,000 During the year 2018, the corporation completed, among others, the following transactions: a) Purchases, all on account, direct materials, P2,100,000; indirect materials,P400,000. b) The total materials requisitioned for use during the year included P360,000 for indirect materials, P42,000 for shipping of finished goods deliveries, and P35,000 for general office repairs. c) The payroll for the year was broken down as follows: direct labor, P1,650,000, indirect labor, P550,000; sales salaries, P840,000, and office salaries, P460,000. Direct labor Indirect labor Sales salaries Office salaries d) The payroll was vouchered and analysis disclosed the following details: Gross W/H Tax SSS Medicare HDMF ECC P1,650,000 P80,000 P40,000 P12,000 P38,000 P6,000 550,000 40,000 12,500 3,000 12,000 1,500 840,000 60,000 20,000 8,000 22,000 4,000 460,000 50,000 11,000 5,000 14,000 2,500 e) The corporation's share of the payroll taxes, SSS contribution, Medicare premium, HDMF premiums and employer compensation contribution was appropriately recorded. (Assume the same amount of SSS, Medicare and HDMF premiums was contributed by the employer.) f) Other manufacturing expenses vouchered amounted to P920,000 and depreciation charges were P250,000 on plant assets, P120,000 on delivery trucks and P80,000 on office equipment. g) Manufacturing expenses were applied to production at predetermined rate equal to 130% of direct labor cost. h) Completed goods were transferred to the finished goods warehouse 1) All sales are made on terms 2/10,n/30; billing price at 150% of cost. Required: i. Prepare entries in general journal form, to record the above transaction of JPE Manufacturing Corporation for the year 2018. 2. Prepare the statement of cost of goods manufactured and sold for the year ended Dec 31, 2018 3. Determine the following amounts: a. Prime cost c. Product cost b. Conversion cost d. Period cost